Market Segment

July 24, 2020

NLMK Shipments and Revenue Plunge in Q2

Written by Sandy Williams

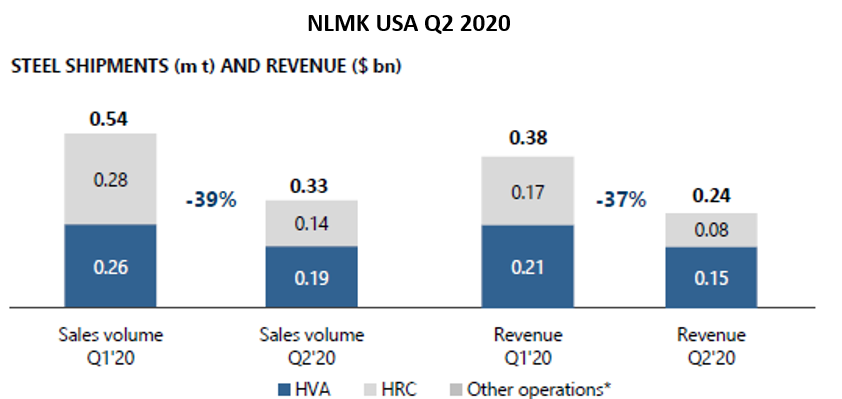

NLMK USA saw shipments plummet 39 percent quarter-over-quarter to 330,000 metric tons as steel demand dropped in Q2 due to the COVID-19 pandemic. Revenue fell 37 percent to $238 million.

EBITDA was $3 million compared to -$22 million in Q1 and was attributed to “widening of the slabs to rolled product price spread” as well as impairment charges on slab inventories in the first quarter.

CEO Grigory Fedorishin expects a breakeven or slightly negative performance from NLMK USA in Q3. “Pricing remains rather low in the U.S., and recovery of the economy is slow,” said Fedorishin. “Construction is okay, but energy and automotive are completely out of the markets. So again, breakeven or slightly negative for the second half of the year.”

NLMK Group saw revenue decrease 12 percent from the first quarter to $2.2 billion due to lower average sales price, weaker demand for finished products and lower sales by NLMK USA and DanSteel.

Net profit plunged 73 percent quarter-over-quarter to $77 million and included depreciation of investments into NBH and currency devaluation.

“The U.S. continues to suffer from the new outbreaks, and it remains to be seen how long it will take for the world’s largest economy to combat the disease,” said Fedorishin. “While demand in Europe and the States remains weak, business activity in Russia recovered strongly already at the end of June, supported by government measures, including interest rate cuts by the Central Bank and delayed demand coming from the construction sector that was backed by falling mortgage rates.”