Market Data

January 22, 2021

SMU Steel Buyers Sentiment: Signs of Price Anxiety?

Written by Tim Triplett

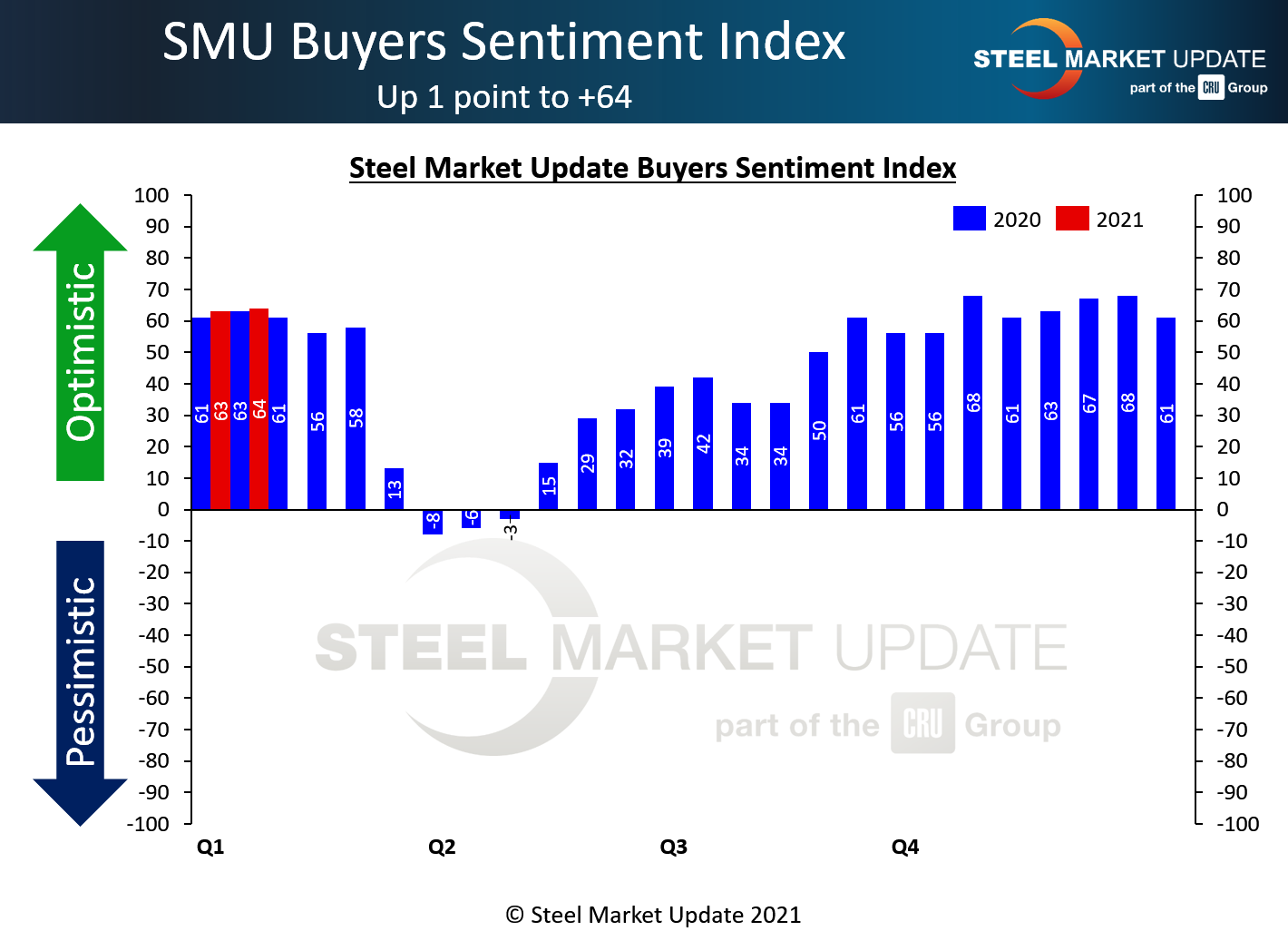

If the market is getting anxious about a coming correction in steel prices, there are few signs of it yet in industry sentiment data, as measured by Steel Market Update. Current Sentiment remains at an optimistic level in the mid-60s where it has ranged since October. Future Sentiment is slightly less bullish but still above typical readings over the last two years.

Every two weeks, SMU asks steel buyers how they view their company’s chances for success in the current environment. The Current Sentiment Index increased by one point this week to a very optimistic reading of +64—up 72 points from the pandemic-induced low of -8 back in April

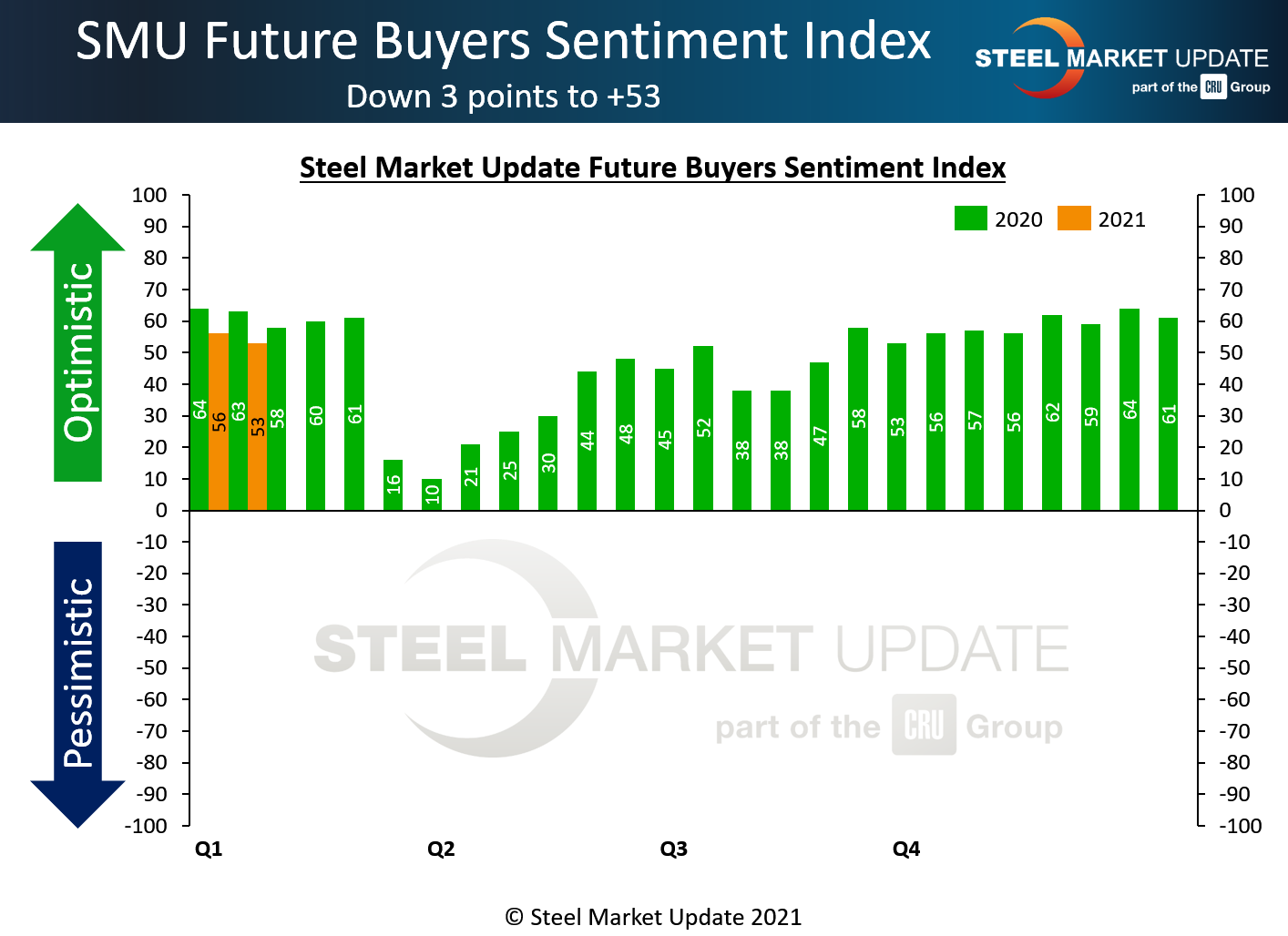

Future Sentiment

SMU also asks buyers how they feel about their chances for success three to six months in the future, which is more uncertain. SMU’s Future Sentiment Index moved down by three points to register +53 on concerns over steel prices and availability, the COVID pandemic and the change of administration in Washington. Future Sentiment readings have declined by 11 points over the past six weeks, from +64 on Dec. 10. Yet at +53, Future Sentiment remains above the average of +48 in 2020 and +51 in 2019.

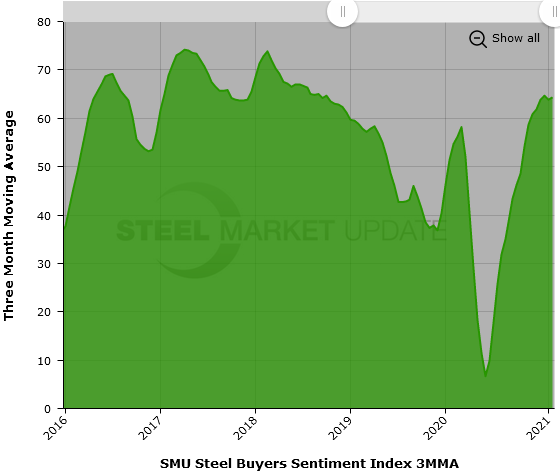

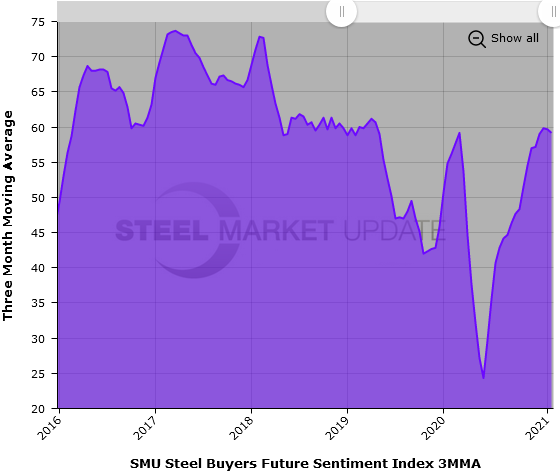

Three-Month Moving Averages

Calculated as three-month moving averages (3MMAs) to smooth out the monthly variability, Current Sentiment now measures +64.33 and Future Sentiment +59.17—both positive readings compared with historical averages.

What Respondents are Saying

“Prices rose too fast.”

“Too much risk and uncertainty to move out of the ‘fair’ condition.”

“If prices do a dive like everyone expects, this will really make things difficult.”

“I feel more confident as we get the COVID-19 under control. The new U.S. administration will be much more proactive to admit we have a problem. Once we get this behind us, things should improve and maybe go really well starting in nine months or so.”

“It all depends on the new administration. All bets are off if they mandate a nationwide shutdown.”

“I picked a good year to retire….”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings will run from +10 to +100 and the arrow will point to the righthand side of the meter located on the Home Page of our website indicating a positive or optimistic sentiment. Negative readings will run from -10 to -100 and the arrow will point to the lefthand side of the meter on our website indicating negative or pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace.

Readings are developed through Steel Market Update market surveys that are conducted twice per month. We display the index reading on a meter on the Home Page of our website for all to see. Currently, we send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies; approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business. Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, tim@steelmarketupdate.com