Overseas

October 26, 2019

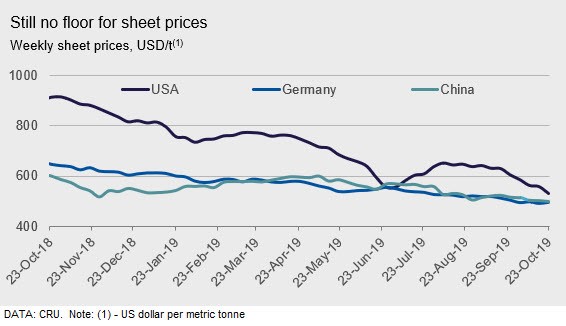

CRU: Global Sheet Prices Fall Again But Scrap May Soon Offer Support

Written by George Pearson

By CRU Prices Analyst George Pearson

The North American market has continued to see steel prices erode. We had previously anticipated that October scrap prices may be the lowest price seen over the next several years. We are now hearing that at least some market participants expect gains for November. The recent decline in scrap prices has allowed finished steel prices room to fall, which has hindered mill profitability. For sheet products, prices have fallen to a new low for the year losing $23-33 /st w/w. Lead times remain weak as the manufacturing economy remains under pressure while the market is entering its weakest period of the year. If scrap prices do indeed rise in November, we expect price increase announcements to come about as well for sheet and plate products.

[Editor’s note: U.S. flat rolled mills announced a $40 per net ton price hike on Oct. 24-25.]

West Coast sheet prices are holding flat for now, as buyers continue to watch Midwest prices deteriorate. West Coast mills have limited availability through the end of the year, which may help to hold up prices despite negative outlooks.

Europe

The German market has changed little in the last week, with HR coil falling by €1/t. Service center stocks are still reported as high enough to cover demand, with hand-to-mouth business and short delivery times. Some buyers with financial end-of-years approaching already have one eye on finishing with a healthy balance sheet, reducing appetite for larger orders, and causing stocks to be offloaded in some cases. Italian HR coil prices fell again but this week by €2/t, less than the €5-8/t weekly decreases since early September. Competitive import prices, primarily from India and Turkey, have put pressure on Italian HR coil. CRU’s Turkey HR coil price was flat at $405/t FOB this week after six consecutive decreases. Turkish scrap import prices have gone up by $25-30/t from the bottom, firming Turkish mill offers for finished steel.

China

The Chinese domestic sheet market remains subdued with prices falling by RMB20-40 /t over the past week. Sluggish end-use demand has reduced transactions and buyers are in wait-and-see mode, reducing purchasing activity. Consequently, traders who have credit concerns have started to offer higher discounts to improve sales and get cash. This was proved by a 4.8 percent w/w decline in sheet market inventories. Falling HR coil prices, underlined by a bearish futures market, also dragged down prices for the coated sheet market. Sheet demand has yet to recover while supply remains relatively strong compared with last year. We expect sheet prices will remain on a downward trajectory unless any positive news appears.

Asia

Prices of imported sheet products in the Asia market tumbled last week on low deals.

For HR coil SAE1006 grade, market participants heard a trader sold Indian material to an end-user at $418/t CFR Vietnam early last week. Because of that, buyers in Vietnam lowered their bid to $410-415/t CFR Vietnam. Even though Indian mills were offering at $425-430/t CFR Vietnam, traders were trying to induce buying interest at $420/t CFR Vietnam. Russia was heard to have offered small coil of this grade at $400-410/t CFR Vietnam for January shipment.

For HR coil/sheet SS400, traders were offering Chinese materials at $435-445/t CFR Vietnam while Indian materials were $10/t lower.

Formosa Ha Tinh also released their offer for December shipment at $455/t CFR Vietnam for HR coil, a $20/t discount from the previous month’s price. They were also offering $25/t discount for early payment and additional discount for big volume.

CRU assessed HR coil prices at $418/t, CFR Far East Asia, a $12/t decrease w/w. CR coil prices were assessed at $520/t CFR Far East Asia, $5/t down w/w, while HDG prices were assessed at $530/t CFR Far East Asia, down by $10/t w/w.