Market Data

June 14, 2020

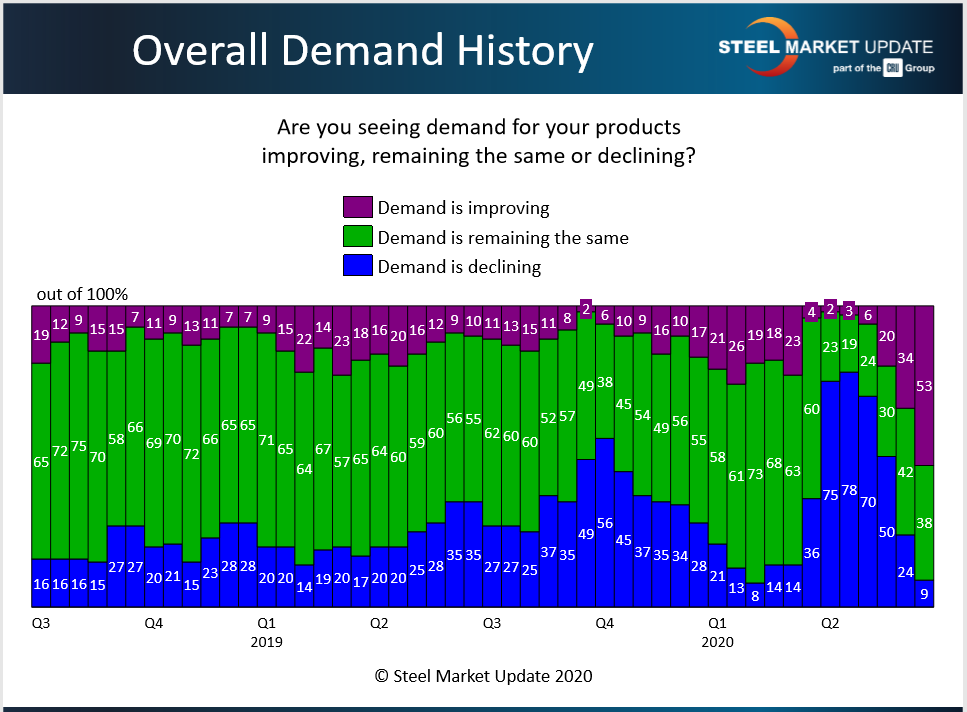

SMU Market Trends: Demand's Improving

Written by Tim Triplett

Steel demand is on the upswing three months after being decimated by government orders to shut down nonessential businesses and stop the spread of COVID-19.

The majority of steel buyers (53 percent) responding to Steel Market update’s market trends questionnaire this past week said they are seeing improvement in demand for their products. Another 38 percent reported that demand is the same/stable. Just 9 percent said they are still seeing declines in demand from their customers—a dramatic turnaround from April when more than 75 percent were suffering from a shocking loss of orders.

Yet respondents’ comments still reflect the market’s continued uncertainty:

“Overall demand is improving, but it’s still a mixed bag.”

“We’ve seen slight improvement from April and May.”

“We’re a little better, but off of low levels.”

“Demand is improving, but very slightly.”

“Improving, but still behind 2019 levels.”

“Construction hasn’t been too bad despite COVID. We are seeing a slight pickup in other segments.”

“Our demand is flat. We are seeing more inquiries, mostly to check competitiveness, but not more orders.”

“Our demand is up roughly 30 percent compared to May.”

“Plate demand is improving at the project/OEM level. Government-funded or subsidized initiatives continue to place requirements directly with the mills, keeping outward pressure on lead-times. Distribution centers remain focused on replenishing only sold stocks. Deliveries shorter than four weeks are available, albeit at a premium.”

Demand has been sufficient to support a modest increase in steel prices. Steel Market Update puts the current benchmark price for hot rolled at $515 per ton, up from a low of $460 per ton in late April. Steel prices in the weeks ahead may be determined more by supply than demand as mills bring idled capacity back online and run the risk oversupplying the market.