Market Data

April 5, 2020

Steel Mill Negotiations: No Surprise, It's a Buyer's Market

Written by Tim Triplett

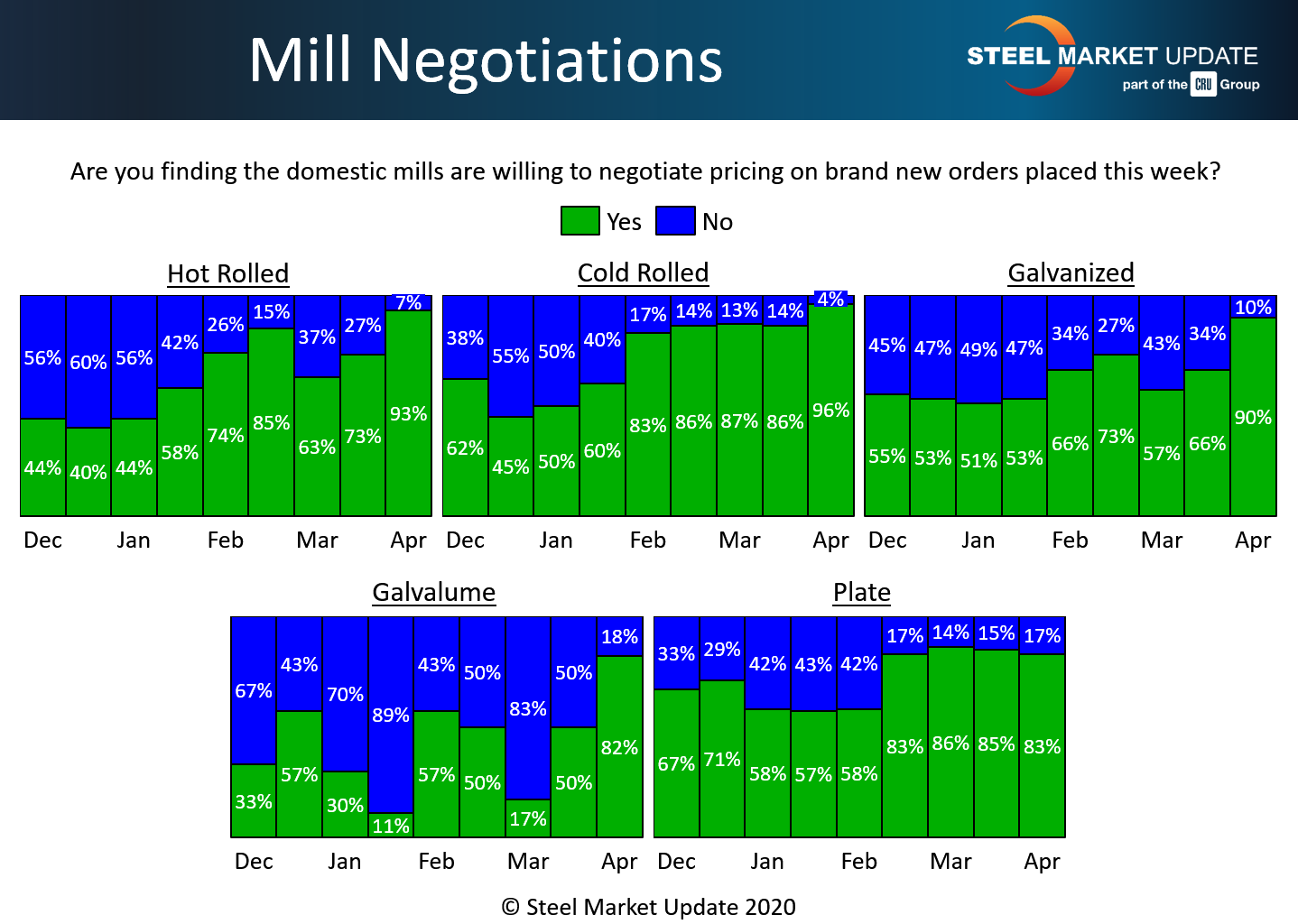

Price negotiations between steel mills and steel buyers are wide open, not surprisingly, as companies scramble to win orders in a market disrupted by the coronavirus. More than nine out of 10 buyers responding to Steel Market Update’s questionnaire this week said the mills are now talking price on all types of products.

In the hot rolled segment, 93 percent of the steel buyers said the mills are willing to negotiate prices on HR, up 30 points from 63 percent in early March. In the cold rolled segment, 96 percent reported the mills willing to talk price, up from 87 percent a month ago. In galvanized, 90 percent reported the mills open to negotiation, up more than 30 points from the 57 percent four weeks ago. Similarly, 82 percent said they have found mills willing to compromise on Galvalume prices.

The tone of negotiations in the plate sector has seen relatively little change since mid-February. About 83 percent said the plate mills are now open to negotiations, while just 17 percent said mills are holding firm on plate.

Benchmark hot rolled steel price declined by $40 in the month of March, to an average of $540 per ton, according to SMU’s canvass of the market earlier this week. With steel prices widely expected to continue dropping as social distancing orders stifle commerce, it’s likely to remain a buyer’s market for some time to come.

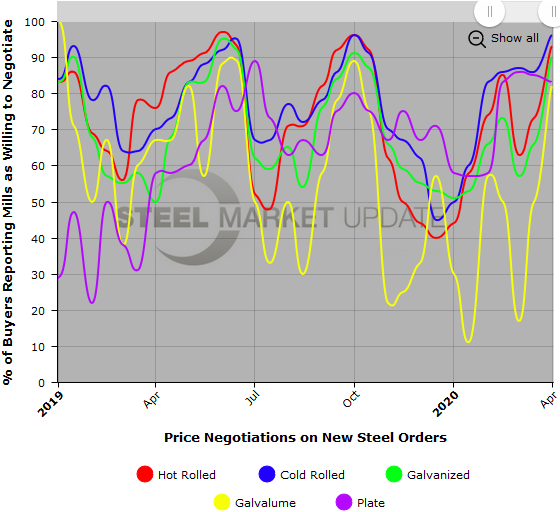

Note: SMU surveys active steel buyers twice each month to gauge the willingness of their steel suppliers to negotiate pricing. The results reflect current steel demand and changing spot pricing trends. SMU provides our members with a number of ways to interact with current and historical data. To see an interactive history of our Steel Mill Negotiations data (second example below), visit our website here.