Market Segment

June 4, 2020

CRU: Covid-19 Impact on the Steel Supply

Written by Iris Speelmanns

By CRU Analyst Iris Speelmanns, from CRU’s Global Steel Trade Service

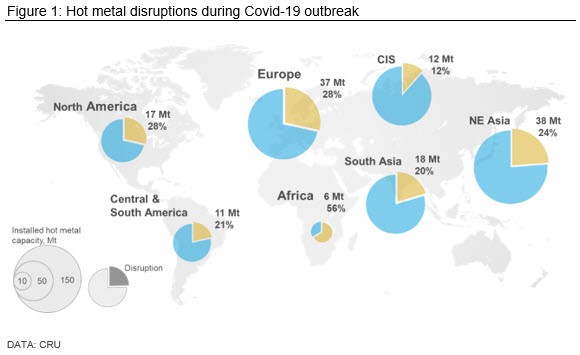

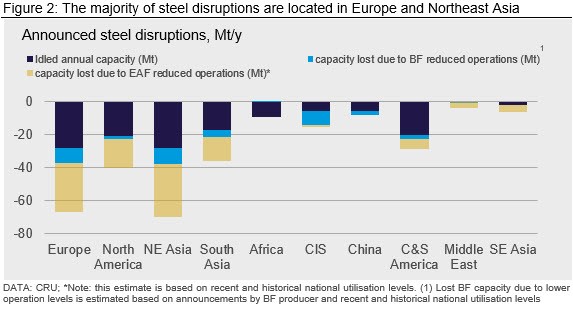

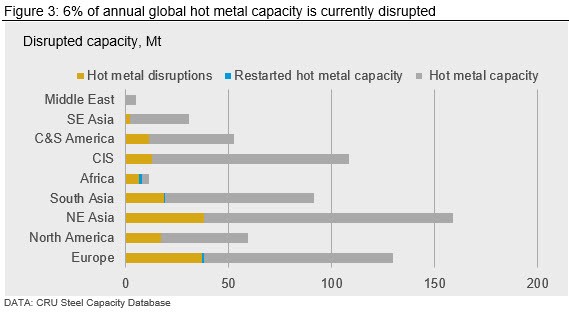

The spread of Covid-19 has resulted in an annualized loss of 284 Mt of steel capacity outside China. Slowly easing lockdown measures in most regions have allowed for the resumption of some industrial activities and steel producers in some countries are restarting their operations, while others have been forced to make further curtailments.

In this regard, key developments have taken place in Brazil and India. While producers in India have been able to increase capacity utilization levels to ~85 percent as the lockdown there is gradually lifted, Brazil has become the epicenter of Covid-19 infections. Although manufacturing activity in Brazil is slowly resuming, with the restart of some OEMs, CSN has temporarily idled one blast furnace (BF) at its Volta Redonda plant to match output with falling steel demand as Covid-19 infections spread.

Further easing of the nationwide lockdown in South Africa allowed ArcelorMittal to resume operation of its EAF in Vereeniging and it is in the process of restarting one of the BFs in Vanderbijlpark. In addition, the restart of ArcelorMittal’s BF at its Newcastle facility is scheduled for early-June, while the restart of the second BF at Vanderbijlpark will depend on how quickly market activity and demand recover. South Africa had the sharpest decline in hot metal production among all countries in April. After the country went into lockdown in late-March and BFs shutdown, only a residual of 3 kt of hot metal were produced in April compared with an average production of 0.3 Mt per month pre-Covid-19.

Meanwhile, in the United States, there are rumors that U.S. Steel is preparing to restart its banked BF at the Edgar Thomson works. The decision to restart this BF is potentially driven more by technical aspects, because of difficulties that arise if banking is applied for a prolonged period of more than six weeks, rather than a fast recovery of demand. Although steel demand in the USA is slowly recovering, with restarting auto and manufacturing activities, BF restarts are “lumpy” and there is a risk of a temporary demand-supply mismatch, particularly during a downturn and at the onset of a recovery.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com