Overseas

March 15, 2022

CRU: Double-Edged Turmoil as the EU Bans Russian Steel

Written by Matthew Watkins

By CRU Principal Analyst Matthew Watkins, part of CRU’s steel series, March 14.

The EU announced it will “prohibit the import of key goods in the iron and steel sector from the Russian Federation.” We do not yet have details of what goods these are, but we can look at trade flows between the two to see which products will hurt which party.

To a certain extent, this move only makes official what the market has already done in the last few weeks. EU companies, as well as those in the UK, USA and Canada to name a few, were already not able or willing to buy anything from Russia because of a combination of current or potential sanctions, inability to finance, insure or ship, and reputational damage. So, in one sense, this announcement simply formalizes it.

Something else that it does, however, is indicate that this is likely to be a structural change rather than a cyclical one. It is unlikely that we will see EU companies return to buying steel from Russia any time soon. The reorganization of global trade flows will be something that persists.

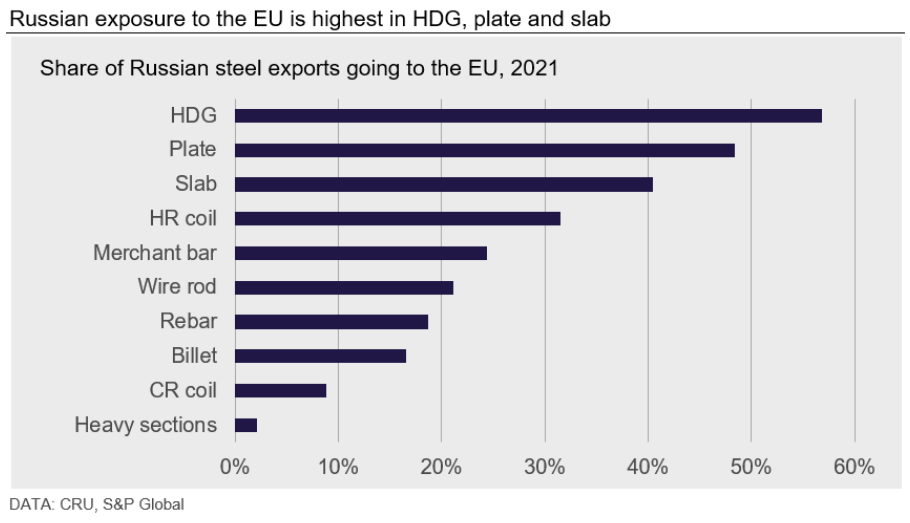

The EU Takes Over Half of Russian HDG Exports

Russian dependence on the EU is highest for HDG, plate and slab, and lowest for CR coil and heavy sections:

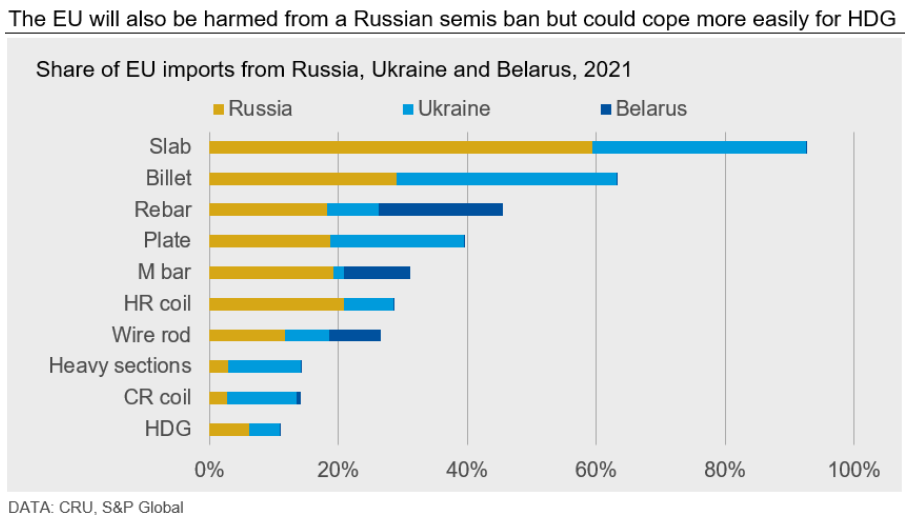

Stopping HDG Would Not Hurt the EU, But Halting Semis Will

In contrast, HDG is a product where the EU has a low exposure to Russia as a share of the total. A ban here will hurt Russia much more than it hurts Europe:

For most other products, there is not such an asymmetry of importance in the trade flow. Halting the flow of semis, particularly slab, will hurt both parties. Plate is also an area where there is a large mutual dependency. It is noteworthy that in plate, a significant share of domestic EU supply is based on re-rolled CIS slab, so there are additional effects.

Overall, there is less of a mutual dependency in longs products than in flats. That said, the EU does import a significant share of its rebar from Belarus as well as Russia; and combining the two origins leaves Europe also with a sizeable resourcing problem for rebar.

Ukrainian trade flows are of course not halted by sanctions or import bans, but rather by an inability to produce or ship. In principle, these could restart – but in practice these volumes are likely to remain also unavailable to EU buyers for some time.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com