Product

October 1, 2019

Service Center Spot Pricing: No Capitulation Yet

Written by John Packard

Two out of three service centers responding to Steel Market Update’s market trends questionnaire last week admit they are lowering spot prices to secure sales in the current market environment. Based on feedback from their customers, that figure (67 percent) may be conservative.

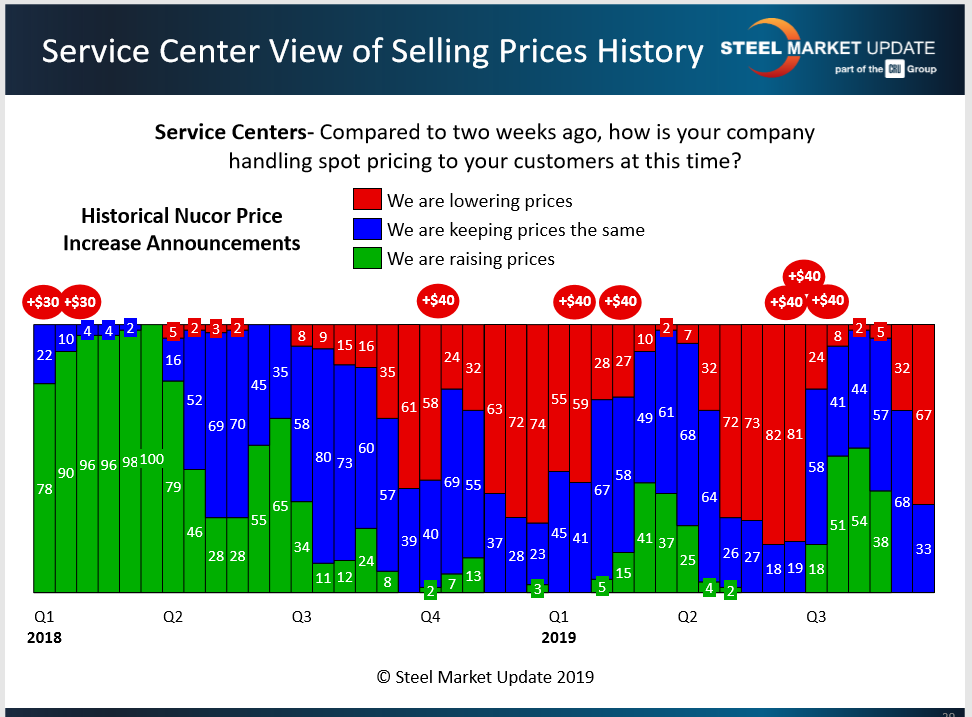

As seen in the chart below, none of the service center executives responding to SMU’s last two polls said they are still raising prices (no green bars). Twice as many said they are lowering prices, while half as many said they are holding the line, compared with data gathered in early September.

SMU data shows that the benchmark hot rolled price began the year at around $730 per net ton, but has decreased by more than $200 per ton since then despite the mills’ attempt to raise prices in June and July. The three $40 per ton price increase announcements can be seen on the chart below, followed by a small but unsustained bump in steel prices. SMU’s current average HR price is $525 per ton and trending downward, just $5 away from the low for the year.

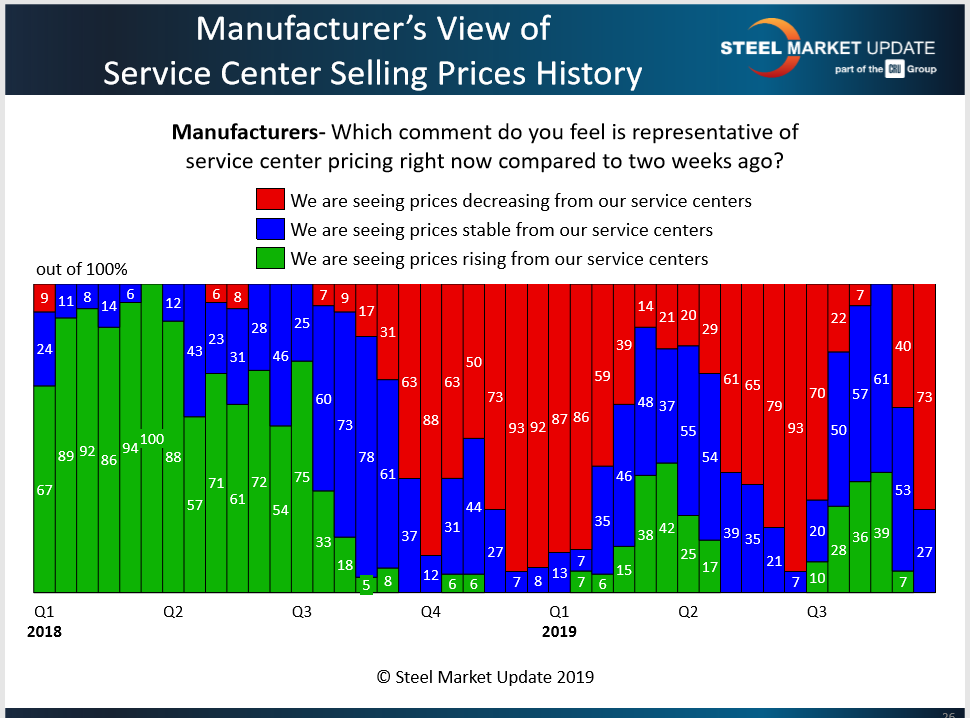

Manufacturers, the service centers’ customers, report a similar trend. Nearly three out of four said they are seeing lower prices from their service center suppliers. None report rising prices from service centers in the latest poll.

How long are prices likely to keep moving lower? That is unknowable, as so many different factors come into play. However, Steel Market Update has identified one potential indicator in its data. As can be seen in the Service Center View of Selling Prices History, service centers typically reach a point of “capitulation” when about 75 percent are lowering prices. In other words, that’s the psychological point at which they give up discounting to win sales and instead begin to hold the line on pricing to safeguard the value of their inventories. With the latest red bar at just 67 percent, it appears service centers are not quite ready to capitulate just yet.