Market Data

September 15, 2019

SMU Steel Buyers Sentiment Index: Slight Uptick, But...

Written by Tim Triplett

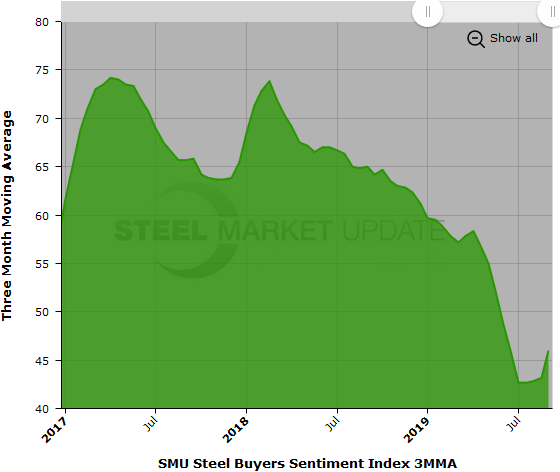

Steel Market Update’s Steel Buyers Sentiment Index saw a slight uptick this week, but not one big enough to indicate a significant change of direction. Industry sentiment has trended downward for much of the year and has been stuck in a mediocre range for the last few months over concerns about demand and pricing. Buyers’ attitudes remain well behind the level of optimism at this time last year.

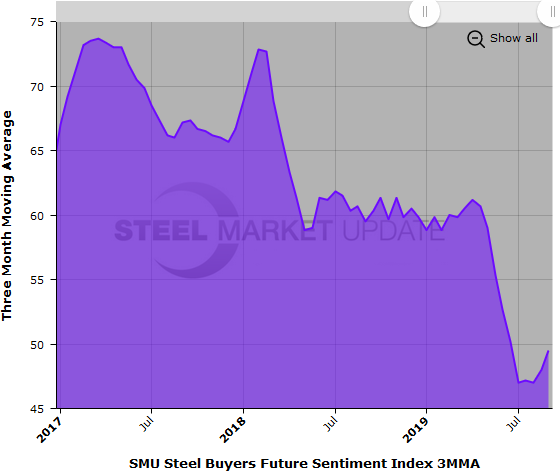

The goal of SMU’s Buyers Sentiment Index is to measure how buyers and sellers of steel feel about their company’s ability to be successful today (Current Sentiment Index), as well as three to six months into the future (Future Sentiment Index). Results are posted as both single data points and as three-month moving averages (3MMAs) to smooth out the trend.

Current Sentiment measured as a single data point registered +52 in the latest data, up eight points from mid-August. At this time last year, Current Sentiment was 11 points higher at +63, and closer to its peak of +78 in January 2018. Current Sentiment, measured as a 3MMA, showed some improvement with a reading of +46.00, up from +43.17.

Future Sentiment

Respondents were asked to assess their chances for success in three to six months. Measured as a single data point, Future Sentiment registered +51, up two points versus two weeks ago. Future Sentiment peaked at +77 in February 2017.

Measured as a 3MMA, the Future Sentiment Index averaged +49.50, up from +48.00 last month. Future 3MMA peaked at 73.67 in March 2017.

Note that all the current readings are above zero and on the optimistic half of SMU’s scale. Therefore, industry sentiment overall remains fairly positive, from a historical perspective.

What Our Respondents Had to Say

“We continue to worry about demand.” Manufacturer/OEM

“Based on history and current market conditions, it appears prices are poised to decline.” Trading Company

“People seem to be waiting for the other shoe to fall on prices and lead times.” Service Center/Distributor

“We’re expecting general economic pressure.” Manufacturer/OEM

“With current trade restrictions, we find it harder and harder to be competitive and supply this steel market. We are down over 40 percent in business vs. our original projections.” Trading Company

“I don’t see anything improving in the future. We will try to change, but that takes time. We need to find more competitive business models and get away from some traditional business types, which are proving more difficult these days.” Trading Company

“We’ll have to cut back production hours and lay people off, but the company will be successful.” Manufacturer/OEM

“Uncertainty about the economy and uncertainty about unstable politics is brewing a recession.” Manufacturer/OEM

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 500 North American companies. Our normal response rate is approximately 110-150 companies. Of those responding to this week’s survey, 37 percent were manufacturers and 45 percent were service centers/distributors. The balance was made up of steel mills, trading companies and toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.