Prices

April 21, 2020

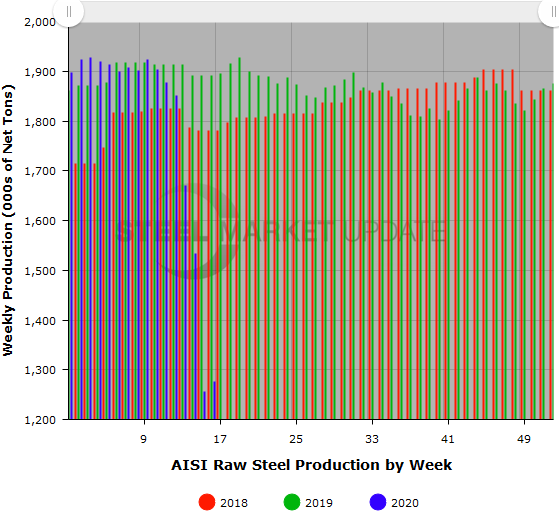

Declines in Raw Steel Production Starting to Level Out?

Written by Tim Triplett

U.S. raw steel production actually inched up last week after a series of declines that has taken the average mill capacity utilization rate down by 25 percentage points since early March. Production in the April 18 week totaled 1,277,000 net tons with the mills operating at an average capability utilization rate of 57.0 percent, down sharply from the 82+ percent level last month, but up slightly from a rate of 56.1 percent in the week ending April 11, reported the American Iron and Steel Institute. The last time raw steel production was this low was in 2009. The current week’s production represents a 32.5 percent decrease from the same week last year.

Adjusted year-to-date production through April 18 totaled 27,600,000 net tons at an average utilization rate of 76.6 percent–down 6.6 percent from production in the same period last year when the average utilization rate was 81.5 percent.

Following is production by district for the April 18 week: North East: 116,000 net tons; Great Lakes, 443,000 net tons; Midwest, 124,000 net tons; South, 539,000 net tons; and West, 55,000 net tons, for a total of 1,277,000 tons. Production increased modestly in four of the five districts by a total of 21,000 tons.

The raw steel production tonnage provided in this report is estimated. The figures are compiled from weekly production tonnage from 50 percent of the domestic producers combined with monthly production data for the remainder. Therefore, this report should be used primarily to assess production trends. The AISI monthly production report provides a more detailed summary of steel production based on data supplied by companies representing 75 percent of U.S. production capacity.

Editor’s note: Steelmakers have announced roughly 10 million tons of production cuts in response to the dropoff in demand as the economy struggles with the coronavirus. AISI’s capacity utilization figures are somewhat misleading as they do not factor in furnaces that have been idled by various mills in the past few weeks. AISI considers a furnace to be part of a mill’s capability until it has been shut down permanently. Thus, the mills that remain in production are most likely operating above the levels currently reported by AISI.