Market Data

May 28, 2020

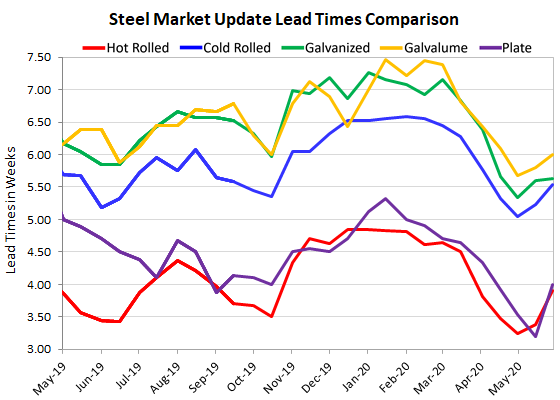

Steel Mill Lead Times: Extend During May

Written by Tim Triplett

Lead times for spot orders of flat rolled and plate steels extended during the month of May following steady declines in April as demand suffered from the government shutdowns of nonessential businesses to stem the spread of COVID-19.

Lead times for steel delivery are a measure of demand at the mill level—the longer the lead time, the busier the mill. The latest SMU data, combined with recent steel price increases, suggests that activity is beginning to improve at the mill level.

Hot rolled lead times now average 3.91 weeks, up from 3.25 at the end of April. Cold rolled orders currently have a lead time of 5.54 weeks, up from 5.04 weeks a month ago. The current lead time for galvanized steel is 5.63 weeks, up from 5.34, while Galvalume is at 6.00 weeks, up from 5.67 in SMU’s late April check of the market.

Plate lead times have also extended over the past month to 4.00 weeks from 3.53 weeks.

Lead times for steel delivery were expected to extend as businesses reopened and steel demand improved. The market will be watching closely to see what happens to lead times when the mills begin to bring back idled capacity.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.