Market Data

March 15, 2022

Service Center Shipments and Inventories Report for February

Written by Estelle Tran

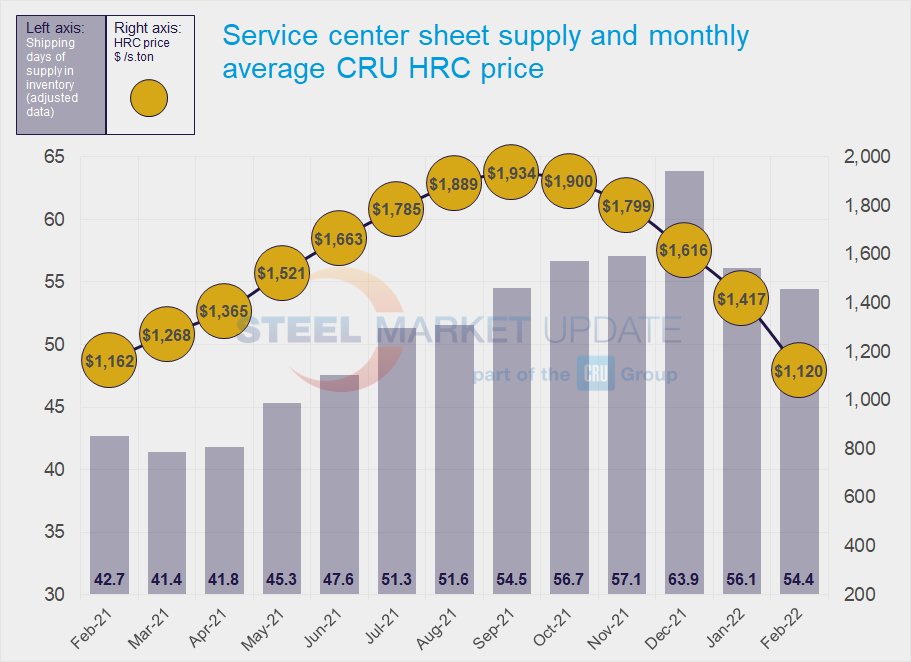

Flat Rolled = 54.4 Shipping Days of Supply

Plate = 51.1 Shipping Days of Supply

Flat Rolled

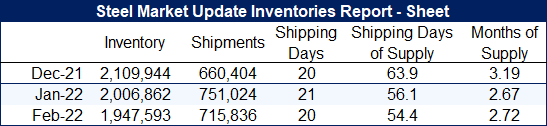

U.S. service center flat rolled inventories continued to recede in February, indicating that inventories may be near balance. At the end of February, U.S. service centers carried 54.4 shipping days of supply on an adjusted basis, according to data from Steel Market Update. This is down from January’s level of 56.1 shipping days for sheet. February inventories still appear to be slightly elevated compared to February 2020, before the pandemic, when service centers carried 51.7 shipping days of supply. In terms of months on hand, inventories were a little higher with 2.72 months of supply in February versus 2.67 in January.

February had 20 shipping days, the same as January’s 20. In the last two weeks, the situation has changed dramatically because of the war in Ukraine. Market sentiment has shifted as the lower priced deals have vanished. Service centers have started seeing price increases, driven by skyrocketing scrap and pig iron prices. U.S. scrap prices increased $125-200 per gross ton, depending on the grade, while pig iron prices jumped more than 50% m/m in March, according to CRU data.

Initially, the $50 per ton price increases announced by mills in late February were expected to stop prices from falling. Nucor followed up with a $100 per ton price increase on March 7, and prices have already bounced back.

Demand has been steady, though some market contacts have been worried about inflation holding back demand as well as component supply disruptions related to the war. In February, service centers were fighting over orders, eager to move inventory as prices have fallen quickly. As the war has escalated, so have sanctions against Russia. Service centers expressed concern about too much panic buying by people trying to beat price increases.

The amount of supply on order stopped declining in February, which is related to lower inventory levels but also may reflect large opportunistic buys that took place at levels that did not factor in the price increases.

Market contacts have shared information about large deals for March shipments and indicated that April prices would be higher. This may be showing in lead times. SMU’s latest lead time survey on March 3 showed HRC lead times edging back up to 4.07 weeks from 3.89 weeks a month ago.

Plate

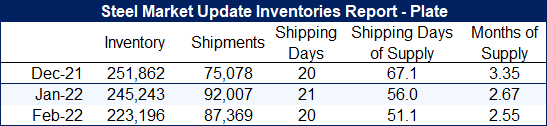

U.S. service center plate inventories also fell further in February and are nearly even with pre-pandemic levels. At the end of February, service centers carried 51.1 shipping days of supply of plate on an adjusted basis, according to SMU data; this was down from 56 in January. In February 2020, before the pandemic, U.S. service centers carried 49 shipping days of plate supply. Plate inventories represented 2.55 months of supply in February, down from 2.67 in January.

The reduction in inventory also seemed to coincide with slower shipments, indicating softening in the market. Market contacts said they were struggling to be competitive in the resale market as well.

Service centers said they were hesitant to build inventory at what they perceived to be the peak of the market, and there have been reports of mills willing to negotiate more than previously. Mills were reportedly reluctant to announce any price moves, amid market uncertainty and rising raw material costs. Seeing skyrocketing scrap prices, SSAB Americas on March 9 issued a letter to customers imposing a raw material surcharge that would raise plate prices dollar for dollar when heavy melting scrap prices rise above $465 per gross ton.

Prior to this announcement, service centers viewed the plate market to be in balance and were surprised that prices have held steady for this long, as HRC prices have fallen precipitously. In the last week, service centers have seen increased customer demand, perhaps because of expectations of price increases.

Plate mill lead times increased slightly though remain short at 4.33 weeks, according to the March 3 survey, up from 4.08 weeks a month ago.

Plate volumes on order eased back in February but were still significantly higher than February 2020.

By Estelle Tran, Estelle.Tran@CRUGroup.com