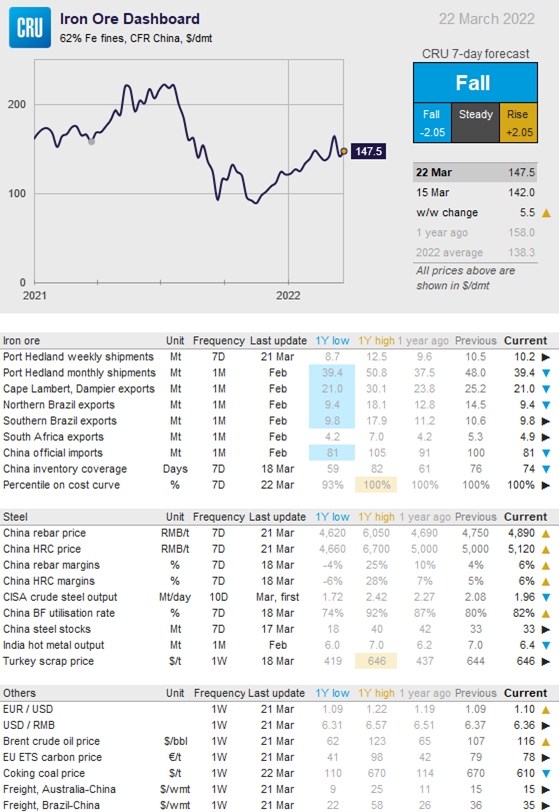

Prices

March 22, 2022

CRU: Iron Ore in a Volatile But Upwards Price Trajectory

Written by Aaron Kearney-Keaveny

By CRU Research Analyst Aaron Kearney-Keaveny, from CRU’s Steelmaking Raw Materials Monitor, March 22

In the past week, the iron ore price has been influenced by two notable shocks, a supply shock from lost CIS volumes, which has been occurring since the invasion, and a demand shock from China after lockdowns created bearish sentiments. Improving iron ore supply has primarily come from an end-of-quarter production push, while trade routes still undergo change as exports are redirected towards Europe.

![]() Global seaborne supply is on the rise, led by Australia. Port Hedland fell marginally by 0.3 Mt to 10.2, with reduced shipments from all users except for FMG. This is within the 10-10.5 Mt range the port has achieved in the last month. Rio Tinto increased its shipments in the last week to the highest level seen since the first week of January, achieving more expected levels as the company reaches the end of the quarter. Since Covid-19 restrictions were eased in Western Australia, cases have been on the rise from ~4,000 daily cases to ~6,000 in the past week. While this is not an issue for now, it could prove problematic for the availability of workers or the reintroduction of restrictions if cases continue to rise.

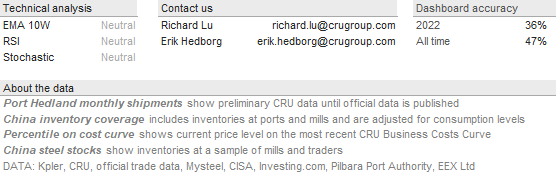

Global seaborne supply is on the rise, led by Australia. Port Hedland fell marginally by 0.3 Mt to 10.2, with reduced shipments from all users except for FMG. This is within the 10-10.5 Mt range the port has achieved in the last month. Rio Tinto increased its shipments in the last week to the highest level seen since the first week of January, achieving more expected levels as the company reaches the end of the quarter. Since Covid-19 restrictions were eased in Western Australia, cases have been on the rise from ~4,000 daily cases to ~6,000 in the past week. While this is not an issue for now, it could prove problematic for the availability of workers or the reintroduction of restrictions if cases continue to rise.

In northern Brazil, exports increased drastically as rainfall reduced recently, although forecasts predict heavy rainfall through March and April. The drop in February and March was not as bad as what the south faced in January, largely due to the expectation and therefore preparation for the poor weather. Legislators in the north have pushed for Vale to increase its spending on state projects, which could lead to strains between the mining giant and the political establishment. In the south, there has been a mild fall, the decrease being much smaller than the north’s increase.

In Ukraine, Russian forces have reached Dnipro, where the majority of iron ore mining is conducted. This region was subject to bombings from Russia in the past two weeks. Soon after the invasion began, ArcelorMittal evacuated its sites, but other producers such as Metinvest continued at limited capacity of ~30-40%. Mariupol is still being fought for, which does not have iron ore mining but had a steelmaking presence that used iron ore produced by Metinvest.

On the demand side, Chinese domestic steel prices have risen w/w with our assessed HRC and rebar prices up by RMB120 /t and RMB140 /t, respectively, partly offsetting the big losses seen in the past week. Steel flat products demand edged down w/w but was broadly elevated, while the continuous recovery of long products demand stopped due to the ongoing Covid-19 pandemic in many cities. The recent price increases primarily resulted from concerns that steel production increases would be smaller than expected due to pandemic-led disruptions on raw materials supply, slowing mills’ operations. Last week, the surveyed BF capacity utilization rate lifted after operating restrictions eased in Hebei and Shandong province. This pushed up iron ore consumption, among which sinter consumption increased at the fastest rate at the expense of pellet and lump due to eased operating restrictions on sintering capacity. However, iron ore consumption is under downward pressure, as lockdown measures have been enacted in Tangshan.

During this week, the price will be driven primarily by demand concerns. Although sintering restrictions have been eased, lockdowns have hit too many major iron ore buyers in China. This, in combination with strengthening seaborne supply, despite the impacts of the war in Ukraine, will drive the price down.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com