Market Data

December 9, 2021

Steel Mill Lead Times: Hot Rolled Down to Five Weeks

Written by Tim Triplett

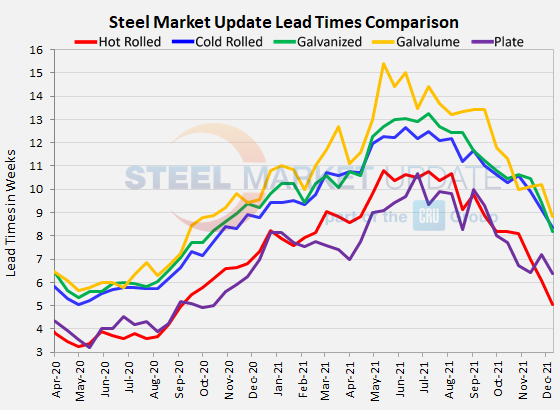

Lead times for steel sheet and plate continued to decline over the past two weeks, shortening by an average of more than a week. The move correlates with a sharp downtrend in steel prices.

Steel Market Update’s latest check of the market shows the average lead time for hot rolled orders nearing five weeks. Cold rolled and coated lead times are approaching eight weeks. That’s still 1-2 weeks longer than historical averages but far below the peaks of 11-13 weeks seen earlier this year. Current lead times are also the shortest they have been since September/October 2020, according to SMU data.

Buyers polled by SMU this week reported mill lead times ranging from 3-8 weeks for hot rolled, 5-12 weeks for cold rolled, 4-12 weeks for galvanized, 8-10 weeks for Galvalume, and 4-8 weeks for plate.

The average lead time for spot orders of hot rolled has declined to 5.04 weeks from 6.09 weeks in late November. Cold rolled lead times now average 8.35 weeks, a decline from 9.13 two weeks ago. Galvanized lead times dipped to 8.19 weeks from 9.42 weeks in the same period. The average Galvalume lead time moved down to 8.83 weeks from 10.20 weeks.

Like sheet products, mill lead times for plate also continue to shorten. The average plate lead time moved down to 6.38 weeks from the 7.20 weeks seen in SMU’s market check two weeks ago.

Lead times are a sign of activity and demand at the mill level and are considered a leading indicator of finished steel prices.

By Tim Triplett, Tim@SteelMarketUpdate.com