Prices

November 26, 2019

Ferrous Scrap Prices Rise $30-40 in December

Written by Tim Triplett

Ferrous scrap prices settled up $30-40/GT in December for most regions and most grades, on top of the $15-20/GT increase in November, lending further support to rising finished steel prices.

Not only did prices find support from seasonally tighter scrap supply, but mill demand was stable or higher month over month for most regions, said CRU North America Senior Analyst Ryan McKinley. Mills that entered the market early generally secured the lowest prices at around $30/GT higher. Increased demand in the Ohio Valley and the South amid limited supply availability caused mills in those regions to pull from the Great Lakes or East Coast regions, causing prices to rise further late in the trade week.

“Short supply is the main culprit behind this increase,” agreed a dealer in the Northeast. He reported that prices for all grades went up $30 with the exception of shred, which jumped from up $30 to up $45 in the Ohio Valley and Southeast. Expectations are for another jump of $10-20/GT in January, he added.

Foreign demand for U.S. scrap is lending additional support to prices. “The export market has recently strengthened, which also helped underpin price increases this month,” said McKinley. “Turkish import prices are now at their highest level since August, for example.”

Added one dealer: “Export continues to run up with sales taken today from the U.S. at $295-300 Turkey, which will put additional pressure on domestic prices moving forward.”

The December increase puts prices for busheling at $270/GT, shred at $255/GT and HMS at $230/GT, said one source, who expects the uptrend to continue.

“There is little doubt the U.S. scrap markets will rise again in January. Mills are still looking for scrap in December. Therefore, January has nowhere to go but up, whether it’s from demand/supply, bad weather or an export-driven scenario. It’s gonna go up!” he said.

Looking Back at Scrap in 2019

Offering a retrospective on the past year, CRU’s McKinley said 2019 was a weaker year for scrap prices than most had anticipated. “January was sort of harbinger for price movements in 2019 after prices fell for the first time during that month in 13 years. Even with November and December price increases this year, prices are now almost $100 lower than they were in December 2018. We can categorize the year generally as a period of scrap price weakness, but I see three distinct phases that occurred,” he continued.

The first phase took place during the first three quarters of the year when oversupply drove month over month price decreases. The oversupply was caused by relatively high scrap prices in general, which allowed an influx of material to enter dealers’ yards. Many scrap peddlers, demolition companies and feeder yards kept sending in as much scrap as they could, sensing that scrap would keep declining. “In a way, this created a self-perpetuating cycle of price declines. Prices would drop after these market participants sent in so much scrap, so they would send in yet more scrap because prices were poised to fall even further and they wanted to be rid of the material. Keep in mind that finished steel prices were also under enormous downward pressure during this time, so mills really had no choice but to lower scrap prices to help maintain some margin, even with relatively high capacity utilization rates.”

August is when this oversupply began to fade and prices began to rise. This was the transition month from phase one to phase two. The second phase was brief (September through October), but resulted in a precipitous decline in scrap prices. Instead of supply-driven price decreases, a litany of mill maintenance outages created substantial pressure on demand and forced prices lower still, McKinley explained.

The third phase of this year is what has occurred in November and December. Mills returned from their maintenance outages and the oversupplied market dissipated thanks to lower scale prices and adverse weather conditions. Meanwhile, demand has remained relatively stable and the export market firm, allowing prices to rise once again.

Looking ahead, McKinley also sees higher scrap prices during the first quarter of 2020. “There is upward price momentum, for now, heading into January, and from there it will be largely dependent on the weather.”

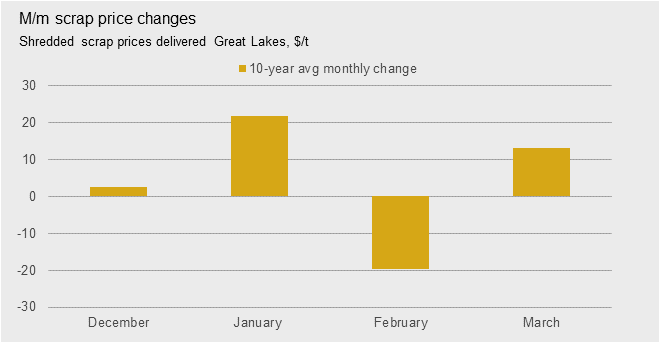

The CRU chart below shows what an “average” year might look like based on 10-year price movements in December and into Q1.

Pig Iron Market’s Also Looking Up

Pig iron prices have been bolstered by the iron ore price levels, said one SMU source. “Producers did not give in to the mills like scrap dealers had to. They refused to operate at a loss. What saved them is the buying by the Chinese.”

Chinese buyers looked at the ore price levels and thought they could use pig iron, mainly from South Brazil (which USA mills turn away from due to Phos levels). Chinese mills have bought at least 200,000/MT over the last two months and have signaled their continued interest. CIS producers will not be generating the same volumes as in the past. The renewed pressure on scrap has them believing that higher prices are imminent.

Current pig iron prices are $326-28/MT CFR NOLA with new offers for February shipment rising to $335-340/MT. These levels give domestic busheling an opening to rise in price.

Many were surprised by the announcements from Stelco and Cleveland-Cliffs/AK Steel that they are considering pig iron production. “Stelco will be producing pig iron to optimize its blast furnace. Very smart. When HRC is weak, they can sell MPI. When steel is better, they can use the ‘hot metal’ in their BOF to increase production. In either case, they will not have to decrease iron production, so their hot metal costs remain optimally static,” he said.

Any pig iron that may be produced at AK Steel’s Ashland Works will probably be used internally. The new entity will theoretically have the same options as Stelco. However, to reopen a shuttered mill just for this purpose may take some further justification, he added.