Analysis

April 12, 2021

Final Thoughts

Written by John Packard

There are specific reasons for the tightness of supply that exists in the market today. Events have been in motion for the past 25 years that have culminated in the limitations of supply.

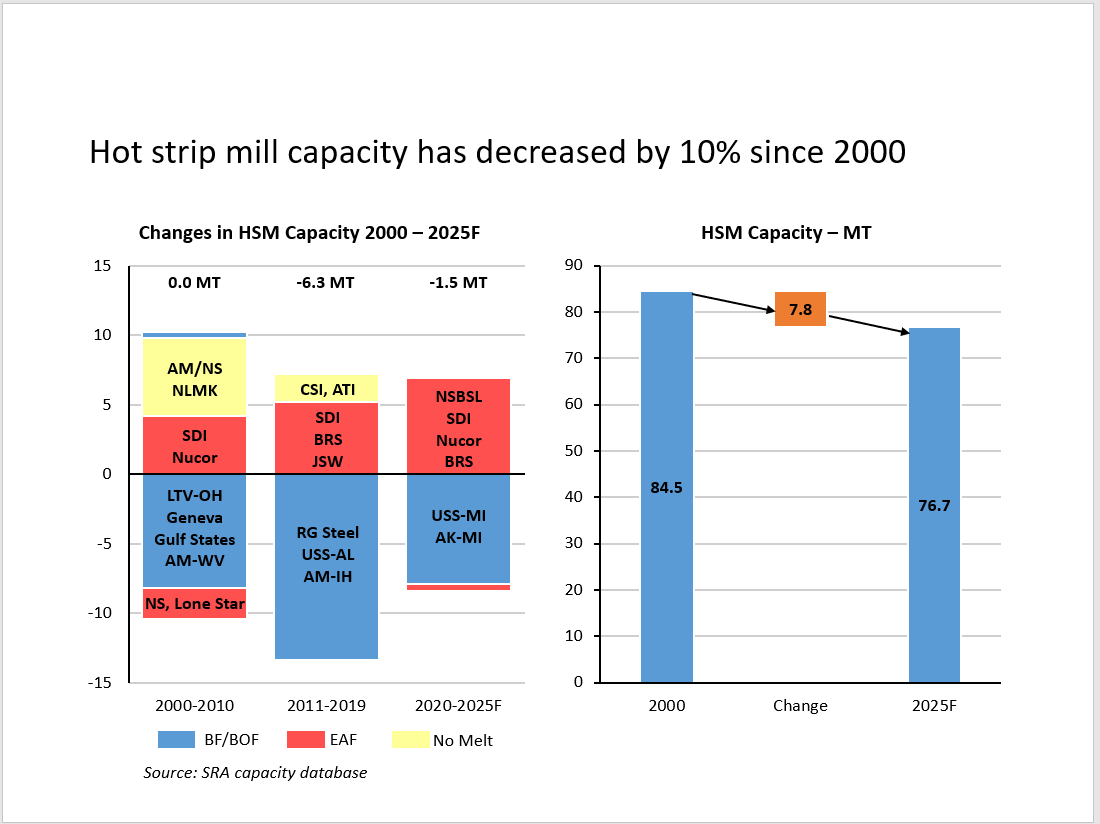

For those of you who have attended SMU Steel Summit Conferences you may recall a presentation done by Paul Lowrey, Managing Director of Steel Research Associates. Paul provided data regarding the reduction of hot strip mill capacity and projected that there would be tightness in the market (see slide from SRA presentation below).

Lowrey provided the following to me today when I asked for a copy of this slide for review, “There are two critical points for you to address. First, domestic HSM capacity has declined 10% over the last 25 years as shown in the chart. Second, and more important, the recent closures (roughly equal to the new additions) occurred before the new additions have been brought on-line. That is the reason for the current tightness, coupled with the import restrictions.”

There are reasons to attend SMU workshops and conferences. We work hard to provide information to our attendees that will prepare them for the future, and not just look at the past. This year’s SMU Steel Summit Conference will be no different. We will have Paul Lowrey back this year, not to talk about the hot strip mills, but rather what may be the next big issue for the industry: the availability and cost of ferrous scrap and how the steel mills are adjusting to what may be a big question mark in the years to come.

Many of the domestic and foreign auto makers have announced they will be moving to all electric vehicles by 2035 (or before). On top of the known auto companies are such new upstart EV manufacturers here in the United States as Lucid, Rivian, and Lordstown Motors, joining Tesla as domestic EV auto makers. How will the electric vehicle industry affect the steel industry, especially when it comes to sheet supply?

I added another speaker to the SMU Steel Summit Conference today to assist in answering the EV/steel question. John Catterall is Vice President of the AISI Automotive Program where he is responsible for leadership of the Automotive Applications Council. He is well-versed on the key issues affecting the steel industry as the auto industry moves to electric vehicle production.

We all want to know, how much change will there be from the existing vehicle production to the new EV platforms? Where will the steel be used? What kinds of steel will be utilized? What steels will be eliminated? What about the electric charging stations? What will the growth of the stations mean for the industry and the electrical grid?

Granted, the SMU Steel Summit Conference is going to be THE place to see and be seen, and to network with others within the manufacturing, fabrication, distribution, trading, steel mills, logistics, toll processing and related industries. It is also going to be THE place to learn more about what this industry is going to look like in 2022 and out to 2035. Change is coming fast and furious and you will want to attend our conference to see what’s ahead.

There are 123 days left before the first live and in-person steel conference of the year….

You can learn more about the 2021 SMU Steel Summit Conference, our agenda and speakers (work in process), costs to attend, discounts available and how to register by clicking here.

As always, your business is truly appreciated by all of us here at Steel Market Update.

John Packard, President & CEO, John@SteelMarketUpdate.com