Prices

June 23, 2020

CRU Forecasts Volatility for Steel Prices

Written by Sandy Williams

CRU analysts, speaking during a virtual version of their Annual New York Steel Briefing earlier today, said volatility is in the cards for steel pricing as demand increases and new EAF capacity comes online.

CRU forecasts sheet consumption will fall 17.6 percent or 12.4 million metric tons year-over-year in 2020, and long and plate products will fall 11 percent. The decline in consumption is the largest since the Great Financial Crisis, but is expected to rise at a strong rate in 2021 and 2022.

The speed of the economic shutdown during the pandemic was unprecedented, but the numbers show the economy is picking back up. Monthly data is improving for unemployment, personal income and retail sales. The housing sector is showing resilience and automotive production is essentially back to normal.

CRU bases flat rolled demand on industrial production, which is expected to rebound sharply in 2021 and moderate in 2022. It will take several years, however, before sheet and plate demand return to 2019 levels, potentially not until 2022 or 2023, the analysts said.

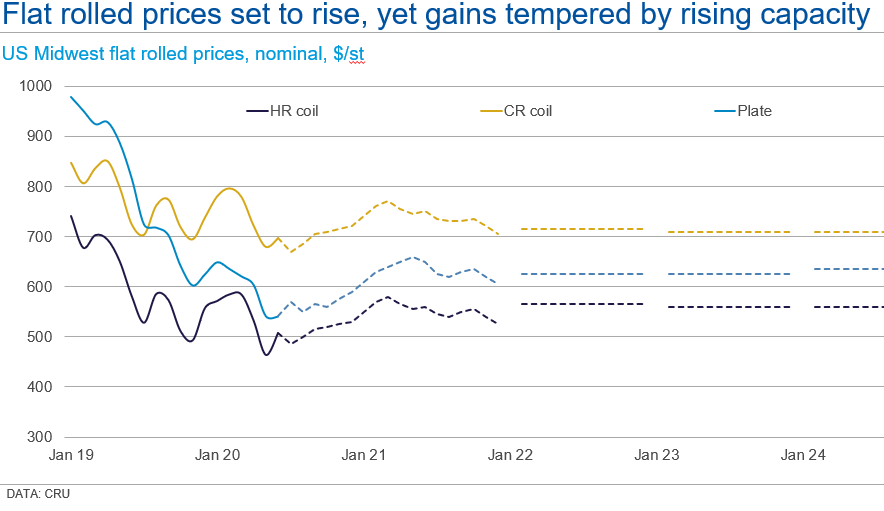

Increased demand usually equals higher prices, but steel prices will face downside pressure due to nearly 7 million MT of new flat rolled capacity and 1 million MT of plate capacity coming online in the near future. Current EAFs continued to operate through the pandemic, although at reduced capacity. About 16 million MT of blast furnace capacity was taken offline in the U.S. and Canada during the same period. Of those 12 BFs, two reached end-of-life, three were banked for quick restart and the rest blown down, said CRU.

The resumption of auto production will boost demand, and some BFs are expected to return to production soon. However, the flexibility and low operating costs of the new EAF capacity, as well as their geographical advantage and high value products, will make BF restarts challenging. CRU expects some blast furnaces will be altered and others may never come back online.

In the near term, steel prices are expected to fall back and then improve toward the end of the year. CRU’s latest forecast is for hot rolled to hit $530 per short ton in December before new capacity begins to pressure it downward. For 2021, CRU is currently forecasting an annual average of $553 per ton for hot rolled and $631 for plate, and $565 for HR and $625 for plate in 2022.

CRU sees a series of pricing mini-cycles occurring until a supply and demand balance is achieved. Pre-coronavirus, demand was rising, but the idled furnaces will return to operation in a lower-demand environment due to underlying economic activity. A “U” shaped recovery is forecast for the current recession.

Government support may increase further this year and a complete infrastructure investment package would be welcomed by the industry. CRU analysts don’t expect an infrastructure bill to be passed before the election, however.

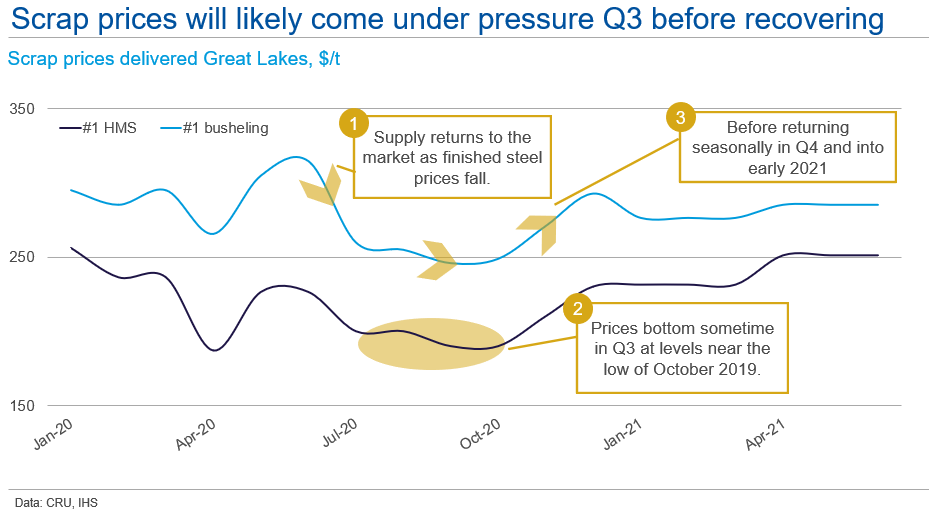

Scrap pricing has faced persistent downward pressure since 2018 and bottomed in October 2019. The COVID-19 crisis caused steel demand and scrap demand to plummet in April, but prices remained well above levels of the Great Financial Crisis of 2008 supported by a concurrent decline in scrap supply.

Steel demand was most affected by the shutdown of integrated mills, which require less scrap than EAFs. EAF steel demand fell about 25 percent and blast furnace about 75 percent. EAF producers were still buying scrap, but then supply fell nearly overnight as pandemic restrictions ended scrap collection and automotive shutdowns ended prime scrap generation. Lower supply kept prices from falling.

Scrap prices will be pressured in the third quarter as supply returns to the market and finished steel prices fall. Prices are expected to bottom in October near their 2019 level and then rise as the seasonal cycle begins in Q4 and early 2021.

The entrance of more EAFs to the market will cause higher scrap demand. CRU anticipates changes in how scrap is bought and sold, moving from a monthly basis to perhaps twice a month or weekly.