Market Data

April 24, 2020

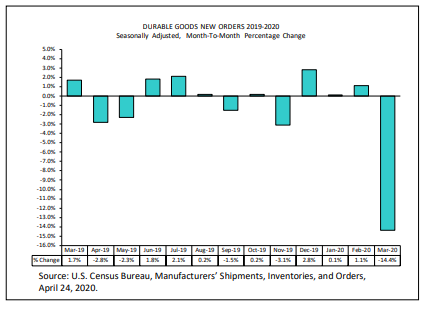

Durable Goods Orders Tumble on Economic Uncertainty

Written by Sandy Williams

Durable goods orders plummeted 14.4 percent in March to $213.2 billion, said the U.S. Census Bureau in its latest report. The decrease followed three consecutive months of increase and was the largest monthly decline since August 2014.

Transportation equipment led the decrease in March falling 41 percent to $51.2 billion. Commercial aircraft and parts plunged 296 percent, due mostly to order cancellations at Boeing. Aircraft parts manufacturers were hit hard as global airlines grounded planes in response to the pandemic. Automotive orders dropped 18.4 percent as sales stalled due to job losses and shelter-in-place orders.

Excluding transportation, durable goods orders were down 0.1 percent. Orders for capital goods, nondefense goods excluding aircraft and a proxy for future business investment, surprised economists by edging up 0.1 percent last month. The April report is expected to show a decrease that may continue through at least the second quarter.

The March advance report on durable goods manufacturers’ shipments, inventories and orders follows:

New Orders

New orders for manufactured durable goods in March decreased $36.0 billion or 14.4 percent to $213.2 billion. This decrease, down following three consecutive monthly increases, followed a 1.1 percent February increase. Excluding transportation, new orders decreased 0.2 percent. Excluding defense, new orders decreased 15.8 percent. Transportation equipment, down two of the last three months, led the decrease by $35.6 billion or 41.0 percent to $51.2 billion.

Shipments

Shipments of manufactured durable goods in March, down eight of the last nine months, decreased $11.4 billion or 4.5 percent to $240.7 billion. This followed a 0.8 percent February increase. Transportation equipment, also down eight of the last nine months, led the decrease by $10.9 billion or 12.8 percent to $74.1 billion.

Unfilled Orders

Unfilled orders for manufactured durable goods in March, down following three consecutive monthly increases, decreased $23.4 billion or 2.0 percent to $1,135.2 billion. This followed a 0.1 percent February increase. Transportation equipment, also down following three consecutive monthly increases, led the decrease by $22.9 billion or 2.9 percent to $768.3 billion.

Inventories

Inventories of manufactured durable goods in March, up 18 of the last 19 months, increased $2.7 billion or 0.6 percent to $437.4 billion. This followed a virtually unchanged February. Transportation equipment, up 20 of the last 21 months, led the increase by $0.9 billion or 0.6 percent to $152.6 billion.

Capital Goods

Nondefense new orders for capital goods in March decreased $24.5 billion or 33.4 percent to $48.7 billion. Shipments increased $1.4 billion or 1.9 percent to $75.7 billion. Unfilled orders decreased $26.9 billion or 4.0 percent to $643.2 billion. Inventories increased $2.1 billion or 1.0 percent to $200.4 billion. Defense new orders for capital goods in March increased $0.7 billion or 4.3 percent to $16.4 billion. Shipments decreased $0.3 billion or 2.0 percent to $12.8 billion. Unfilled orders increased $3.5 billion or 2.1 percent to $169.6 billion. Inventories decreased $0.3 billion or 1.2 percent to $23.8 billion.

Revised February Data

Revised seasonally adjusted February figures for all manufacturing industries were: new orders, $497.1 billion (revised from $497.4 billion); shipments, $500.1 billion (revised from $500.3 billion); unfilled orders, $1,158.5 billion (revised from $1,158.6 billion) and total inventories, $699.6 billion (revised from $699.4 billion).

U.S. Census Bureau Statement Regarding COVID-19 Impact: Due to recent events surrounding COVID-19, many businesses are operating on a limited capacity or have ceased operations completely. The Census Bureau has monitored response and data quality and determined estimates in this release meet publication standards.