Market Data

June 25, 2021

SMU Steel Buyers Sentiment: Price Correction a Concern

Written by Tim Triplett

Steel buyers’ sentiment saw a slight dip in the past two weeks but remains near record highs, in line with record-high steel prices and profitability.

Respondents’ comments suggest they are slightly less bullish about their future prospects than their current situation:

“Our prospects in next three months? Excellent. In six months? Good. We all know that things will turn unexpectedly.”

“We are concerned that demand is getting ready to drop due to the high prices and limited availability. That’s a bad combination.”

“Bookings are strong, but for how long? This is a supply-driven shortage.”

“Our sales are solid and profitable for what we have booked, but we are not getting the incremental sales.”

“There are still too many exogenous factors overshadowing the fundamentals.”

“I just hope demand continues after the supply corrections.”

“We’re well positioned at the moment, trying not to get ahead of ourselves.”

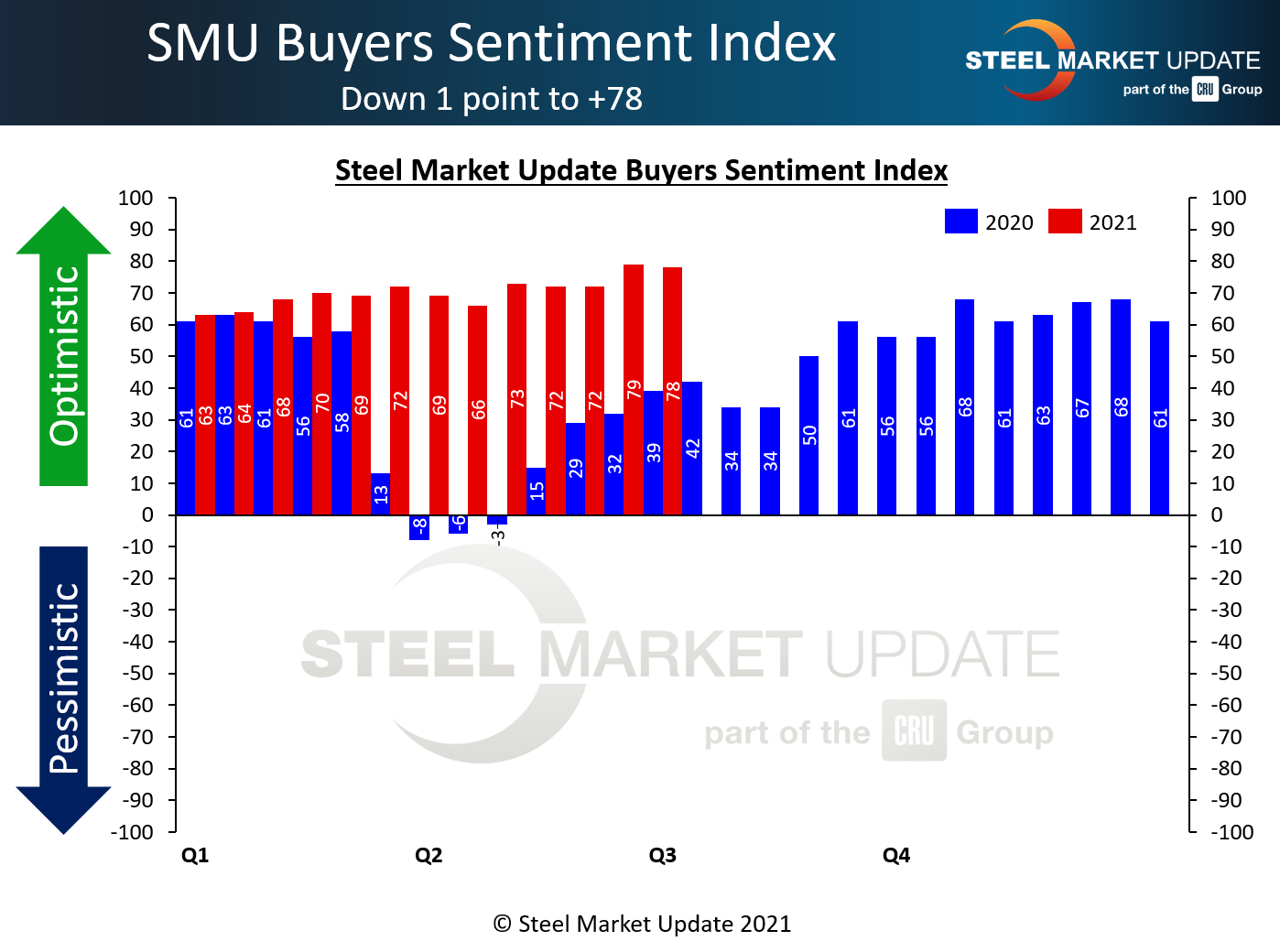

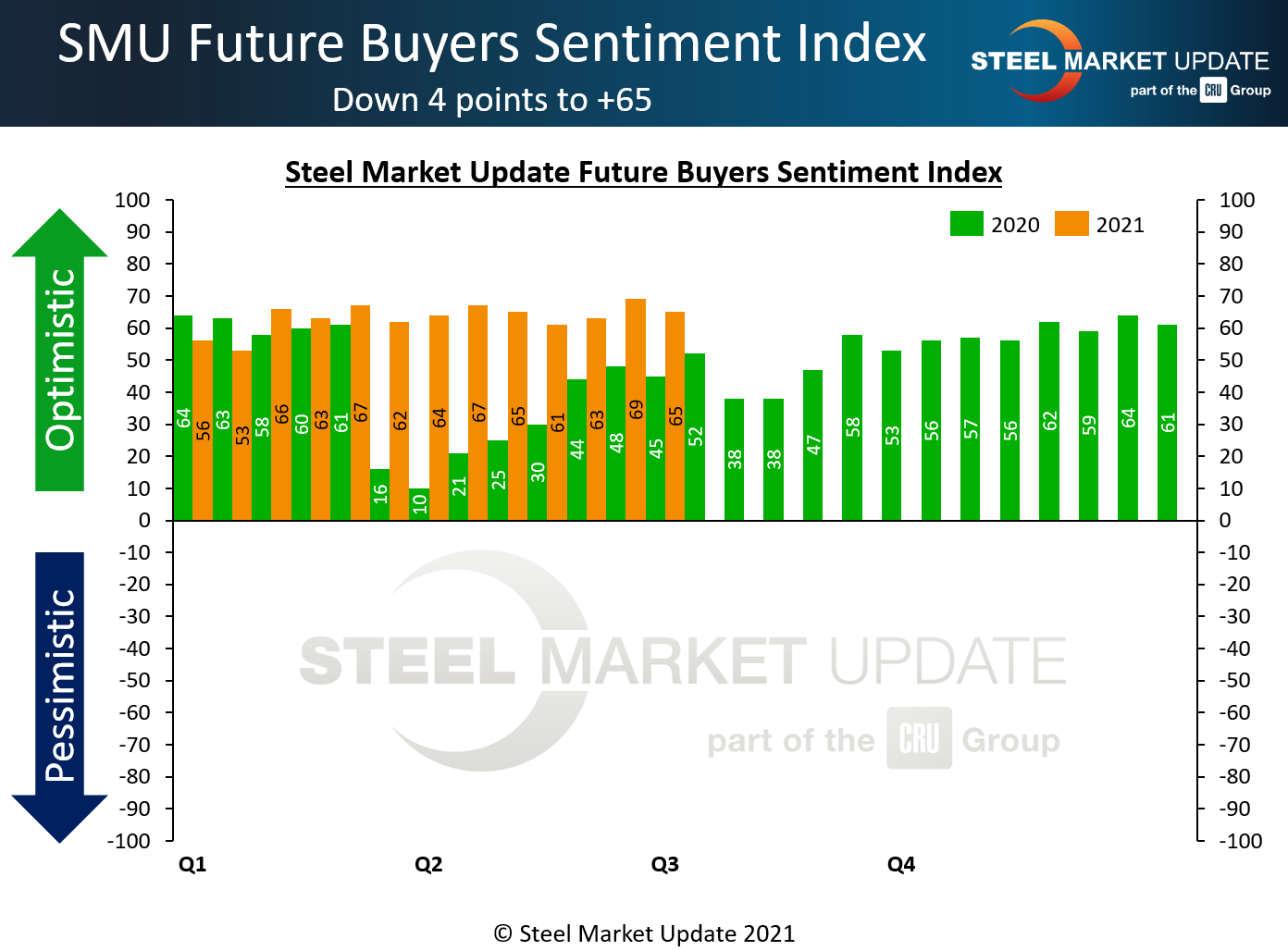

SMU asks steel buyers every two weeks how they view their company’s chances for success in the current environment and how they view their prospects three to six months in the future. SMU’s Current Buyers Sentiment Index stands +78 this week, down one point from the all-time high two weeks ago. SMU’s Future Sentiment Index dipped by four points to +65. Both are far in advance of levels this time last year when the economy was struggling to recover from the pandemic disruptions (see charts below).

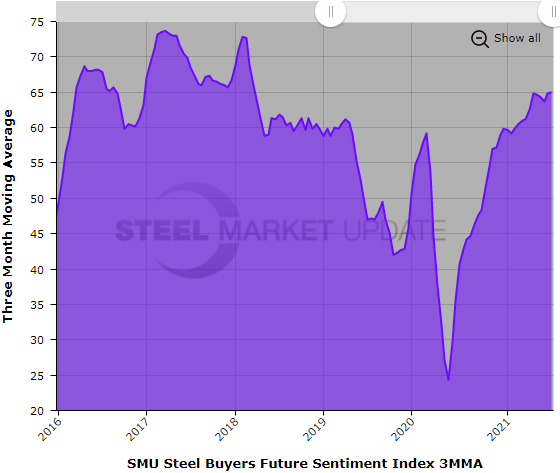

Measured as a three-month moving average (3MMA) to smooth out the variability, Current Sentiment stood at +73.33 this week, up from +71.83 two weeks ago. The Future Sentiment 3MMA was at +65.00, up slightly from +64.83 in the last survey.

Generally speaking, optimism among steel buyers, as measured by SMU, has never been much higher. But it has likely peaked, tempered by the realization that a correction in historic steel prices is inevitable at some point. Possibly soon. And when that happens, sentiment can be expected to follow steel prices downward.

Meanwhile, as one buyer commented, “It’s fun to see our team working their butts off and taking full advantage of the market. It’ll be nice to reward everyone at the end of the year.”

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat-rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via Steel Market Update surveys that are conducted twice per month. We display the meter on our home page for all to see.

We currently send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies. Approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com