Market Data

June 17, 2022

CRU on June FOMC: Extraordinary Inflation Requires an Extraordinary Response

Written by Veronika Akhmadieva

By CRU Economist Veronika Akhmadieva, from CRU’s Global Economic Outlook

With a higher-than-expected headline CPI inflation reading of 8.6% in May, the Fed opted for an even more aggressive monetary tightening. After a 50 bps increase in the federal funds rate in May – which is the highest increase since 2000 – the Fed raised the federal funds rate by 75 bps which is the highest increase in 27 years, bringing it to a range of 1.5%–1.75%. The median estimate of Fed policymakers for the Federal Funds rate at 2022 year-end is now 3.375%, suggesting that we will see at least additional 175 bps worth of increases before 2022 is over.

As an additional measure of monetary tightening, the Fed continues to shrink its balance sheet by rolling up to $30 billion of maturing Treasury securities, and up to $17.5 billion of mortgage-backed securities (MBS) off its balance sheet monthly. In September, the speed will pick up as well, with these caps increasing to $60 billion for Treasuries and $35 billion for MBS, further reducing the money supply.

The US economy shrank by 1.5% in the first quarter of this year. However, with the trade deficit narrowing from the all-time record of $107.7 billion in March to $87.1 billion in April and economic activity peaking up in Q2, we expect to see much stronger annualized quarter-on-quarter (QoQ) growth of around 2% in Q2.

As for the labor market, we saw solid job gains with non-farm job monthly increases averaging 488,400 in the first five months of 2022. Meanwhile, the unemployment rate remained at 3.6% over the last three months, with anything below 4% being considered full employment. However, aggressive monetary tightening in 2022–2023 will inevitably scar the labor market, although we do not expect the negative impact to be severe.

Tackling Inflation Is a Top Priority for the Committee

A substantially more hawkish dot plot confirms that inflation pressure in the US is still strong, and a big part of bringing inflation back to the target rate is controlling inflation expectations. Even more than the rise in headline CPI in May, the Fed will have been concerned by the University of Michigan’s survey showing household inflation expectations rising.

Hence, the Committee is using all tools at its disposal to send a strong signal to the markets that it is determined to bring inflation down – even if it will slow down economic growth in 2022–2023. The main reason for such elevated prices in the US is the pandemic that disrupted supply chains and the labor market, leading to severe supply and demand imbalances. However, higher energy prices that increased in 2021 as economic activity began to recover – and that increased further because of the war in Ukraine and Covid-19-related lockdowns in China – made a bad situation even worse.

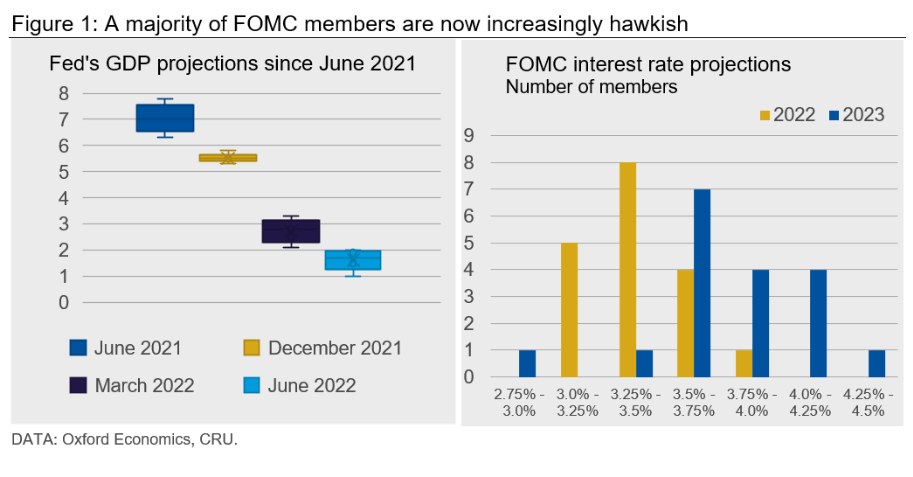

A more noticeable upward shift in the dot plot shows that the majority of FOMC members now believe that even more aggressive monetary tightening is necessary given the current state of the economy. Not all agree, however. Some FOMC members were in favor of a more moderate approach, leaning towards a 50 bps hike in June. Median dot for 2022 shifted from 1.75% in March (in May the Fed did not release its projections materials) up to 3.375%; and for 2023, from 2.375% to 3.375% with a strong consensus among the FOMC members.

Needless to say, more aggressive monetary tightening will take its toll on economic activity. The median real GDP growth forecast for 2022 was revised down from 2.8% in March to 1.7% in June. This is below our forecast of 2.4% for 2022 and below consensus, which will now likely be revised. Furthermore, the FOMC members now expect a higher unemployment rate this year, with the median increasing from 3.5% in Q1 projections to 3.7%.

Also compared to March economic projections, the median estimate for headline PCE inflation increased from 4.3% to 5.2% in June; and for core PCE inflation, from 4.1 to 4.3%. However, the FOMC members are rather optimistic about how quickly inflation will subside, with June projections suggesting that the median headline PCE will decrease to 2.6% by 2023 year-end, and core inflation will drop to 2.7%. These numbers are very close to the March projections, 2.7%, and 2.6%, respectively.

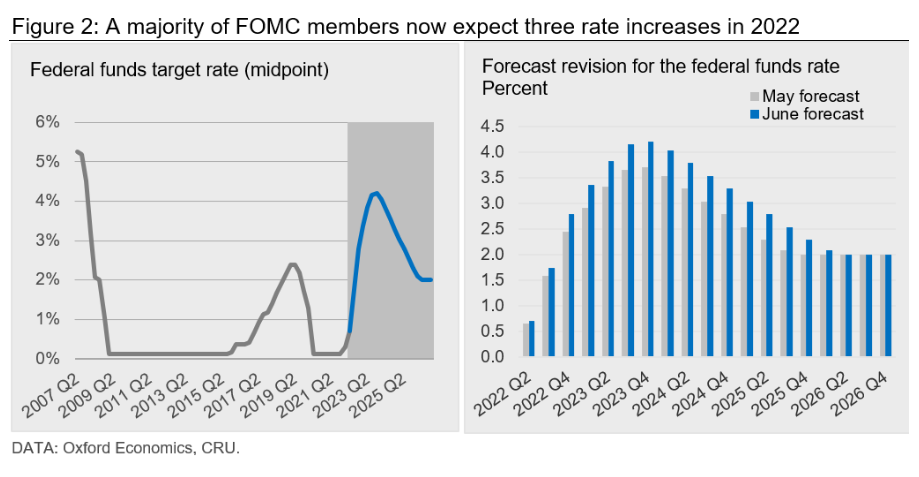

More Tightening Ahead in 2022 H2 and 2023 H1

With an announcement of a 75 bps increase, we are adjusting our federal funds’ rate schedule for 2022–2026. At the time of our last GEO, with year-over-year headline CPI inflation dropping from 8.5% to 8.3% in April, we expected a more moderate increase of 50 bps in June, with additional 150 bps increases over the remaining four meetings in 2022 and 75 bps worth of increases in 2023 H1. However, with stronger inflation data for May and an increase in the inflation expectations, we had then expected a 75bps which was realized yesterday.

We expect to see another 175 bps rate hike in 2022 with 50 bps increases in July, September, and November. We expect this to be followed by a 25 bps increase in December and a further 75 bps worth of increases in 2023 H1 – as the Fed slows down the pace of tightening, assuming inflation begins to tackle down. These series of rate hikes will bring the federal funds rate to 4.25% in 2023 Q2.

One may wonder what the impact of these rate hikes on the economy will be. Indeed, higher rates will put pressure on demand in some commodity-intensive parts of the economy, such as the housing and automotive sectors. Regarding the former, in April, residential spending continued growing at 0.9% month-on-month (MoM) despite rising costs. However, non-residential spending already showed some worrying signs, falling 0.4% in April and lagging for a second-straight month.

As borrowing becomes costlier, we expect to see a decline in residential and non-residential spending, and a subsequent slowdown in the construction sector in 2023. As for the auto sector, prices for used cars and trucks eased in Q1 only to increase 1.8% in May – up 16.1% YoY. With higher rates ahead, these price gains will ease in the first half of 2023. Moreover, USD is likely to strengthen further if other central banks do not follow with similar tightening of their monetary policy.

So far it seems, that the European Central Bank is resisting increasing the policy rate too sharply due to fearing it may push the economy into recession and is again focusing on limiting the fallout from financial fragmentation and fiscal risks. If this divergence continues, we expect to see the dollar appreciating against the Euro in 2022 H2.

Looking ahead, one 75 bps hike potentially leaves the door open for another hike of this magnitude to follow – if inflation does not begin cooling off over summer. Multi-decade high inflation calls for more aggressive monetary tightening, but we still expect the Fed to be careful not to hit the brakes too hard, given that projected real GDP growth for 2022 is now already less than half of the growth rate forecasted just half a year ago.

This article was originally published on June 16 by CRU, SMU’s parent company.

Request more information about this topic.

Learn more about CRU’s services at www.crugroup.com