Market Data

August 6, 2020

Steel Mill Lead Times: Gradually Recovering from the Trough

Written by Tim Triplett

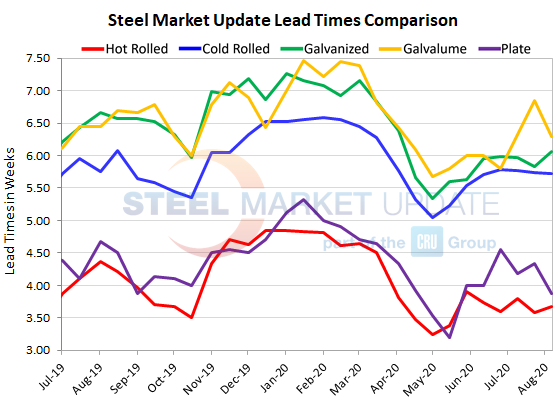

Lead times for spot orders of flat rolled steel from the mills were at their shortest in the week of April 30 as orders dried up due to the coronavirus. Since then lead times have extended by about half a week, but saw only minor fluctuations in June and July. Currently, lead times for hot rolled and plate steels are less than four weeks, while lead times for cold rolled and coated are approximately six weeks. Lead times are an indicator of steel demand—shorter lead times indicate the mills are less busy and more inclined to negotiate on prices.

According to Steel Market Update’s check of the market this week, hot rolled lead times now average 3.67 weeks. That’s up from 3.25 weeks at the trough in late April, but down from 4.36 weeks at this time last year.

Cold rolled lead times are virtually unchanged over the past two months at 5.72 weeks. That’s up from a low of 5.04 weeks in April, and comparable to lead times in early August 2019.

Galvanized lead times have extended to 6.06 weeks from the April low point of 5.34. Last August, galvanized orders took 6.67 weeks for delivery, on average. The current average Galvalume lead time is 6.29 weeks, about the same as last year.

Plate lead times bottomed at 3.20 weeks in mid-May and ranged from 4.0 to 4.5 weeks for most of June and July. The latest reading, at 3.88 weeks, is down from 4.33 registered two weeks ago, which suggests the plate mills are slightly less busy.

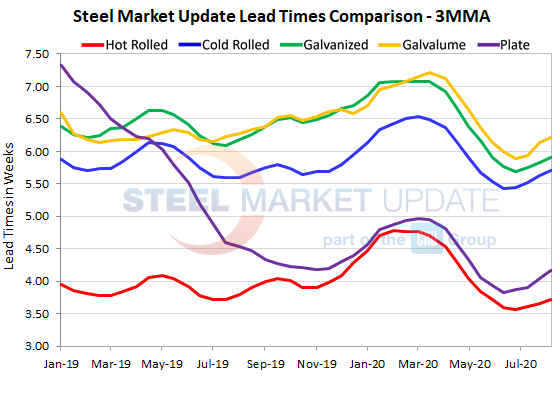

Looking at three-month moving averages, which smooth out the variability in the biweekly readings, lead times for flat rolled and plate have been inching upward for the past month. The current 3MMA for hot rolled is 3.71 weeks, cold rolled is 5.71 weeks, galvanized is 5.90 weeks, Galvalume is 6.21 weeks and plate is 4.16 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.