Market Data

November 24, 2020

Steel Mill Negotiations: No Reason to Bargain

Written by Tim Triplett

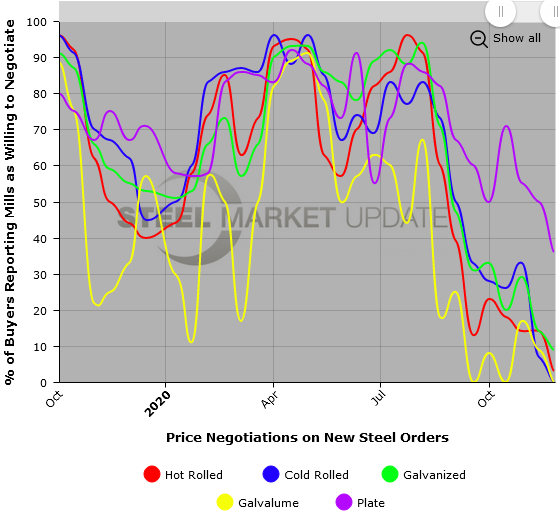

In a market where supplies of various products are so tight that some buyers say they would be willing to pay almost any price just to get material, there is very little negotiation going on between the mills and their spot market customers. The mills have no reason to bargain when demand is so far outpacing supply and they can easily sell all that they make.

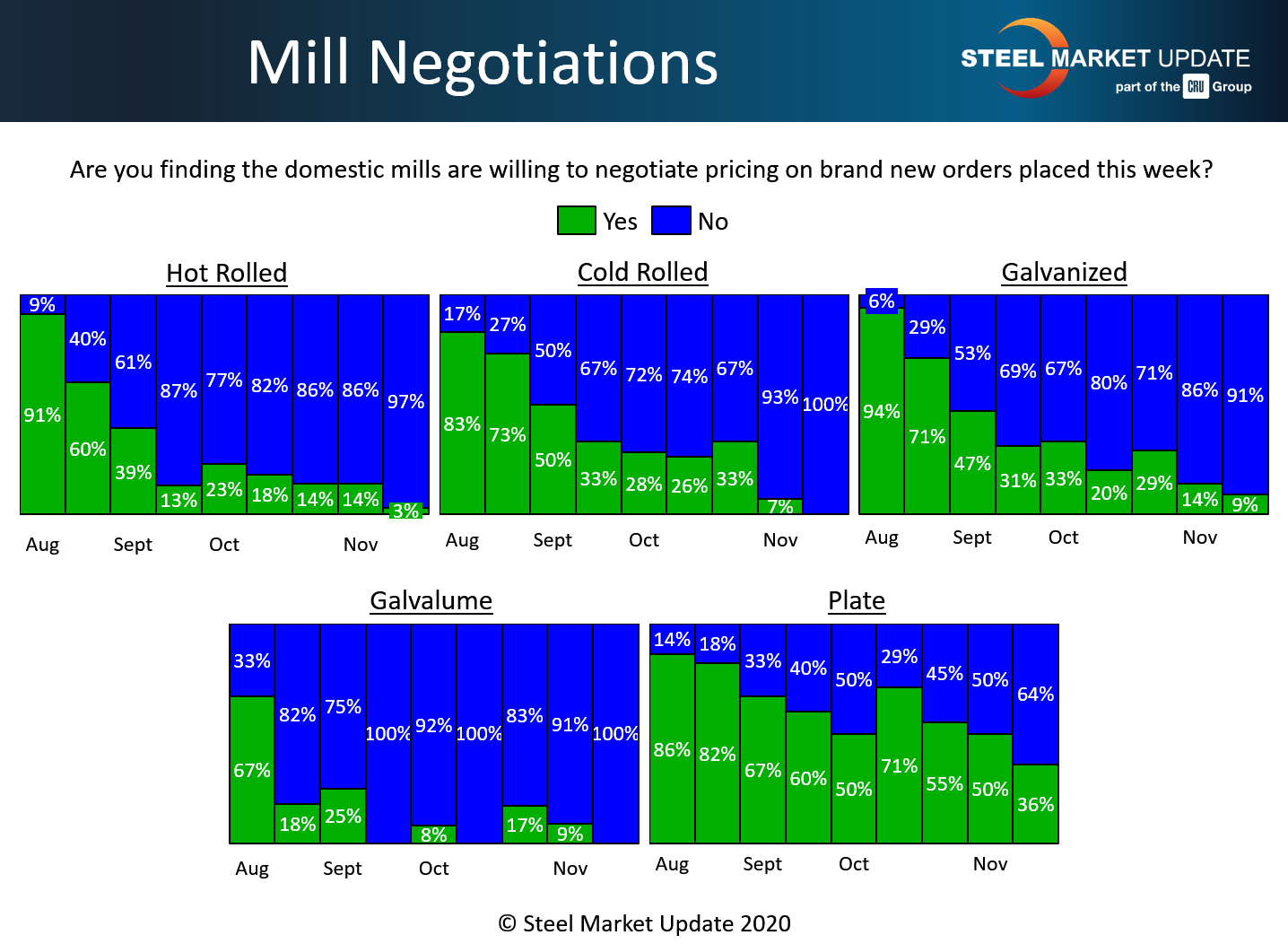

Nearly all (97 percent) of the steel buyers responding to Steel Market Update’s market trends questionnaire this week said the mills are unwilling to deal on hot rolled. Only 3 percent said the mills are willing to bargain to secure an HR order. That compares to 14 percent who were still open to price talks at this time last month.

In the cold rolled segment, there is virtually no room for price negotiations. All those responding said the mills see no reason to talk price.

Negotiations for coated steel orders are just as tight, with 91 percent reporting the mills refusing to discount galvanized orders, and 100 percent reporting no price breaks on Galvalume.

The negotiating environment is slightly less contentious in the plate market, where 36 percent of respondents said they have still found mills with some flexibility on price.

The steel mills clearly retain the upper hand in price negotiations as they continue to control the amount of steel that makes it to market. Based on SMU’s check of the market this week, the benchmark price for hot rolled steel has risen to around $770 per ton, up dramatically from around $440 per ton in August.