Market Data

October 1, 2020

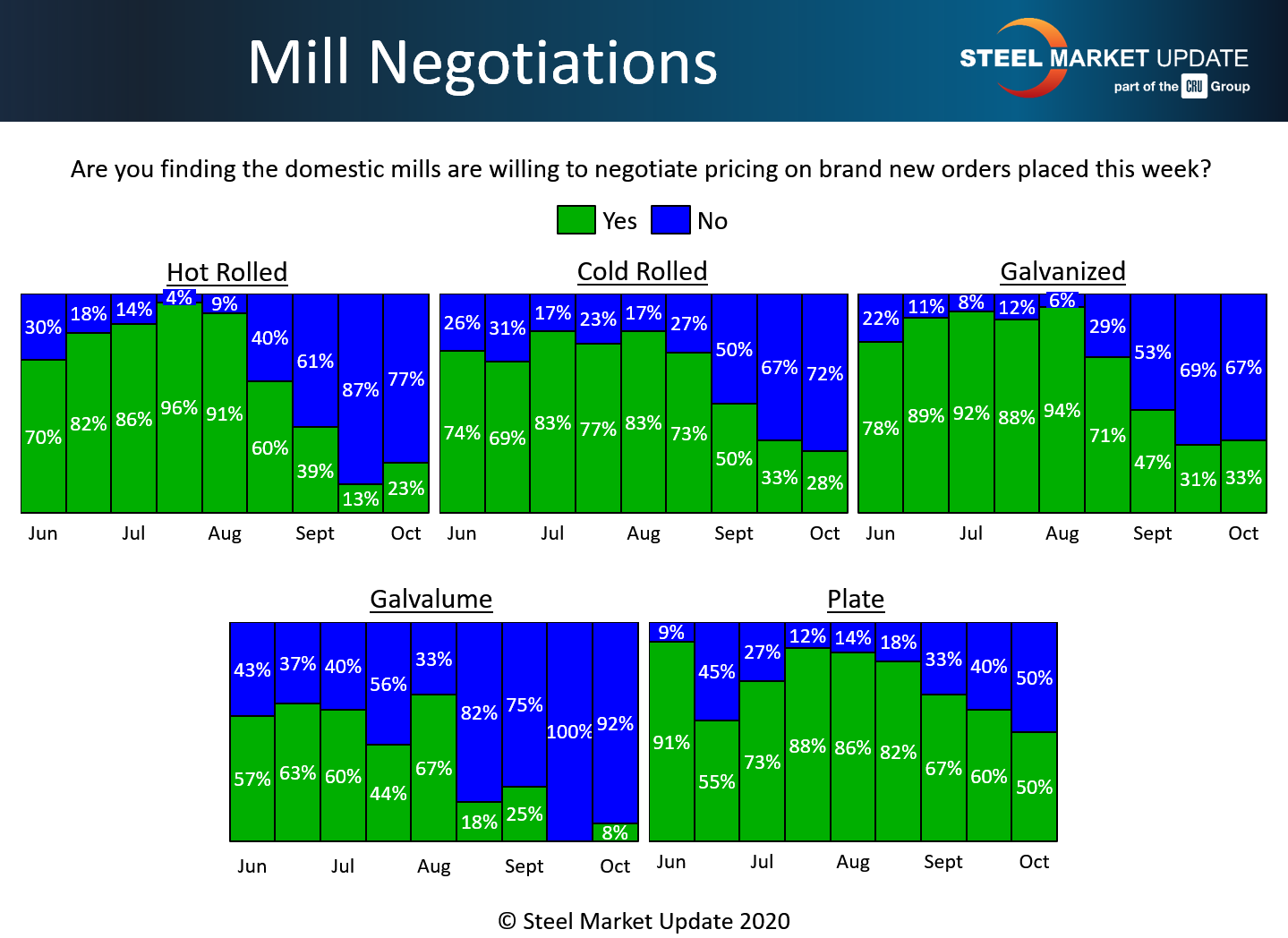

Steel Mill Negotiations: It's a Seller's Market

Written by Tim Triplett

It’s a seller’s market as the mills hold firm in price talks on hot rolled, cold rolled and coated steel orders, while they seek to collect the higher prices announced this week in an improving market, according to respondents to Steel Market Update’s market trends questionnaire.

About 77 percent of the hot rolled steel buyers responding to SMU’s poll this week said the mills are not willing to deal on HR. That’s up from 61 percent a month ago, but down slightly from 87 percent two weeks ago. Only 23 percent said the mills are now willing to bargain to secure an HR order.

In the cold rolled segment, 72 percent said the mills are not willing to talk price. That’s up from 50 percent a month ago and 67 percent two weeks ago. The other 28 percent reported some room for price negotiation on cold rolled.

The percentages are similar in galvanized, where 33 percent reported the mills open to discounts, but the majority, 67 percent, said the mills are just saying no. Nearly all those responding to the question on Galvalume, 92 percent, reported little room for negotiation as supplies remain tight.

Talks have tightened a bit in the plate market, where the likelihood of mills negotiating is now a 50-50 proposition.

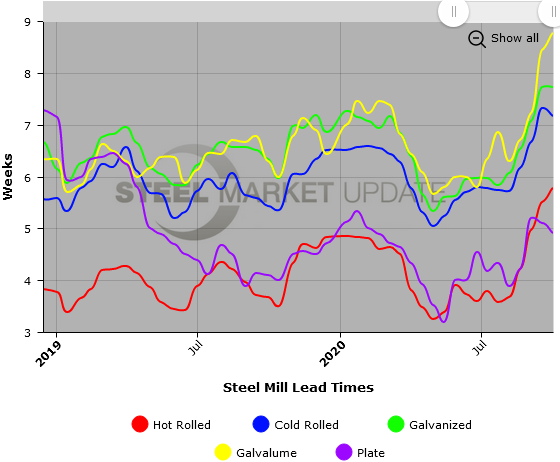

Benchmark hot rolled steel prices now average $605 per ton, based on SMU’s latest check of the market. That’s up sharply from $440 a ton six weeks ago. Steel prices continue to see strong upward momentum, as the mills announced $40-50 price increases on both flat rolled and plate this week.