Market Data

December 16, 2020

Service Center Shipments and Inventories Report for November

Written by Estelle Tran

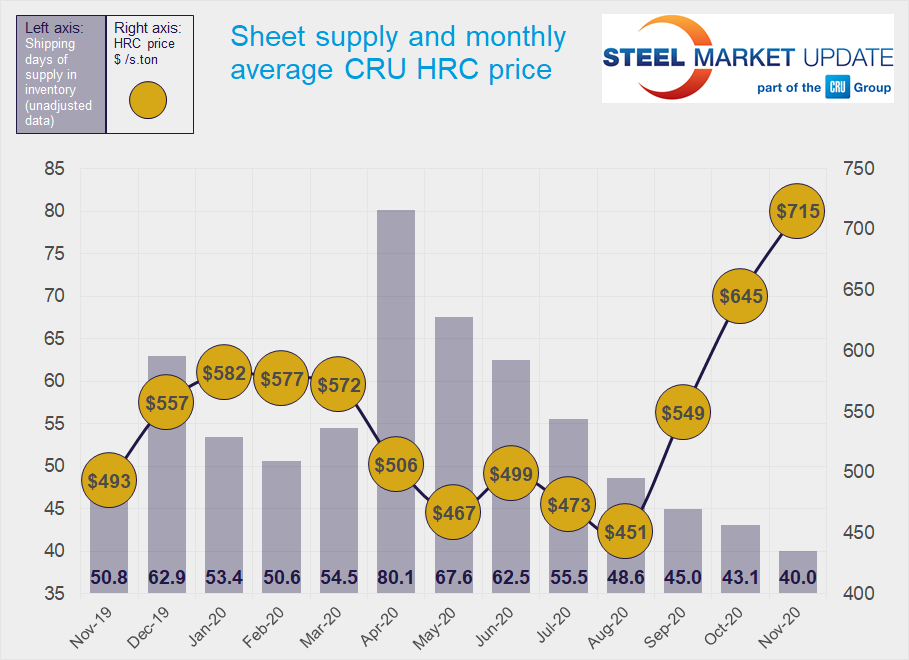

Flat Rolled = 40.0 Shipping Days of Supply

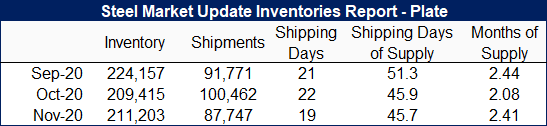

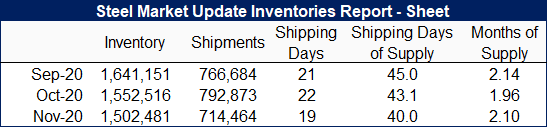

Plate = 45.7 Shipping Days of Supply

Flat Rolled

Service center flat rolled steel inventories continue to reach new lows. At the end of November, service centers carried 40 shipping days of supply, down from 43.1 days in October. November had 19 shipping days, compared to October’s 22. The shorter month made inventories appear higher when considering months of supply; service centers had 2.10 months of supply in November, which was up from 1.96 in October.

Overall sheet shipments dropped, which was expected for the shorter shipping month. However, market contacts have said that shipments continue to be very strong and have been limited by inbound material. The daily shipping rate increased about 4 percent m/m.

Idled capacity and mill shipment delays continue to keep lead times extended. SMU’s survey results released Dec. 10 found HRC lead times still extended to 7.31 weeks from the prior survey’s 6.82 weeks.

With mills controlling order entry for January and February and lead times pushed out, service centers continue to have elevated levels of material on order.

U.S. Steel’s restart of Gary Works’ No. 4 blast furnace should help to alleviate some of the market tightness. At the same time, however, mills will be facing increasing cost pressures from rapidly increasing scrap, pig iron and iron ore prices. There seems to be more runway for prices to rise with mills eyeing $1,000/st HRC, and we expect inventories to remain lean as contacts report not being able to order enough steel.

Plate

Plate inventories were nearly flat in terms of days of supply on hand. Service centers carried 45.7 days of supply at the end of November; this is down from 45.9 days in October. In terms of months of supply on hand, plate inventories represented 2.41 months of supply, up from 2.08 months in October.

Plate prices have been slower to rise than sheet but have gained more traction recently. At the same time, mill lead times for plate extended to 7 weeks, according to the latest SMU survey, up from 6.27 two weeks prior.

Market contacts said that the increase in purchasing activity has been driven by expectations of higher prices and necessary restocking rather than a clear pickup in demand. With plate prices trending up and lead times moving out, plate service centers increased their orders in November.

The price increases announced by Nucor and SSAB are expected to get support from the $70/lt spike in scrap price hikes in December.