Market Data

October 13, 2019

SMU Market Trends: On Demand, Pricing, Growth

Written by Tim Triplett

Steel Market Update’s canvass of the market this past week reveals that many buyers are leaning pessimistic about their prospects for the fourth quarter. The majority responding to SMU’s questionnaire expect demand to continue weakening, prices to continue declining and growth to remain flat into the fourth quarter and possibly beyond.

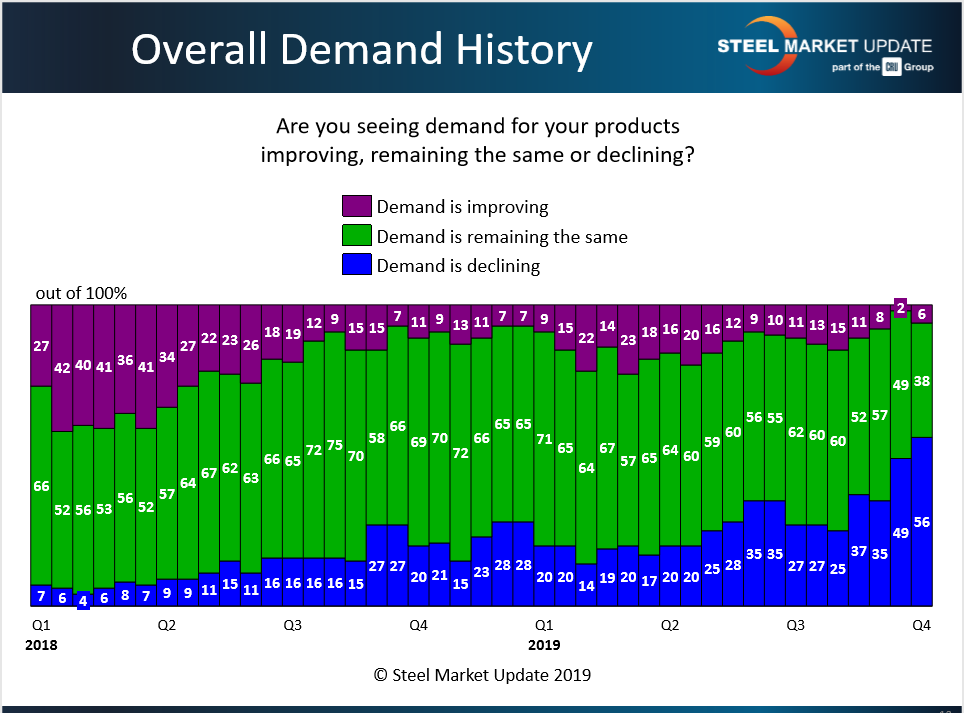

Demand

SMU asked: At this time are you seeing demand for your products improving, remaining the same or declining?

About 56 percent of steel buyers responded that demand for their products and services is declining. Thirty-eight percent see demand remaining about the same. Just 6 percent report improving demand.

Some comments from respondents:

“Everyone is back to sitting on their hands.” Service Center/Wholesaler

“Due to actual and anticipated slowdown, customers are cutting back on buys now.” Trading Company

“The GM strike is starting to be felt throughout the supply chain.” Service Center/Wholesaler

“A slow fourth quarter is being projected.” Service Center/Wholesaler

“It’s more the supply that’s the issue. Orders are there but there’s a lot more competition chasing them.” Trading Company

“Manufacturing is slipping, while construction appears stable.” Service Center/Wholesaler

“Volumes have been off significantly over the last two months.” Service Center/Wholesaler

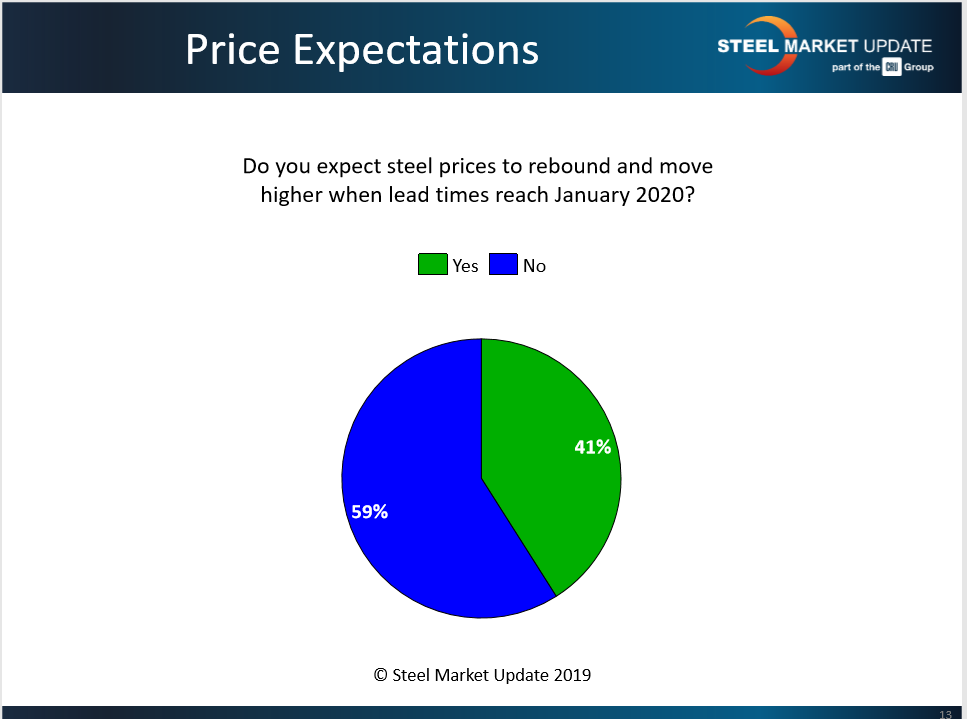

Pricing

SMU asked: Do you expect steel prices to rebound and move higher when lead times reach January 2020?

The market is split on this question. The majority (59 percent) do not foresee a rebound in prices in the fourth quarter, but a substantial number (41 percent) do.

Some comments from respondents:

“How much lower can prices go…?” Service Center/Wholesaler

“I sincerely hope the steel mills will show restraint and not send out rapid price increase announcements again.” Manufacturer/OEM

“I expect mills to try [for an increase] as they will be at price levels that won’t be very profitable if they continue down.” Trading Company

“They can’t go much lower.” Service Center/Wholesaler

“Because whatever goes down, must come up.” Service Center/Wholesaler

“January is a ‘maybe’ for market price improvements. Greater possibility for March ’20 onward.” Trading Company

“Prices will tank in the next few weeks, then level off. But the mills will try for an increase, though demand is not strong enough. With the mills unable to discipline themselves, they will continue to chase each other to the bottom.” Manufacturer/OEM

“Nothing yet to make prices go in that direction [up].” Service Center/Wholesaler

“Not sure it will stick, but I do believe [January lead times] will slow down the rate of prices dropping.” Service Center/Wholesaler

“I suspect we are reaching price points that may be unsustainable for some mills and it will force some level of urgent rationalization, which will support higher prices.” Trading Company

“Maybe by February depending on the severity of winter.” Service Center/Wholesaler

“Prices will rebound. The market will continue to decline through Q4 and eventually get too low.” Service Center/Wholesaler

“Prices were supposed to increase or stabilize in Q4 and that hasn’t happened. So, I hold no hope.” Service Center/Wholesaler

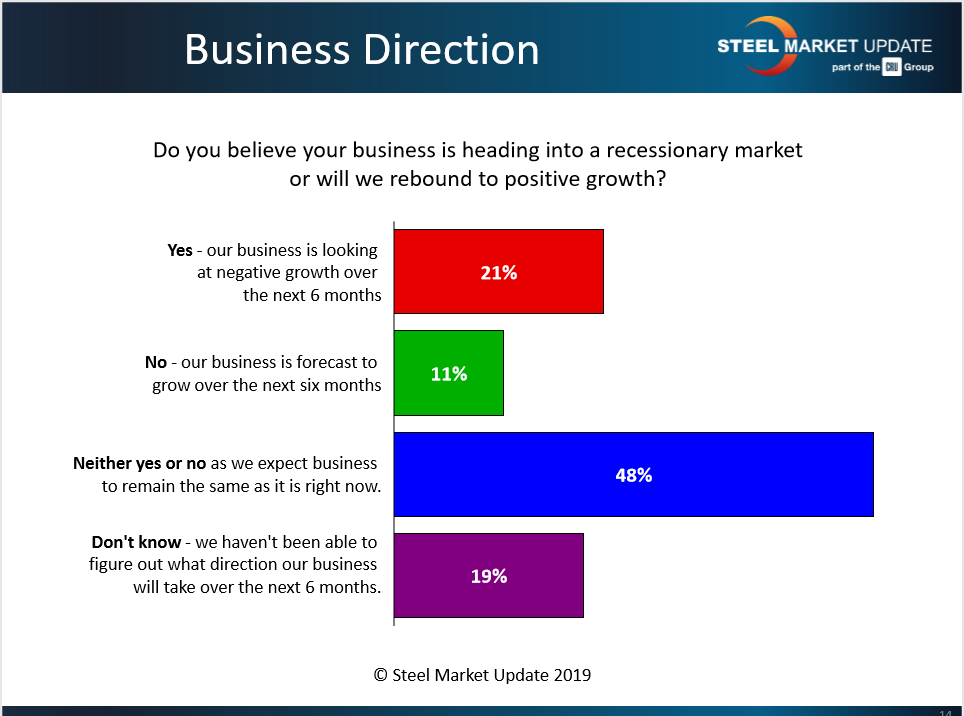

Growth

SMU asked: Do you believe your business is heading into a recessionary market or will we rebound to positive growth?

Just 11 percent of respondents forecast their business will grow over the next six months. The largest group (48 percent) just hope business remains at current levels. About 21 percent anticipate declines in their business. The remaining 19 percent admit they don’t know what direction the market will take in the next six months.

Some comments from respondents:

“We will try and shift to other customers/markets to grow our business.” Trading Company

“It’s a mixed market. Some customers are still busy, others are starting to slow down. As of now, I am leaning toward a slower pace of growth.” Service Center/Wholesaler

“Whilst we see negative growth, the market will not be falling over the cliff. Banks are healthy, cheap money is available. I suspect the politicians will also want to ensure the economy will be OK with some degree of stimulus.” Manufacturer/OEM

“Looking at the business on the books now and what the housing market is projecting, I think it will be pretty close to business as usual at least through first-quarter 2020.” Service Center/Wholesaler

“The continued strike at General Motors, heavy truck starting to fall off and continued softness in the agriculture business are setting the market up for less demand.” Service Center/Wholesaler