Prices

February 11, 2020

CRU: Iron Ore Prices Rebounding on Supply Concerns

Written by Erik Hedborg

By CRU Senior Analyst Erik Hedborg

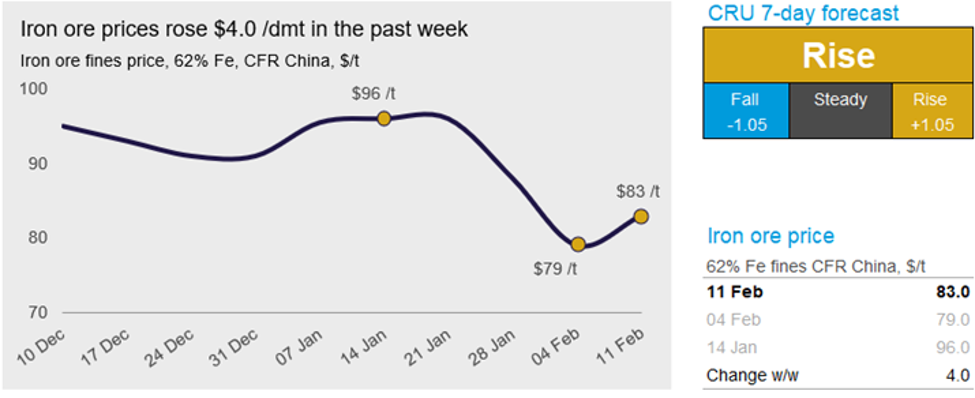

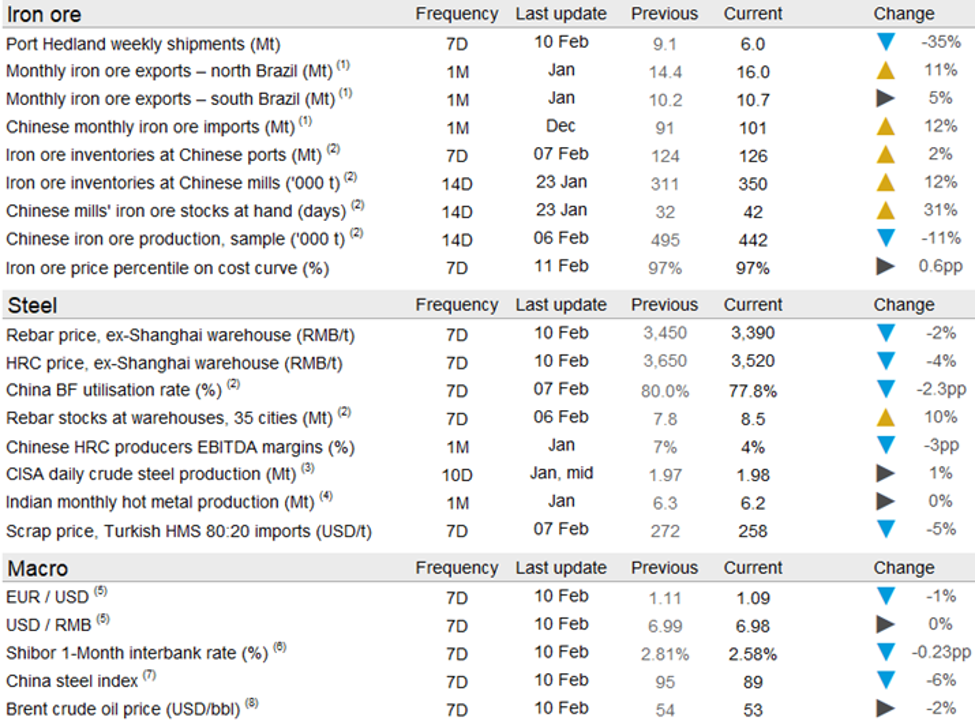

Iron ore prices bounced back in the past week with Tropical Cyclone Damien forcing Port Hedland and Rio Tinto’s two ports to shut for three to six days. This resulted in ~10 Mt of shipments taken out of the seaborne market. At the same time, the sentiment in the futures markets improved on Tuesday and iron ore is currently trading at $83 /t, a $4.0 increase w/w.

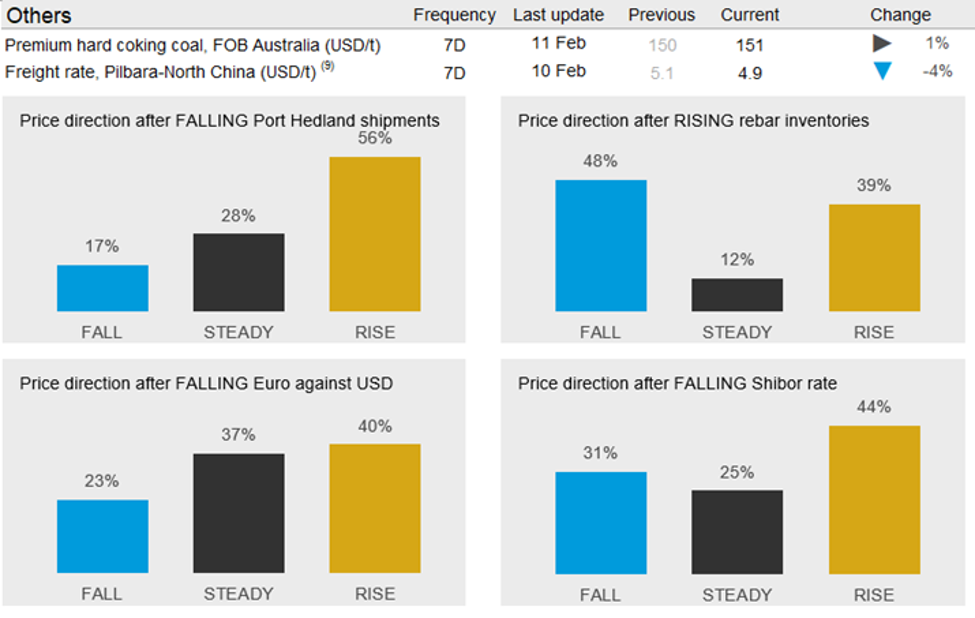

In China, steel prices have continued to decline as large parts of China’s industrial sector are operating at lower levels and many workers at construction sites have yet to return to work. As most blast furnaces are still operating, steel production is still ongoing and inventories, particularly at mills, are piling up quickly. Our sources are saying that bulk materials are still being unloaded at ports, although at a lower rate due to low availability of workers and increasing administrative requirements to contain the virus. One sector that is severely constrained is landborne transportation. The costs of trucking raw materials from mine sites to steel mills have increased rapidly in the past weeks, which is making it challenging to deliver domestic concentrate from Chinese miners to steel mills and pellet plants. As a result, the pellet premium in China has risen to above $40 /dmt in the past week.

In the past week, seaborne iron ore supply was at its weakest level since March 2019 when Cyclone Veronica swept in across the Pilbara region. Cyclone Damien has resulted in Rio Tinto’s two ports closing for several days and we are expecting no shipments for a period of nearly one week. Port Hedland is located further east and the impact on the port was less severe as no exports took place between Feb. 8-10. In addition, the heavy rain over the mining areas is expected to restrict production in the coming week.

The heavy rain in Brazil has continued and exports from both the northern and the southern parts of the country will remain under pressure. In addition, Vale’s pellet exports in January fell to the lowest level since June 2019, with exports to China dropping sharply.

In the coming week, supply will improve, but still remain at a low level. Meanwhile, there is a chance that the situation in China improves further, which may result in further restocking demand in China as mills are currently running down their inventories.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com