CRU

January 15, 2021

CRU: Iron Ore Down Slightly in Highly Volatile Week

Written by Erik Hedborg

By CRU Principal Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

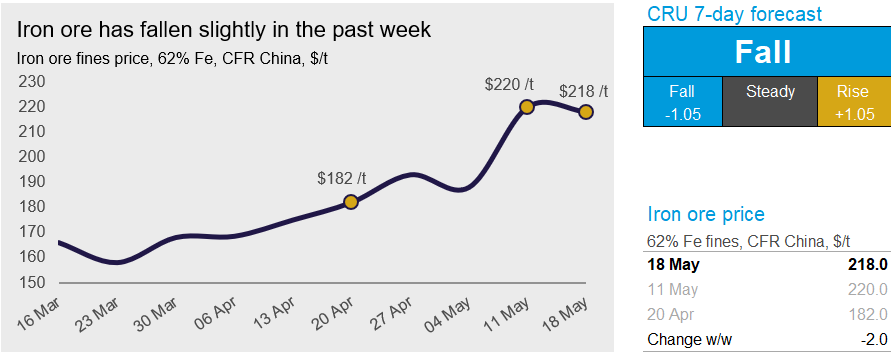

The iron ore market has experienced one of the most volatile weeks on record. Prices have traded within a $40 /dmt range within the past week due to demand uncertainty in China. On Tuesday, May 18, CRU assessed the 62% Fe fines price at $218 /dmt, down slightly from the previous Tuesday.

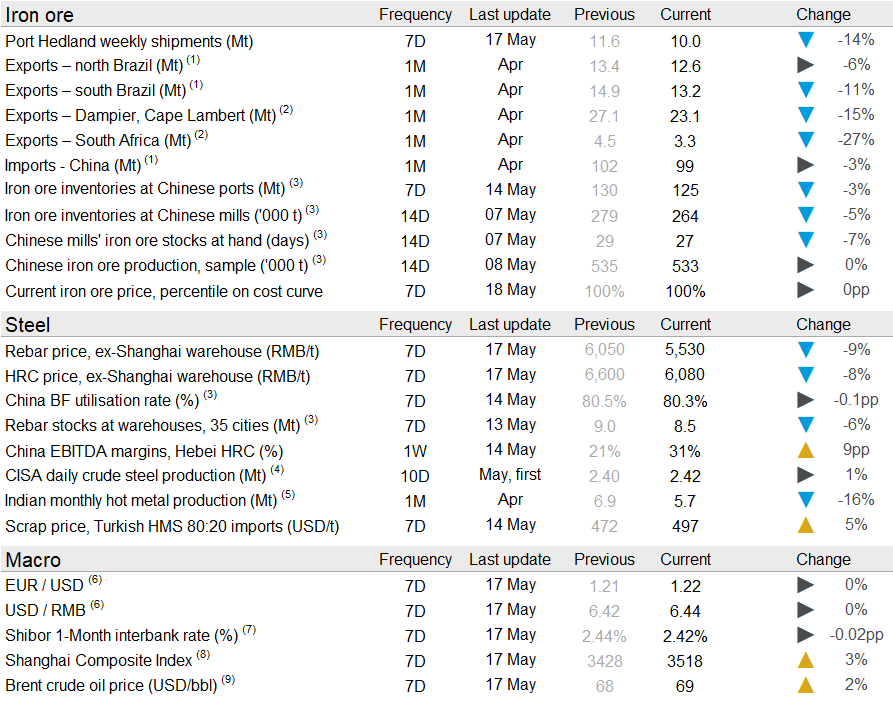

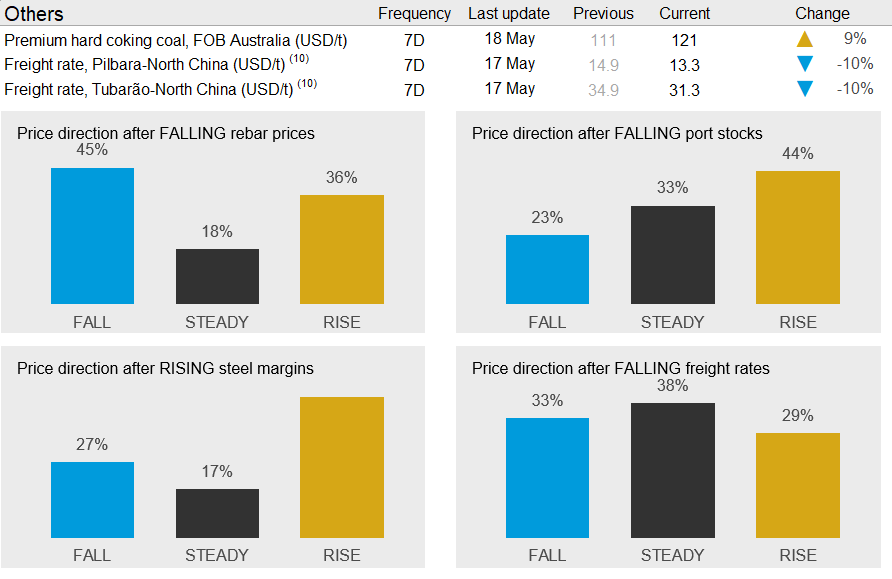

The Chinese steel sector has seen significant price volatility in recent weeks. Prices skyrocketed after the Chinese market reopened following the Labor Day holiday from May 6, with the rise more on speculation and inflation hedging than on fundamentals. Prices then moderated after statements by Premier Li Keqiang, urging the nation to deal with surging commodity prices. Chinese rebar and HRC prices fell 8-9% w/w, but prices are still up 10% overall m/m. CRU estimates HRC producers are currently enjoying a very healthy 31% margin. This is keeping iron ore demand strong, particularly demand for higher-grade ore that boosts productivity.

Seaborne supply has fallen slightly in the past week with Roy Hill still carrying out maintenance at the port, which is reducing Port Hedland exports slightly. Exports from both BHP and FMG have been very strong thus far in May and the producers are gearing up for a strong finish to the Australian financial year that ends on June 30. Rio Tinto has also had a strong week while we are seeing steady shipments from Brazil. The country continues to increase exports y/y, particularly when comparing to an unusually weak May last year. During that time, heavy rainfall in northern Brazil reduced output, but we are seeing lower rainfall this year and exports are expected to increase y/y.

One country that is seeing a decline in iron ore exports is India. Despite the country’s COVID-19 outbreak, steel production remains much higher than during the country’s first wave. This is keeping India’s iron ore exports at reduced levels, despite the high price environment.

There is plenty of uncertainty regarding Chinese demand in the coming week. Steel prices have not been able to follow iron ore prices upwards in the past few days, indicating that steelmakers are having difficulties pushing their higher costs over to their customers. This is confirmed by our sources that have mentioned a slowdown in steel buying. In addition, the construction season is at a peak and we are hearing from people on the ground that rebar demand will start contracting soon.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com