Market Segment

May 4, 2022

Ryerson Posts 547% YoY Profit Gain in Q1, Record Revenue

Written by Michael Cowden

Ryerson reported sharply higher profits on increased prices and despite lower year-over-year (YoY) shipment volumes.

The Chicago-based service center predicted a strong second quarter as well but forecast that average selling prices might be flat or up only modestly.

“Our optimism around enduring secular drivers favoring recyclable industrial metals as a core enabler of sustainable growth and well-being is undiminished,” Ryerson president and CEO Eddie Lehner said in statement released with earnings data after the close of markets on Wednesday, May 4.

The company in addition expects fewer supply-chain snarls and increasing demand later in the year.

All told, Ryerson reported net income of $163.6 million, up 53.8% from $106.4 million in the fourth quarter of 2021 and up 546.6% from $25.3 million in the first quarter of last year.

The company posted record revenue of $1.75 billion in the first quarter, up 14% from the prior quarter and up 52.4% from the first quarter of 2021.

Ryerson predicted second quarter revenue of $1.75 billion to $1.80 billion and average selling prices flat to up 2% versus first quarter levels.

It notched average selling prices of $3,312 per ton in the first quarter of 2022, up 2.3% from $3,236 per ton in the fourth quarter of 2021 and up 56.7% from $2,113 per ton in the first quarter of last year.

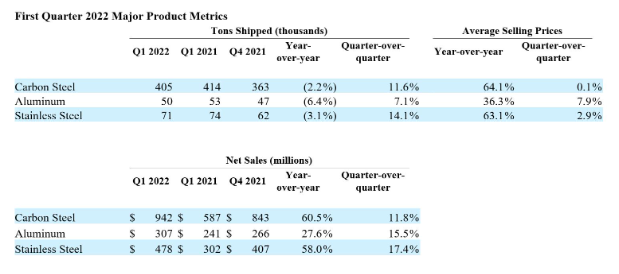

That figure is much higher than carbon steel prices because Ryerson also sells significant volumes of stainless steel and aluminum. A breakdown of the company’s tons shipped, average selling prices and net sales by product is below:

While shipments were down YoY, they were up compared to the fourth quarter with 20% volume gains in commercial ground transportation, 19% in construction equipment, and 13% in HVAC.

On the operations side, Ryerson plans for its new service center in Centralia, Wash., to be fully operational by the end of the year.

The company has also begun preparations at its University Park campus, roughly 40 miles south of Chicago. It will be the future hub of Central Steel & Wire, which Ryerson acquired in 2018.

By Michael Cowden, Michael@SteelMarketUpdate.com