Market Data

October 10, 2019

Steel Mill Negotiations: Wide Open

Written by Tim Triplett

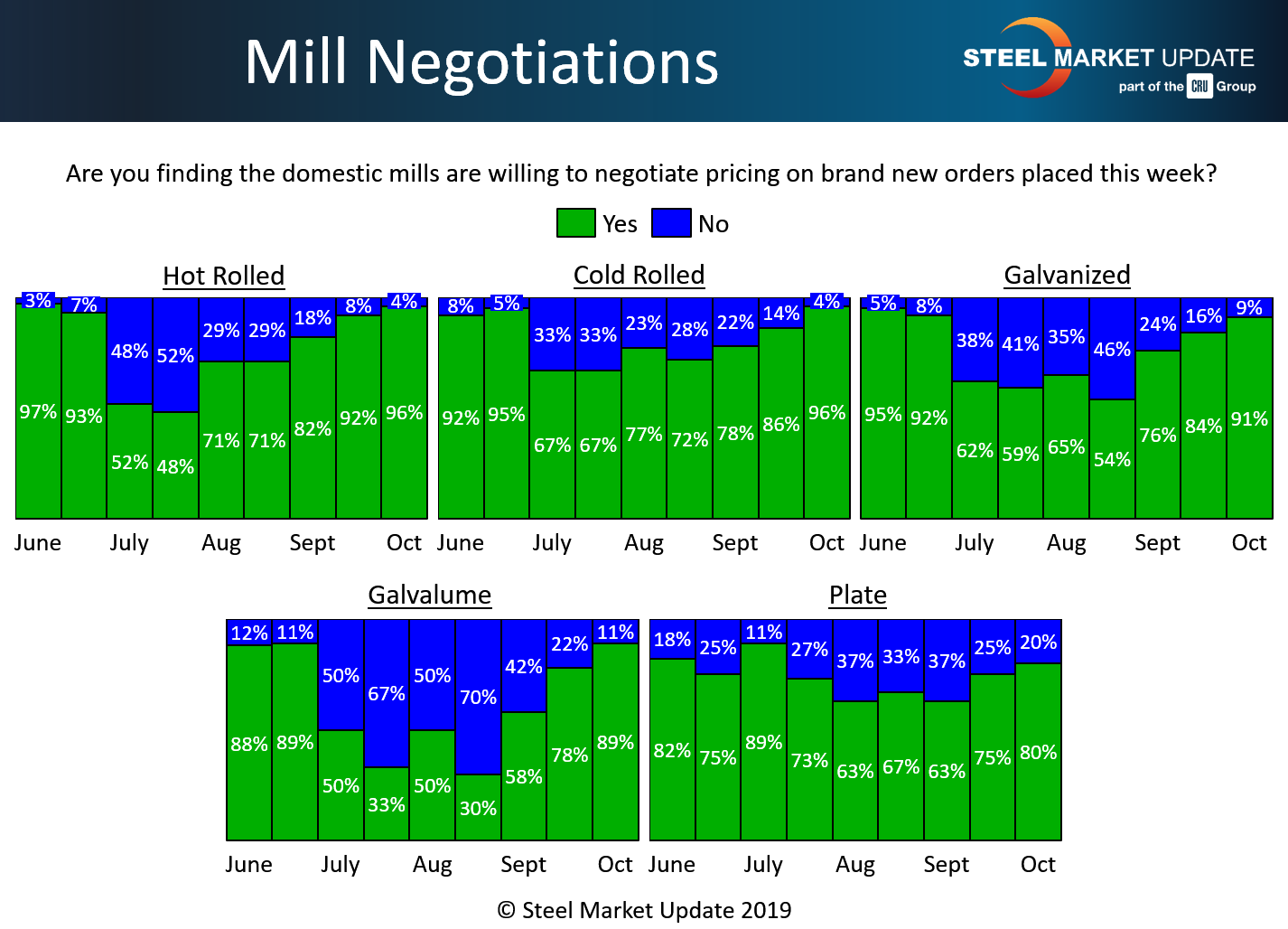

More than nine out of 10 steel buyers responding to Steel Market Update’s market trends questionnaire this week agree that mills are willing to negotiate spot prices on all types of steel products to secure orders in the current, difficult market environment.

In the hot rolled segment, 96 percent of respondents said the mills were open to price talks on HR, up another four percentage points from mid-September. Just 4 percent said their mill suppliers were still holding the line on prices.

In the cold rolled segment, 96 percent said the mills were negotiating, up from 86 percent in mid-September, while just 4 percent said the mills are still standing firm.

The story is the same for suppliers of coated steel. Ninety-one percent said their galvanized suppliers are willing to deal, a jump of seven percentage points from mid-September. Just 9 percent of respondents reported galvanized mills declining to compromise on price. Eighty-nine percent said the mills are now also open to price talks on Galvalume.

Eighty percent of buyers now report the plate mills open to negotiation, as well.

Steel Market Update’s negotiations data reflects the weak steel pricing in the market. Benchmark hot rolled steel prices have slid from around $700 per ton at the beginning of the year to an average of $515 per ton in SMU’s latest data—the lowest point of the year and still trending downward. SMU’s Price Momentum Indicator is pointing Lower for all products as prices are expected to decline further over the next 30 days.

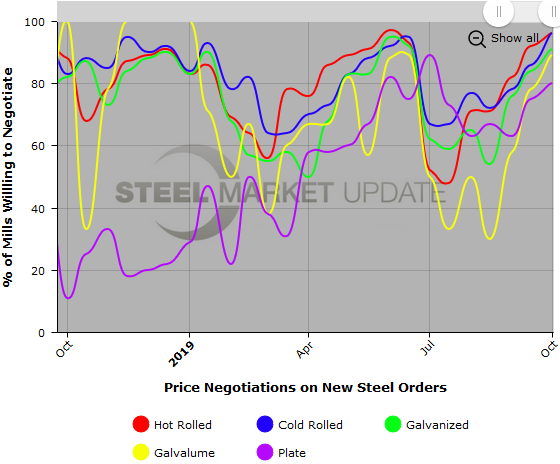

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (example below), visit our website here.