Market Data

December 5, 2019

Steel Mill Lead Times: Mixed Readings

Written by Tim Triplett

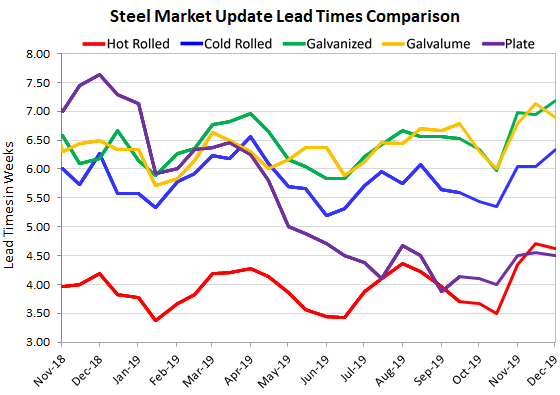

Mill lead times for spot orders of flat rolled steel may be starting to level out after lengthening week after week since early November. The latest data shows slightly longer lead times for cold rolled and galvanized products, but slightly shorter lead times for hot rolled, Galvalume and plate. Lead times for steel delivery are a measure of demand at the mill level. The longer the lead time, the busier the mill.

The average lead time for hot rolled steel is now at more than four and a half weeks, cold rolled is nearly six and a half weeks and coated steels are around seven weeks. Plate lead times are at four and a half weeks, according to data gathered by Steel Market Update this week.

Reporting the change in average lead times since mid-November, hot rolled is now at 4.63 weeks, down from 4.70 weeks. The average lead time for Galvalume is down to 6.89 weeks from 7.13 weeks. Lead times for spot orders of plate steel are down to 4.50 weeks from 4.56 weeks. Moving the opposite direction was cold rolled, now up to 6.33 weeks from 6.04 weeks, and galvanized, up to 7.18 weeks from 6.94 weeks. Except for plate, lead times for all steel products are still longer than they were at this time last year.

The series of price hikes announced by the mills in late October and early November pulled some buyers into the market ahead of the rising prices, pushing out lead times. Steel Market Update estimates the current hot rolled price at $555 per ton, up approximately $75 since October. Do the slight downturns in the average lead times of hot rolled and some other products suggest the price increases may be losing momentum? It’s certainly too soon to tell, but worth watching.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.