Prices

November 17, 2019

Prices Poised for Another Dead Cat Bounce?

Written by Tim Triplett

As of mid-November, steel prices appear to be moving upward following price increases announced by the major flat rolled and plate mills. How high and for how long is the subject of much debate and speculation. The market is clearly split between those in a buying mode in anticipation of sustained higher prices and those in a wait-and-see mode expecting yet another dead cat bounce.

On two occasions earlier this year the mills raised prices only to see a soft lifeless bounce, collecting a small increase for a short time and then watching the price of steel resume its downward trajectory. This time, the flat rolled mills announced one $40 increase on Oct. 24-25, then followed up with a second $40 increase on Nov. 7. Plate mills announced their own $40 price hikes in about the same time frame. Their goal is to reverse the 15-month downtrend that has nearly cut the price of steel in half, with serious consequences for sales and profits at mills and distributors alike. The benchmark price for hot rolled plummeted from more than $900 per ton in the summer of 2018 to just $470 per ton in mid-October, according to Steel Market Update data.

It’s one thing for the mills to announce a price increase, but quite another for them to actually collect it. It generally boils down to the balance between supply and demand and how much support they get from service centers and distributors. Both are moving targets as the market approaches the end of the year.

Higher prices gained some traction in the first few weeks following the price hikes. The average price for hot rolled steel moved up by $30 to $520 per ton. Cold rolled remained unchanged at $690 per ton. The galvanized base price saw a small $5 increase to an average of $695 per ton. Galvalume remained the same at $710 per ton. Plate steel saw its average price increase by $15 to $655 per ton. Ferrous scrap prices, which have declined for much of this year, traded higher by $15-25/GT in November, which promises to lend some support to higher finished steel prices.

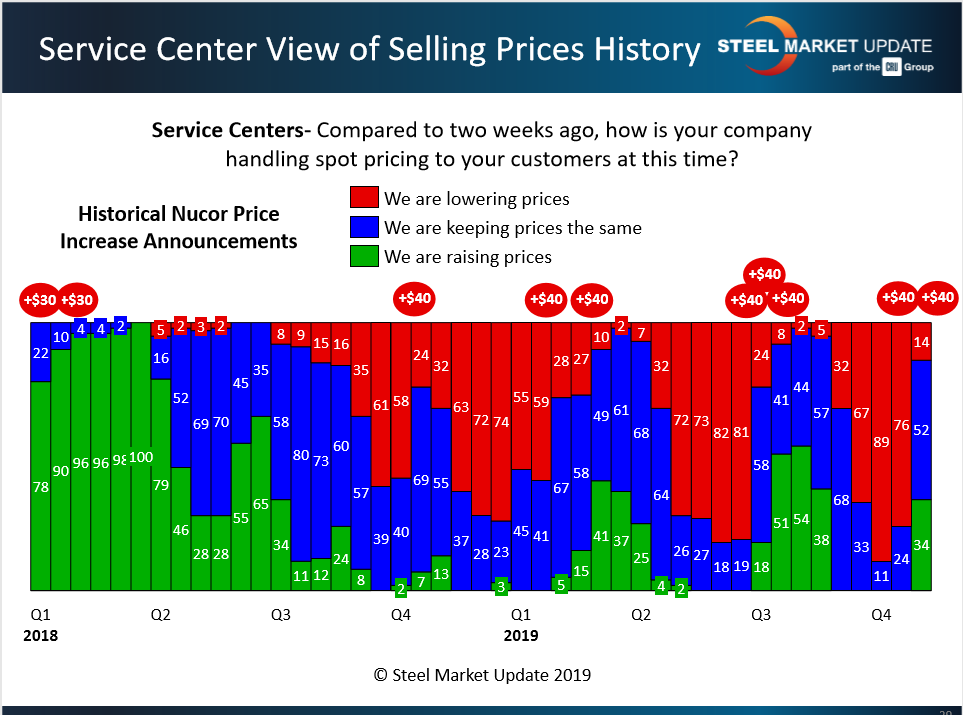

Steel Market Update anticipated the turnaround in prices as the market had been near the point of “capitulation” for several weeks. In tight, competitive market conditions, service centers often discount spot prices to win orders, even though they know declining prices erode the value of their inventories. The history of SMU data has shown that when at least 75 percent of distributors have been lowering prices, and the mills announce a price increase, the service centers will hit a psychological tipping point at which they “capitulate” and begin to support higher prices in pursuit of better margins. The chart below shows the two recent $40 price hikes in the circles to the right. It also shows that 89 percent of service centers were lowering prices to their customers just prior to the mills announcing the first increase.

What the chart does not show is how much support the mills will receive from distributors as they attempt to collect higher prices or how long before the service centers begin to discount once again. As illustrated by the red bars following the failed increases earlier in the year, the service centers were quick to begin lowering prices again. Perhaps predictive of the staying power of the latest price hike, only about one-third (34 percent) of the service centers polled last week said they were actively raising prices, while the majority (52 percent) were keeping prices the same.

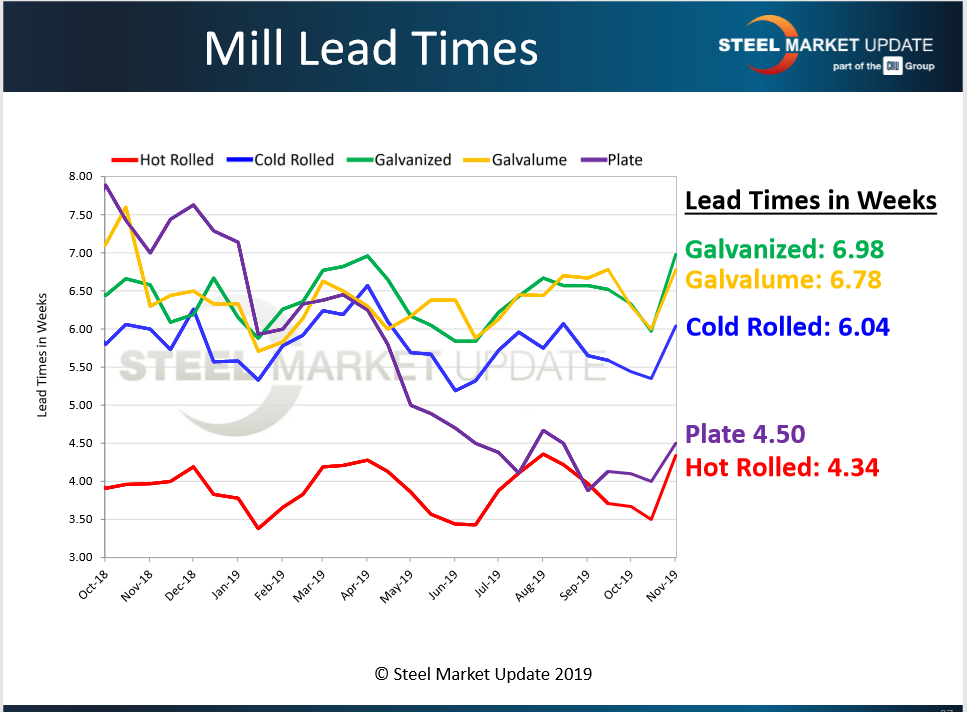

Steel Market Update also tracks lead times for steel delivery, which are a measure of demand at the mill level. Mill lead times for spot orders of flat rolled have shown signs of lengthening. The average lead time for hot rolled moved up to nearly four and a half weeks, cold rolled to over six weeks and coated steels to nearly seven weeks. Thus, it appears the mills are getting busier as buyers step up to place orders ahead of increasing prices. Rising prices and lengthening lead times seem to indicate that demand is sufficient for the mills to collect at least a portion of the $80 increase they are seeking.

The state of negotiations between the mills and their customers is another key indicator that Steel Market Update monitors. SMU asks buyers twice each month: Are the mills holding the line or are they willing to discount the price to secure your order? It was no surprise, following the price increases, that negotiations between steelmakers and steel buyers tightened up a bit. What was surprising is that roughly two out of three buyers, as of the second week in November, still reported the mills actively negotiating spot prices on all types of steel products. If this persists, it casts doubt on whether the mills will have the necessary discipline to stand behind their higher prices into next year or whether we are looking at the third dead cat bounce of 2019.

What Steel Buyers are Saying

“The mills are trying to stop the bleeding. However, demand is the key.”

“Our sales are up, but only because buyers are trying to beat the price increase.”

“The increases are all designed to stop the bleeding and prop up pricing for 2020 contracts. This is another dead cat bounce. There will probably be some increases in January-March, but they will fall apart by April.”

“Prices are pretty firm. I think these two will stick and there will probably be another increase soon. Removal of the blast furnaces by ArcelorMittal and U.S. Steel should keep prices up, if the mills have some discipline…but we know that never happens.”

“The mills have no discipline. They appear content to make money in one quarter and then tank the numbers in the next for the sake of not losing market share. For them, the name of the game is always TONS.”

“As most of the lead times are now in January, prices are a little more firm. Whether this is a dead cat bounce depends entirely on demand after the first of the year and how aggressive the mills try to become.”

“There may be a nice mini-rally here, but the fundamentals are poor and this will fade.”

“I believe the latest increases will prove to be a dead cat. Without an increase in demand or cuts in capacity, there is no reason for steel prices to go up.”