Prices

August 6, 2020

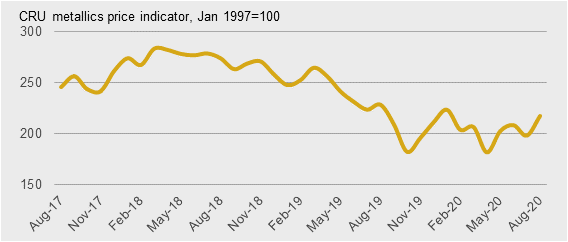

CRU: Chinese Demand Drives Global Scrap, Metallics Price Upswing

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Metallics Monitor

The CRU metallics price indicator (CRUmpi) rose by 3.6 percent m/m in August to 205.1. China’s demand for finished steel has either lifted or stabilized both scrap and metallics prices across the globe. Looking ahead, we expect this trend to continue through September as markets tighten with higher capacity utilization rates in nearly every market we cover.

Price increases around the globe were driven by Chinese steel demand

China’s demand for steel and metallics has helped propel a global price upswing for scrap. A knock-on effect has taken place for Turkish scrap import prices, which has in turn helped stabilize or elevate scrap prices in the U.S., Europe and Russia. Likewise, scrap prices in other Asian countries rose amid the increase in Chinese steel demand. With domestic scrap prices in China also rising, buyers there again sought to secure metallics from abroad, keeping demand elevated even amid low buying activity in more traditional importing markets.

Chinese scrap prices rose again in August m/m as increased mill capacity utilization rates met with supply restrictions caused by adverse weather conditions. Moreover, raw material costs helped generate scrap buying interest from integrated mills as they sought to increase scrap utilization in their melts as an offset to soaring iron ore. At the same time, steel capacity utilization rates at integrated mills have little room for expansion, meaning that EAF operations were also operating at higher levels, thereby raising scrap demand even further.

Higher steel demand in China has also resulted in a decline in export volumes, providing room for other suppliers like Turkey to fill the void in other parts of Asia. With Turkish steel exporters now more competitive in Asian markets, scrap buyers in the country have allowed import prices to rise—especially given that domestic demand there is also solid. Compared to July, Turkish scrap import prices have risen by more than $20 /t.

Higher scrap demand and prices in Turkey have reverberated into the U.S. and European markets. With Turkey pulling scrap away from domestic suppliers in what would otherwise be weaker markets, mills in both regions have had to either stabilize or increase obsolete scrap prices overall. In the U.S., obsolete prices rose in many markets or were at least stable m/m. Generally, this varied by mill proximity to the export market. In Europe, strong Turkish scrap bookings removed excess supply throughout July, preventing oversupply during the August monthly negotiations. Similarly, mills in Russia’s southern region had to increase prices to compete with higher export prices to Turkey.

In other parts of Asia, Vietnamese scrap prices bucked seasonal trends, rising mid-July with support from higher prices in China. Bullish price sentiment prevailed in the Vietnamese market despite seasonal demand weakness because of the increase in export demand for billet and HR coil, as well as easing import competition in the domestic market. Scrap prices in Japan were also higher on increased international demand and stable domestic buying needs.

Despite weakness in demand from traditional buyers, the resumption of Chinese buying was sufficient to support merchant pig iron export prices, and both CIS and Brazilian prices increased m/m. China’s need for metallics also translated into higher HBI/DRI prices across the globe.

Outlook: China Will Continue to Help Drive Price Increases

We expect that demand from China will continue to either stabilize or drive global scrap and metallics prices higher m/m in September. The exception may be in Europe, where we do not anticipate a meaningful recovery in steel demand until Q3 2020. A continuously weak macroeconomic environment paired with the possibility of tighter measures to fight Covid-19 may cut growth in steel demand in that region. Still, elevated Chinese demand will support prices in most regions of the world.

Chinese demand is supporting metallics prices

DATA: CRU

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com