Market Segment

October 13, 2022

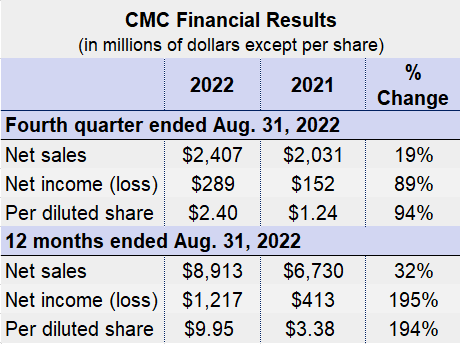

CMC Posts Its Best Fiscal Year Ever, Sees Good Times Ahead Too

Written by Laura Miller

Commercial Metals Co. posted solid results for its fiscal fourth quarter ended Aug. 31, helping make the company’s fiscal year 2022 the best financial performance in its 107-year history.

CMC’s North American segment saw strong demand for it finished long products during the quarter, as well as meaningful increases in downstream bid volumes. Destocking activity and a slower pace of construction led to lower shipment volumes of finished steel compared to the prior year period.

With the ongoing energy crisis, slowing industrial demand, and trade sanctions, market conditions were more challenging for CMC’s European segment, company executives commented on the Q4 earnings call on Oct. 13.

During the quarter, CMC saw significant increases in steel product margins over scrap, with margins up $251 per ton in North America and up $138 per ton in Europe year-on-year (YoY). Margins on sales of raw materials were down sequentially and YoY but were still above historical averages.

Looking forward, CMC is very optimistic because infrastructure spending in the US is anticipated to begin in earnest next year and to ramp up over the next five years. It anticipates 1.5 million tons of annual incremental rebar demand, or a 17% increase in overall consumption.

Company officials acknowledged recessionary concerns. But “in our business, we see no signs of a demand slowdown,” president and CEO Barbara Smith said on the earnings call, noting that leading indicators such as the Architectural Billings Index and Dodge Momentum Index remain strong. Additionally, downstream bidding activity remains at historic levels, she said. Another tailwind: the reshoring of industry and the building of new semiconductor facilities across the US. That is huge for the CMC because the plants are massive consumers of rebar.

CMC’s Arizona 2 project remains on track for startup in spring of 2023, with commissioning well-timed with the expected infrastructure spending. Ramp-up of rebar production will take place first, followed by merchant bar soon after, Smith said. The mix will be two-thirds rebar and one-third merchant bar on an annual basis, with the flexibility to change the mix based on market demand.

Site selection for CMC’s fourth micromill in the Eastern US is taking longer than anticipated, but the company remains committed to the project, Smith said.

Irving, Texas-based CMC operates seven EAF minimills, two EAF micromills, one rerolling mill, steel fabrication and processing plants, construction-related product warehouses, and metal recycling facilities across the US and in Poland.

By Laura Miller, Laura@SteelMarketUpdate.com