CRU

March 16, 2021

CRU: Iron Ore Bounces Back on Supply Concerns

Written by Erik Hedborg

By CRU Principal Analyst Erik Hedborg, from CRU’s Steelmaking Raw Materials Monitor

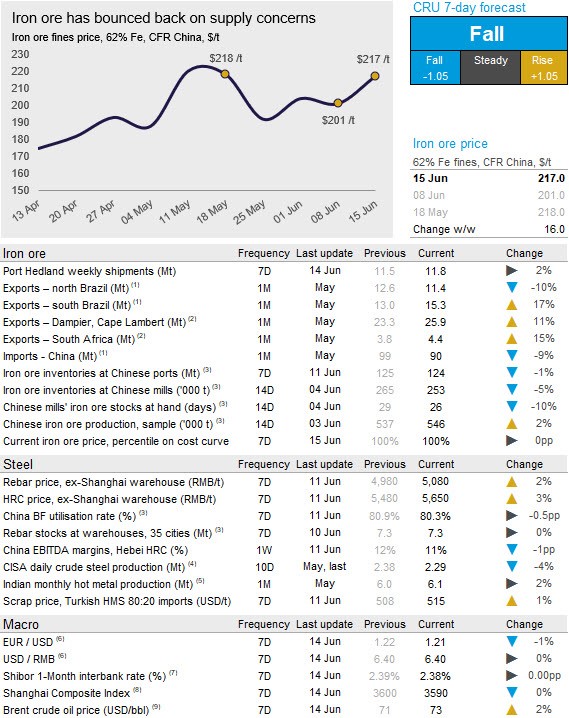

Iron ore prices have risen in the past week and are currently trading at close to $220 /dmt. We see little change on the demand side and sources have mentioned that supply uncertainty is the main driver of the recent rally. On Tuesday, June 15, CRU has assessed the 62% Fe fines price at $217.0 /dmt, up by $16.0 /dmt in the past week.

Chinese steel prices rose prior to the Dragon Boat Festival in China (June 14). The increases were driven by a combination of pre-holiday restocking and stricter environment-led operating restrictions in Tangshan, Qinhuangdao and Handan city, all located in Hebei province. These restrictions were mainly targeting sinter and coke operations, which helped to maintain strong demand for pellets and lump. Iron ore buying activities in China remained strong due to elevated steel production levels as well as restocking prior to the holiday. Other factors that sparked buying activity include supply fears, mainly in Australia, and concerns about the availability of domestic iron ore in the coming months. CRU expects blasting activities in and around Hebei province to be limited during the upcoming 100th anniversary celebration of the Chinese Communist Party. In addition, a recent mine accident in Shanxi province is expected to result in stricter safety checks across the country.

Iron ore supply has increased rapidly in the past week. Rio Tinto increased shipments after a few weeks of lower exports and Port Hedland registered another strong performance. Although rising, Australian supply is still lower than in June last year. In Brazil, exports have continued at a high rate, although the Timbopeba and Alegria sites remain suspended. CRU maintains the view that the current suspensions are unlikely to remain in place for long, and we understand there are negotiations taking place in order to bring back production soon.

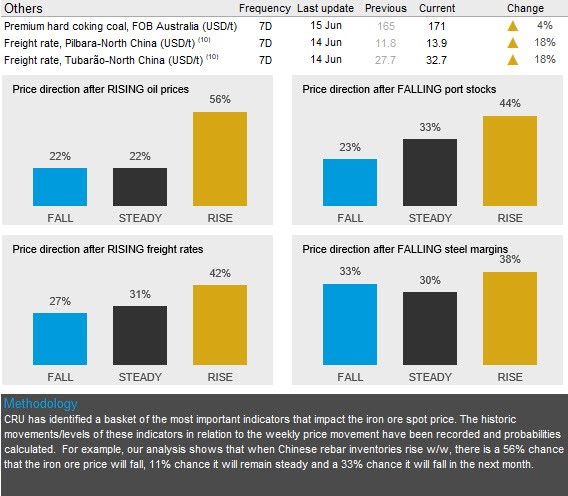

We expect prices to fall in the coming week. Although the indicators below point towards a rise, we are hearing from multiple sources in the market that prices are unlikely to sustain at these levels as there seems to be a limited upside for Chinese demand, while seaborne supply will continue to rise in the coming weeks. Our technical analysis also points toward prices declining in the near future.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com