Market Data

March 17, 2021

Steel Mill Lead Times: Starting to Plateau?

Written by Tim Triplett

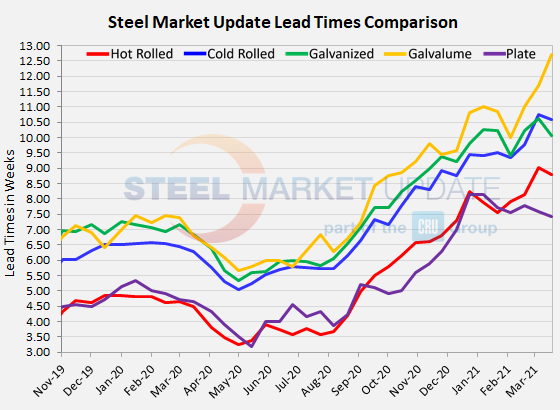

Lead times for spot orders of most steel products appear to have leveled off a bit in the past two weeks, based on Steel Market Update’s latest check of the market. All flat rolled and plate products registered small declines except for Galvalume, which was the only one to see an increase in delivery times since the first week of March.

Lead times are an indicator of steel demand—the longer the average lead time, the busier the mills, and the less likely they are to discount prices. Rising lead times are expected to reverse course at some point as steel supplies catch up with demand, but it would be premature to read too much into the slight shortening seen in this week’s survey. Indeed, buyers tell SMU that this lead times data may not capture the full extent of late deliveries.

“Lead times are highly extended and the mills are still late on orders,” said one respondent. “Contract lead times are normal, but on-time performance is from one to six weeks late,” noted another. “Without a doubt, the long lead times at the mill level have kept this thing rocking,” commented a third.

Current hot rolled lead times now average 8.81 weeks, down from 9.03 two weeks ago but up from 8.13 at this time last month. At nearly nine weeks, HR lead times are almost three times longer than their COVID-driven low last April at 3.25 weeks.

Cold rolled lead times, now averaging 10.58 weeks, are down slightly from 10.74 two weeks ago and are more than five weeks longer than in late April 2020.

In coated products, galvanized lead times now average 10.06 weeks, down from 10.61 weeks in SMU’s last check of the market. The current average Galvalume lead time has stretched to 12.71 weeks from 11.69 weeks in the last survey.

Plate lead times declined to an average of 7.43 weeks from 7.60 weeks earlier this month. That’s still a big recovery from the average low of 3.20 weeks back in May 2020 shortly after the pandemic struck.

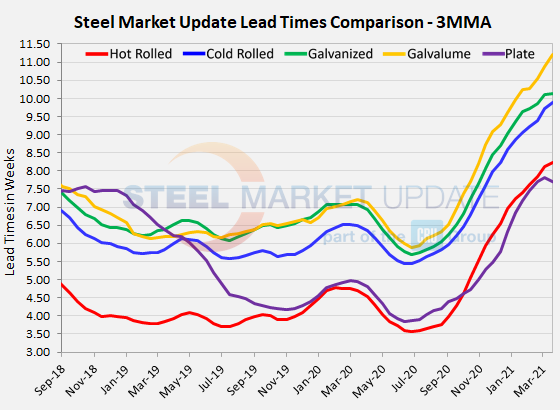

Viewed as three-month moving averages to smooth out the volatility, hot rolled lead times have continued to extend to 8.22 weeks, cold rolled to 9.90 weeks, galvanized to 10.14 weeks, and Galvalume to 11.21 weeks, while plate’s 3MMA dipped slightly to 7.70 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. Our lead times are meant only to identify trends and changes in the marketplace. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Tim Triplett, Tim@SteelMarketUpdate.com