Market Data

October 24, 2019

Service Center Spot Price Index Anticipates Acceptance of Mill Increases

Written by John Packard

ArcelorMittal USA announced a $40 per ton ($2.00/cwt) price increase today, which is in line with our expectations that an increase was inevitable based on comments from service centers and manufacturing companies responding to our flat rolled steel market trends questionnaires over the past few weeks. By the end of the day, NLMK USA had joined AMUSA as they too announced a $40 per ton increase to their flat rolled steel customers.

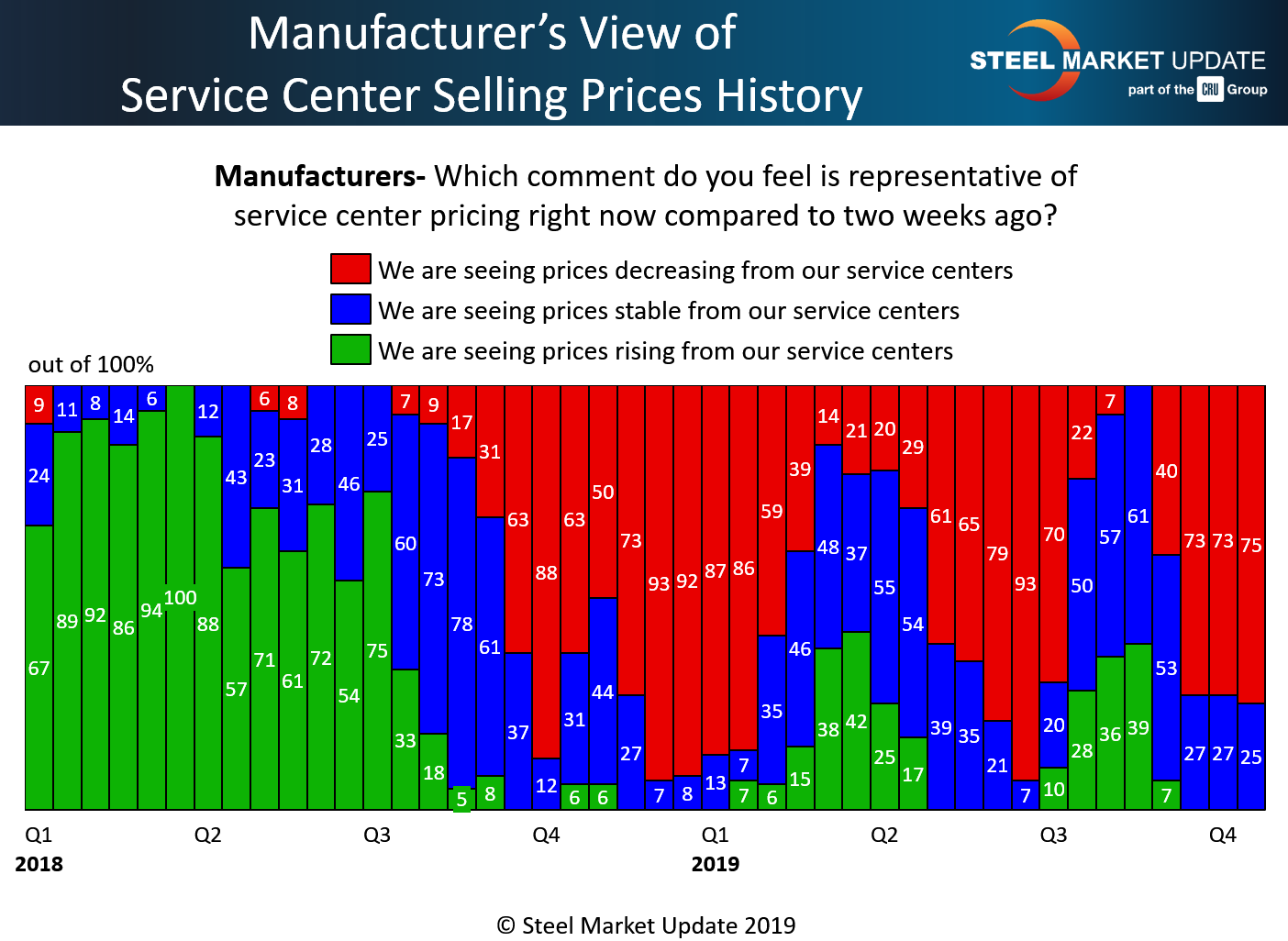

Over the past 6-7 weeks, manufacturing companies and steel service centers have been reporting distributors lowering spot prices to their end user customers. The key being more than 75 percent of the service centers were reporting their company as lowering spot pricing, which puts our index in an area we call “capitulation.”

Capitulation is the point when there are so many service centers lowering prices over an extended period of time, which in the process lowers the value of their inventories and squeezes their margins, that something has to give. As the pain of ever-lower spot prices grows, the distributors get to a point where they are anxious for the cycle to turn. The only way that happens is when steel mills announce price increases, and then the domestic steel distributors in turn support those increases by raising prices to their customers.

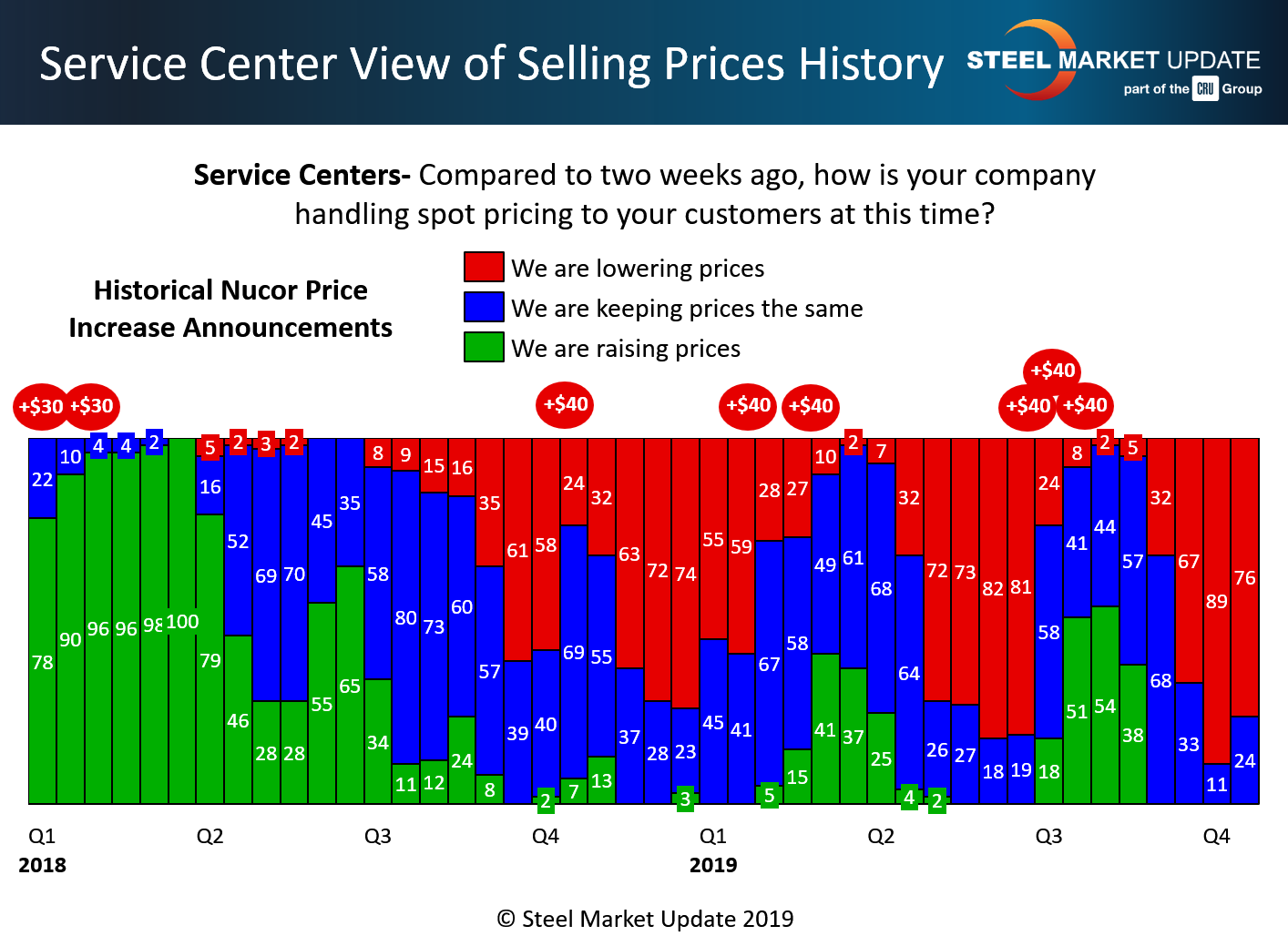

SMU conducted one of our flat rolled and plate steel market trends surveys this week. The survey was closed earlier today. We found 75 percent of the manufacturing companies who responded to our questionnaire reporting their service center suppliers as offering lower spot prices than what they were seeing two weeks earlier. As you can see by the graphic, below this is the third survey at or above 73 percent.

We saw 76 percent of the distributors reporting lowering spot prices to their end customers in this week’s analysis. At the beginning of October, we saw the highest percentage (89 percent) of service centers reporting lowering spot prices for the past couple of years. The red circles above the bar graph indicate Nucor price increase announcements. As of this writing, Nucor had not yet notified their customers of their intention to raise prices in line with ArcelorMittal USA and NLMK USA.