Market Segment

December 8, 2021

Vale in 'Advanced' Talks to Sell Stake in CSI

Written by Michael Cowden

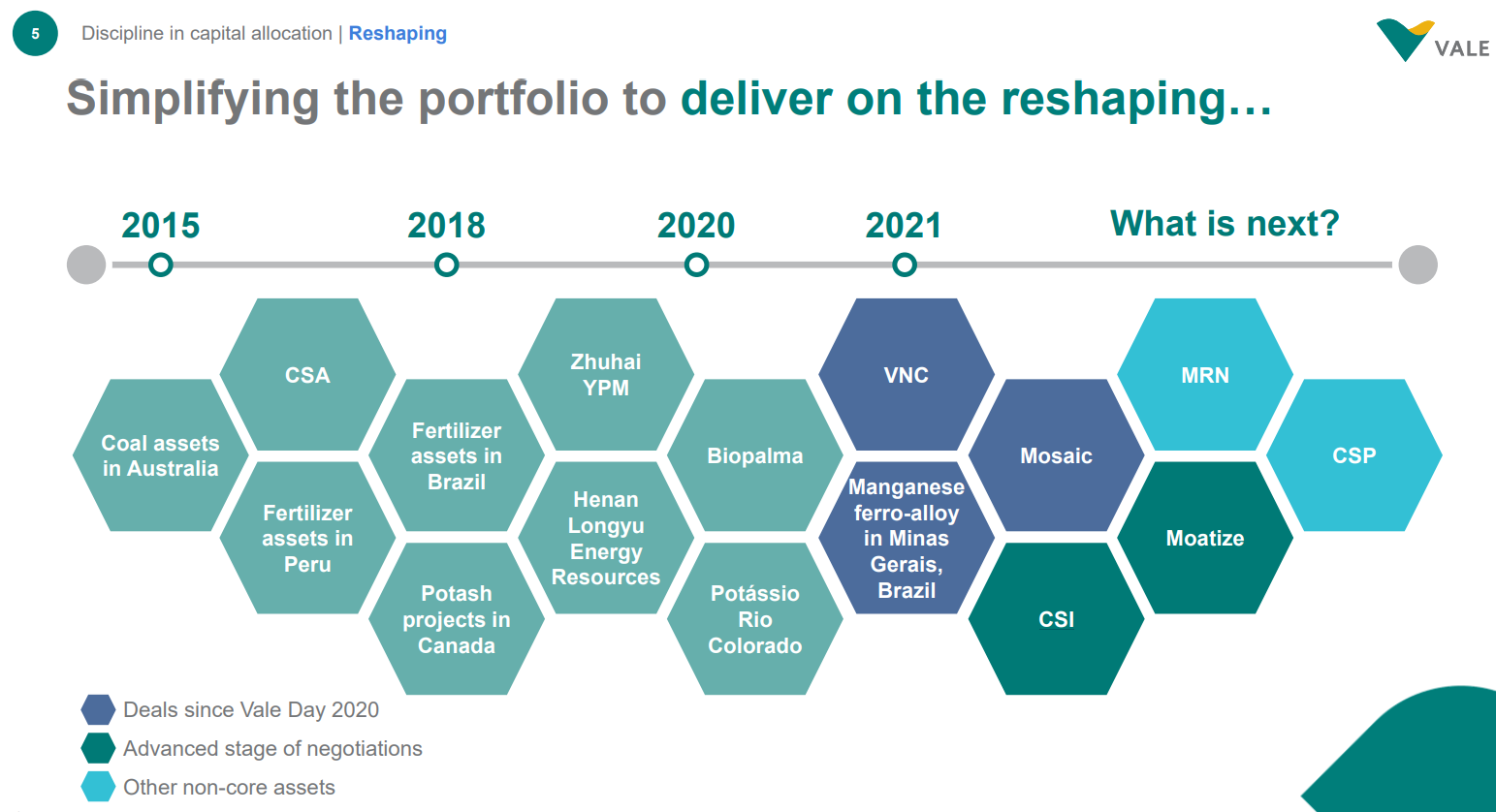

Brazilian iron ore miner Vale is in an “advanced stage of negotiations” to sell its stake in California Steel Industries (CSI), according to an investor day presentation.

The presentation did not say which company Vale was in talks with.

![]() CSI is a Fontana, Calif.-based slab converter. It is also a 50-50 joint venture between Vale and Japanese steelmaker JFE – and an important supplier of sheet products and welded pipe to the West Coast.

CSI is a Fontana, Calif.-based slab converter. It is also a 50-50 joint venture between Vale and Japanese steelmaker JFE – and an important supplier of sheet products and welded pipe to the West Coast.

Charlotte, N.C.-based electric arc furnace (EAF) steelmaker Nucor is the most likely candidate to acquire Vale’s stake in CSI, according to market participants.

An acquisition of CSI, or at least Vale’s stake in CSI, by Nucor or any other U.S-based mill would provide a presence on the West Coast. And M&A is probably the best means to acquire such a footprint given the high environmental and regulatory hurdles to any new heavy manufacturing projects in the region.

The relevant slide from the Vale presentation is here:

The slide also notes that Vale has in 2021 already successfully sold its stake in fertilizer producer Mosaic and its Vale New Caledonia (VNC) nickel operations.

CSI, approximately 50 miles east of Los Angeles, makes hot-rolled, pickled-and-oiled, cold-rolled and galvanized products as well as welded pipe.

The company could become an important supplier to infrastructure work on both the sheet and pipe sides if it were to have a source of domestically melted slab and hot band for pipe scalp, some sources said.

CSI currently relies primarily on imported slabs, which means it is not eligible for projects requiring that steel be melted and poured in the United States.

Nucor, Vale and CSI did not respond to requests for comment for this article.

By Michael Cowden, Michael@SteelMarketUpdate.com