Prices

January 16, 2022

CRU: Global Metallics Markets Unseasonably Bearish in January

Written by Ryan McKinley

By CRU Senior Analyst Ryan McKinley, from CRU’s Steel Metallics Monitor January 2022

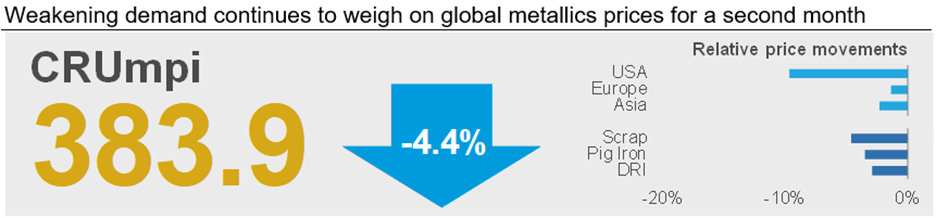

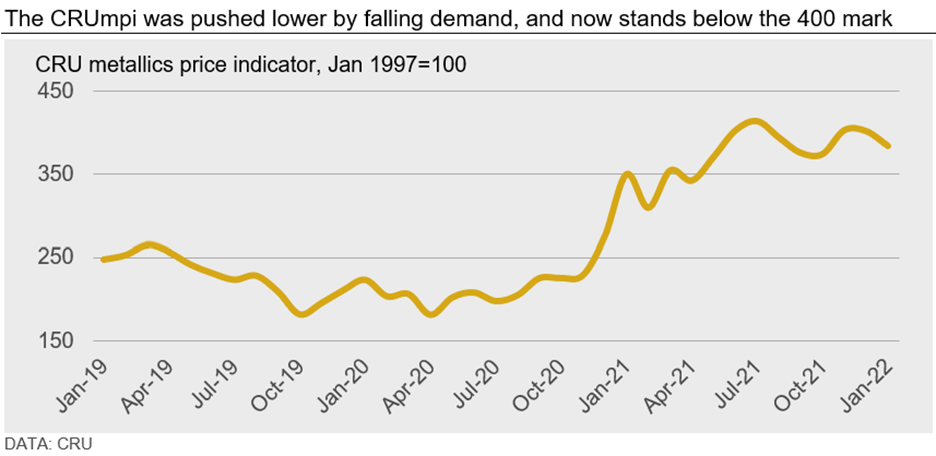

The CRU metallics price indicator (CRUmpi) fell in January m/m by 4.4% to 383.9, which is an unusual move for this time of year. Demand in most markets, particularly in Europe and the USA, was weaker-than-expected, and relatively mild weather conditions leading up to early January kept supply plentiful. We expect to see high levels of price volatility over the next few months.

After stabilizing in December, the direction of metallics prices around the world was generally split between east and west in January—with higher demand in the former creating somewhat more stable markets and a lack of demand creating bear markets in the latter. Of note was a substantial decrease for scrap prices in the USA, which underwent their largest January decrease on record. European scrap prices also fell somewhat m/m, although the size of this decrease was much more modest compared to the U.S. market. In China, steel producers are now no longer subject to 2021 output restraints from the government, which has caused production and scrap demand to rise. For other areas of Asia, sentiment has turned more bullish as well following economic stimulus measures put in place in key countries, although prices were somewhat lower m/m. Meanwhile, ore-based metallics prices fell m/m given weakness in the U.S. and European metallics markets even though production in Brazil and the CIS has become severely constrained.

January’s unusually large price correction in the USA was driven primarily by demand-side factors as mills found themselves with plentiful inventories amid falling finished steel prices. In addition, mild winter weather during December and historically elevated prices kept scrap inflows high, and supply availability was high enough that not all sellers successfully placed their material for the month. In Europe, demand was curtailed by rising electricity prices that caused producers to operate on a more limited schedule, meaning scrap that had been bought the prior month was sufficient to meet most mills’ needs.

Conversely, Chinese integrated steel producers began to ramp up production in January given that they were no longer subject to government-mandated 2021 output restraints. This increase in steel production caused demand for scrap to rise, and mills are also seeking to secure enough material ahead of the Spring Festival that begins on Jan. 31. In Asian markets outside of China, a lull in buying activity appears to be at an end after countries like Vietnam and Malaysia announced major spending plans on infrastructure over the next few years.

Ore-based metallics markets were more heavily influenced by bearish markets in Europe and the USA, causing prices to fall somewhat m/m even though output was hampered in major producing regions. In Brazil, heavy rainfall has halted iron ore mine production and thus stopped pig iron making activity, and pig iron producers have told customers to prepare for delays of at least three weeks on previously confirmed orders. Concurrently, one major pig iron producer in Ukraine has idled for at least the next month, which is further squeezing supply. Nevertheless, pig iron prices fell by $10-20 /t this month, much less than the fall observed in prime scrap prices in the U.S. market.

Outlook: Downside Price Pressures to Continue in February

We expect demand to be somewhat stronger next month in Europe and the USA, but falling steel prices and elevated input costs will likely prevent scrap prices from rising meaningfully. While markets are turning more bullish in Asia, Covid-19 outbreaks will continue to threaten output and end-use steel demand. Ore-based metallics, however, may find support from production issues assuming demand for these products holds firm. Overall, we expect to see high levels of volatility for metallics markets across the globe for 2022 1H.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com