Market Segment

July 30, 2020

Ryerson Posts Loss for Second Quarter

Written by Sandy Williams

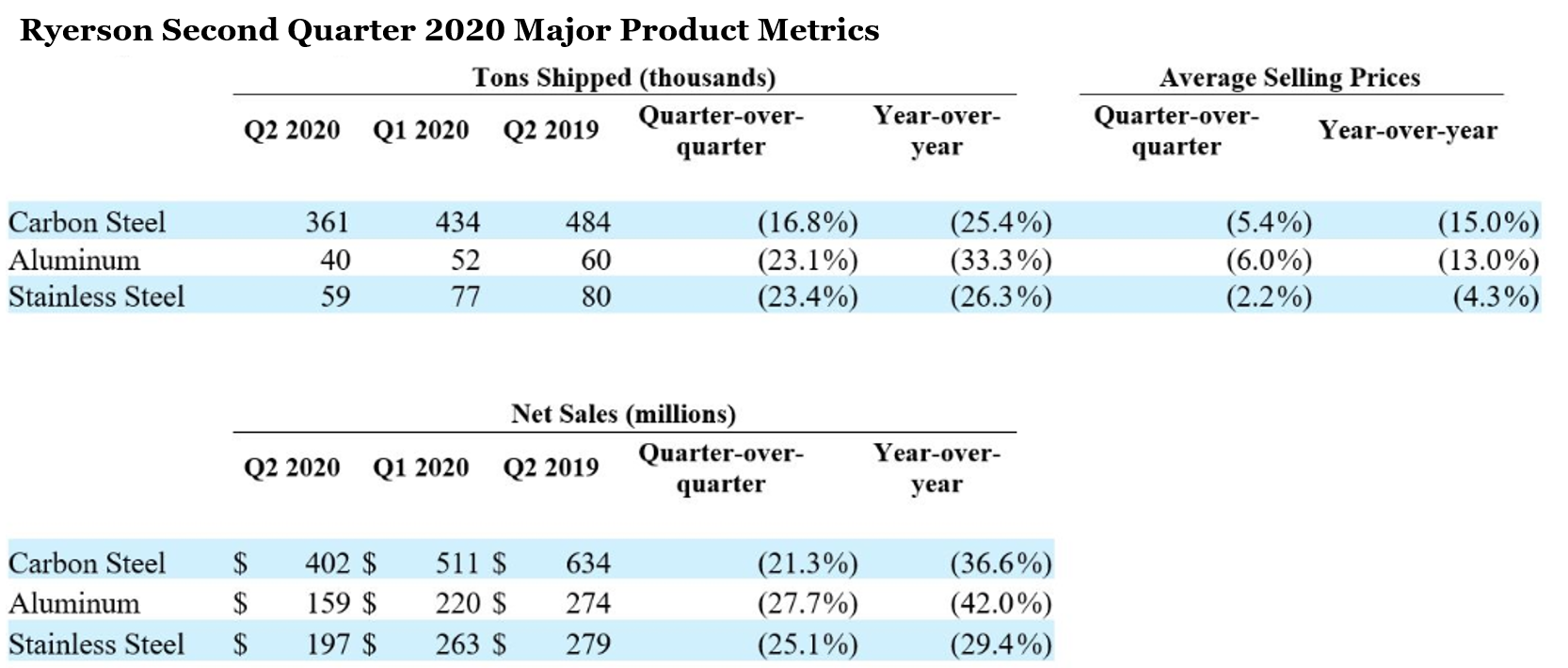

Metals processor and distributor Ryerson Holding Corp. recorded revenue of $772 million for the second quarter of 2020, a plunge of 35.9 percent from a year ago and 23.6 percent sequentially. Shipments fell 25.8 percent to 462,000 tons. Average selling price declined 13.6 percent to $1,671 per ton.

The company reduced warehousing, delivery, general and administrative expenses by 24.6 percent or $40.5 million, but it was not enough to prevent a net loss of $25.6 million for the quarter.

End markets that showed relative strength in the quarter included ground transportation, consumer durables, agriculture, HVAC and automotive. Construction, fabrication and machine shops were neutral, while industrial equipment, and oil and gas continued to struggle.

“The second quarter presented a myriad of challenging public health, economic and societal circumstances that were omnipresent,” said President and CEO Eddie Lehner. “In the U.S. we experienced the largest plunge in industrial production recorded in 101 years, reflecting the economic shocks that materially affected economic activity.

Pricing held up better than expected, said Lehner, with mill capacity globally and in North America adjusting responsibly to declining demand. Carbon sheet and plate prices stabilized in the first few weeks of July. Demand took a “cliff dive” in April resulting in shutdowns, with gradual improvement during May and June.

Continued economic stress due to the pandemic is expected to affect third-quarter result, but some improvement is in the works. “Through the first few weeks of third quarter, the company noted favorable trends in average selling prices, gross margins excluding LIFO, shipments and bookings relative to the second quarter as it appears that carbon prices are stabilizing in a range, stainless and aluminum prices are on an improving trajectory and demand conditions continue to see incremental improvement in the majority of Ryerson’s end-markets,” said Lehner.