Market Data

April 19, 2020

Service Center Spot - Pandemic Overrides Capitulation

Written by John Packard

If not for the pandemic, SMU would be calling the service centers as being at a point of capitulation. Our expectation would be for the steel mills to announce price increases in the near future. If not for the pandemic.

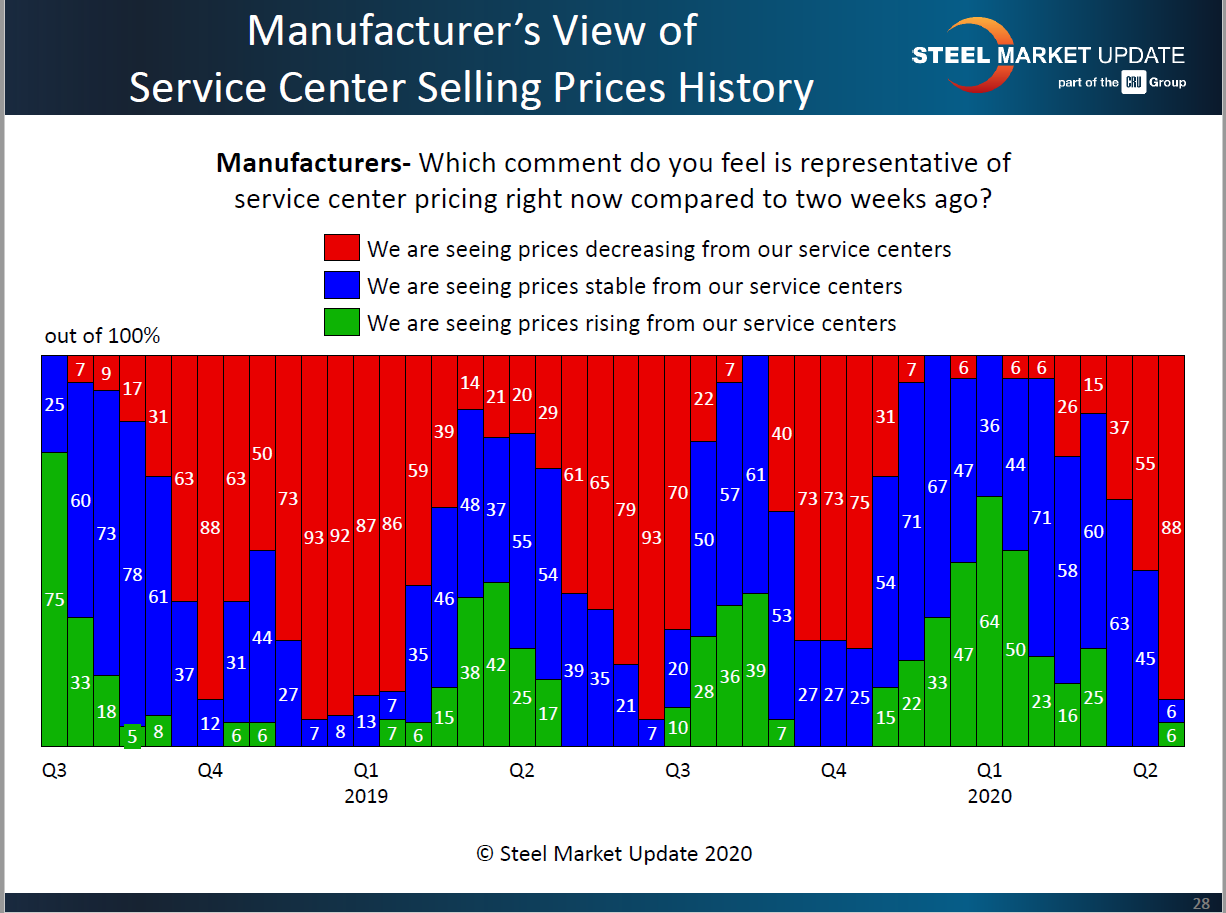

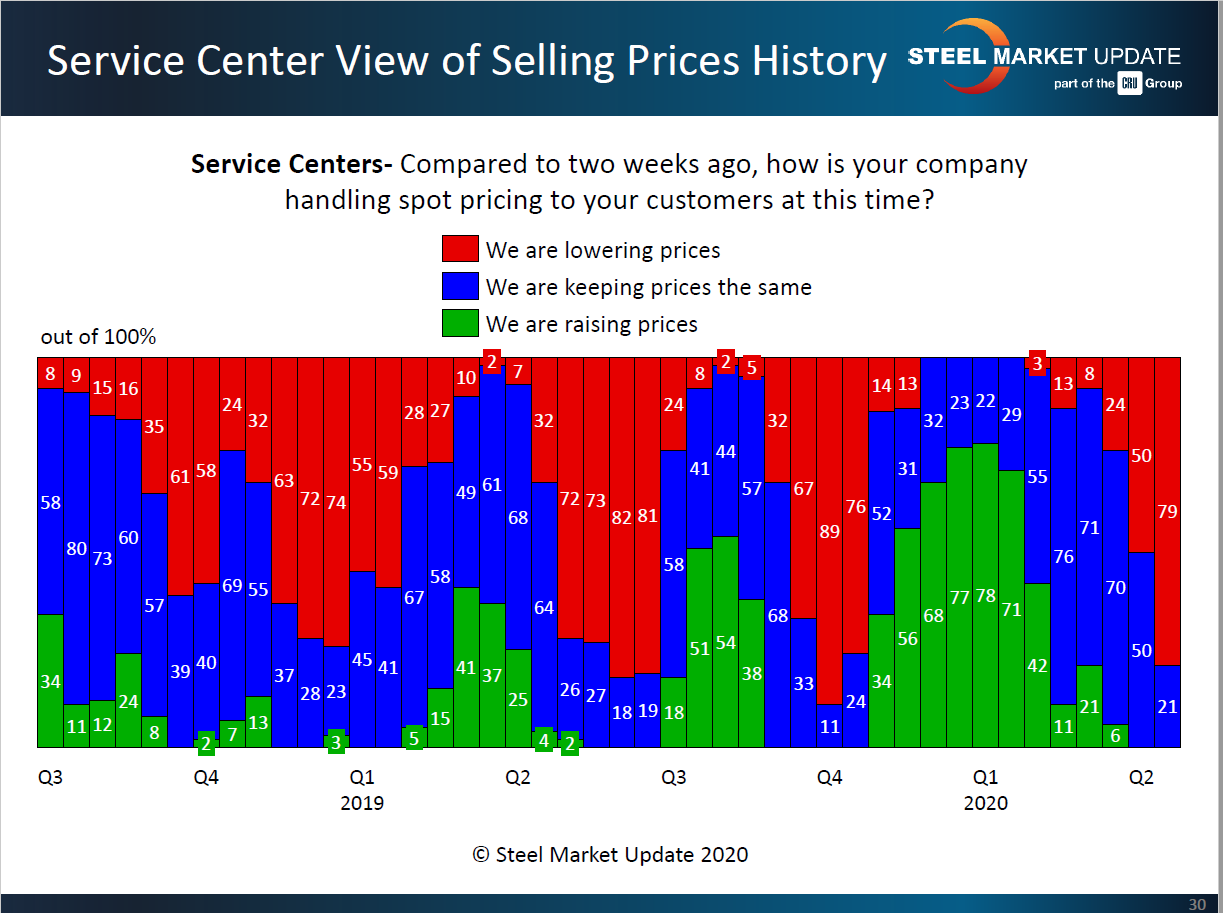

We have seen both manufacturing companies and service centers reporting spot prices out of the service centers as being lower than two weeks ago. When we find 75 percent or a greater percentage of the steel distributors reporting their company as offering lower spot prices, we normally peg that point as being when service centers are willing/anxious to have the domestic mills announce price increases.

However, we are not in a normal world. With COVID-19 the rules have changed.

Granted, service centers would very much like to see spot steel prices move higher, but the pandemic and the associated demand destruction is creating a market where distributors are over-inventoried and not capable of putting more steel on their floors.

We will have to wait out this market to see what happens next.

Eighty-eight percent of the manufacturing companies responding to last week’s questionnaire reported service centers as lowering spot pricing. We have not seen spot numbers at this level since late second quarter 2019.

Service centers also reported their companies as lowering spot prices to their end customers. Last week 79 percent of the distributors reported lowering prices.