Market Data

February 4, 2022

SMU Steel Buyers Sentiment: Slightly Less Optimistic

Written by Tim Triplett

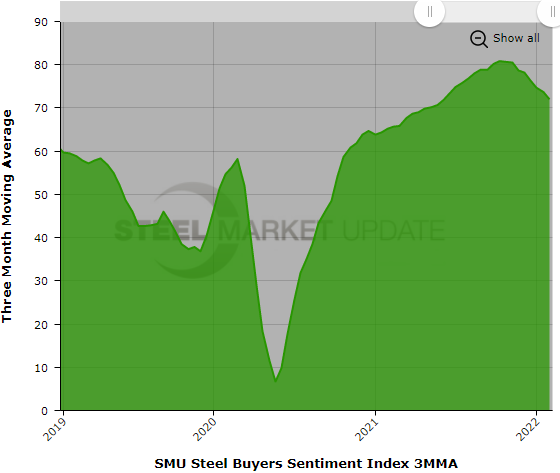

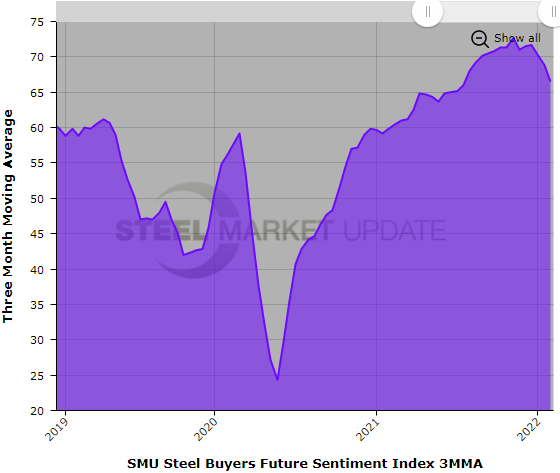

Steel Buyers Sentiment, as measured by Steel Market Update, has inched downward since the beginning of the year and may finally be reflecting the market’s concerns about sharply declining steel prices. While sentiment readings in the 60s are the lowest they have been since last spring, they remain at very optimistic levels on the 100-point scale.

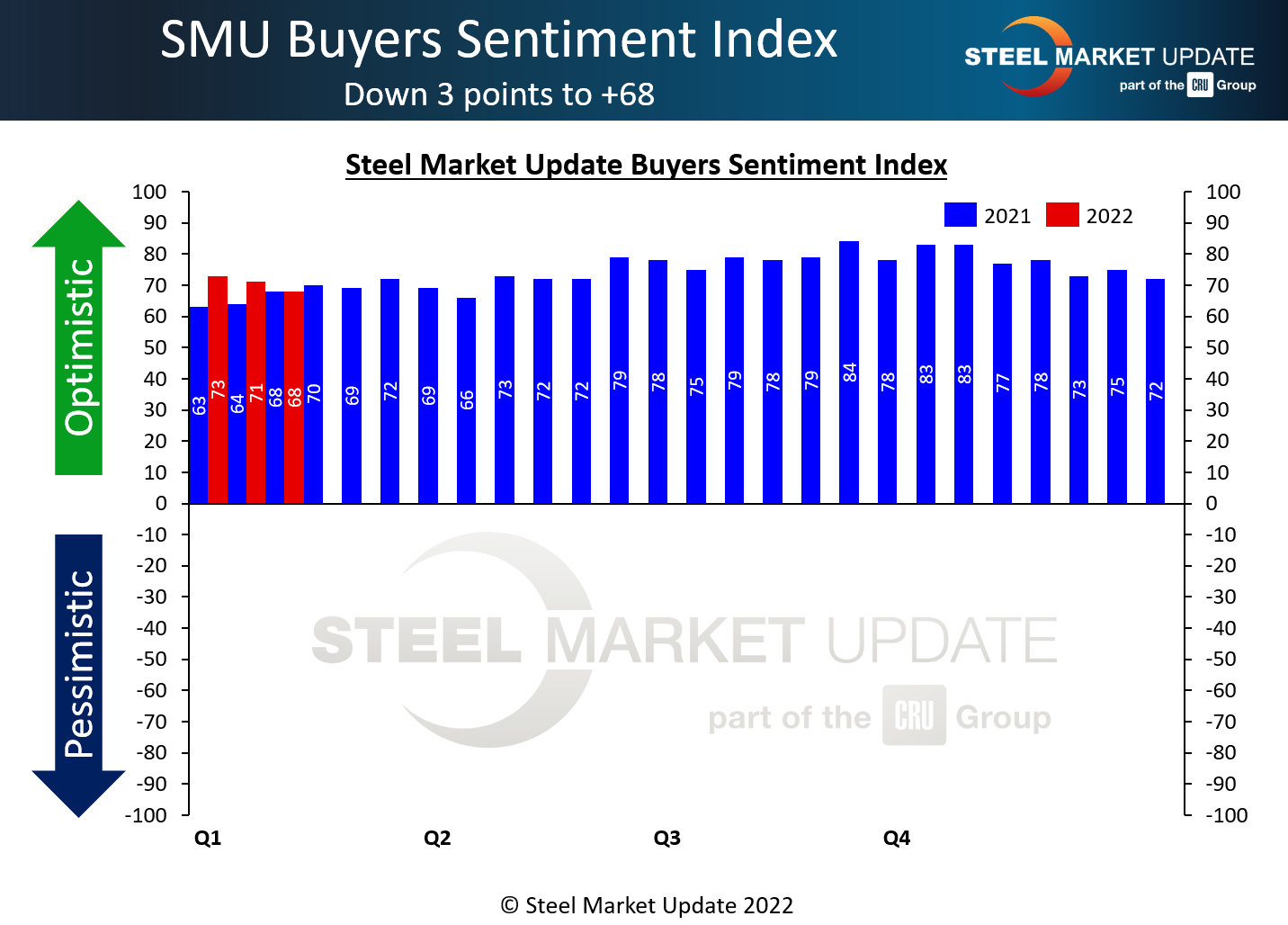

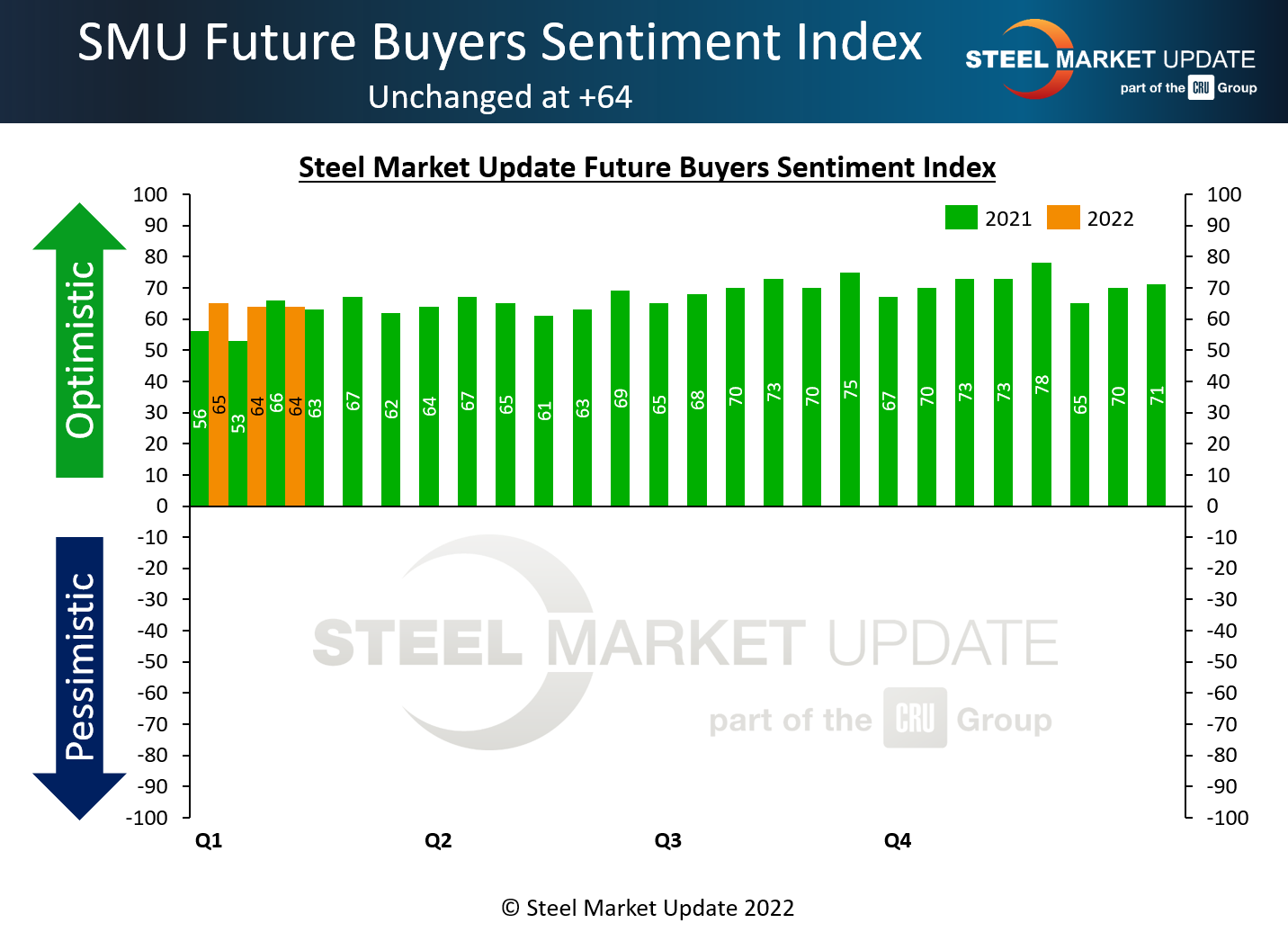

SMU surveys buyers every two weeks and asks how they view their chances of success in the near and longer term. SMU’s Current Sentiment Index registered +68 this week, down 3 points over the past two weeks. The last time Current Sentiment had a reading in the 60s was in April 2021. Future Sentiment – which measures buyers’ feelings about their prospects three to six months in the future – stayed steady at +64. The slight downtrend in sentiment also can be seen in the three-month moving averages in the charts below.

The benchmark price for hot rolled steel has dropped by 37% since its peak last fall to an average of $1,235 per ton – and by all indications will continue to decline until supply and demand find some sort of equilibrium. Yet 69% of the buyers responding to SMU’s questionnaire this week said they remain optimistic about their prospects for the first half of the year. “I’m still feeling pretty darn good, thanks to our contracts and elevated spot numbers,” said one service center executive on the West Coast. “There’s pent-up demand just waiting for the pricing to bottom,” added a tubulars supplier.

Other comments reflect some growing pessimism in the market. “The price correction will hurt everyone, lowering profits across the board,” said one trader. “We’re losing money with high-cost inventory. Until prices stabilize, we are constantly chasing our tail,” added another service center exec.

About the SMU Steel Buyers Sentiment Index

SMU Steel Buyers Sentiment Index is a measurement of the current attitude of buyers and sellers of flat-rolled steel products in North America regarding how they feel about their company’s opportunity for success in today’s market. It is a proprietary product developed by Steel Market Update for the North American steel industry.

Positive readings run from +10 to +100. A positive reading means the meter on the right-hand side of our home page will fall in the green area indicating optimistic sentiment. Negative readings run from -10 to -100. They result in the meter on our homepage trending into the red, indicating pessimistic sentiment. A reading of “0” (+/- 10) indicates a neutral sentiment (or slightly optimistic or pessimistic), which is most likely an indicator of a shift occurring in the marketplace. Sentiment is measured via Steel Market Update surveys that are conducted twice per month. We display the meter on our home page.

We send invitations to participate in our survey to more than 600 North American companies. Our normal response rate is 100-150 companies. Approximately 40 percent are manufacturers, 45 percent are service centers/distributors, and 15 percent are steel mills, trading companies or toll processors involved in the steel business.

Click here to view an interactive graphic of the SMU Steel Buyers Sentiment Index or the SMU Future Steel Buyers Sentiment Index.

By Tim Triplett, Tim@SteelMarketUpdate.com