Analysis

December 18, 2022

Johnson: Last Week in US HRC Futures

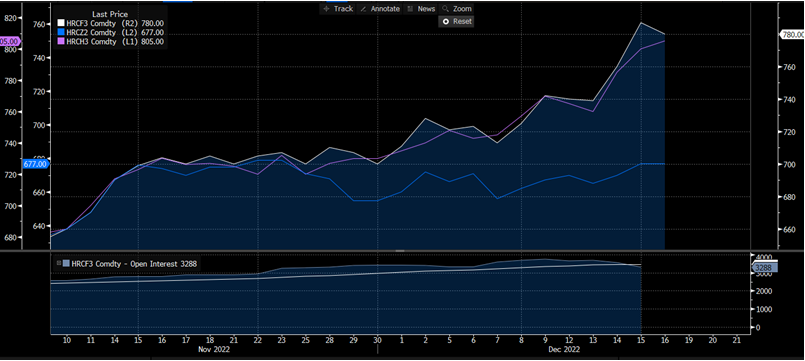

The trend is your friend these days in US HRC futures. They posted another strong week of gains on the back of a massive upswing in the index last week.

While widely expected to be higher—we supposed a $40-per-ton increase was being priced into the cards in our last comment on Dec. 9—this still managed to surprise to the upside with a substantial $49/ton jump, moving into line with other indices in the market.

All of these were assessed last week, for the most part, around the $670/ton range, which remains consistent with mill offer prices overheard in most regions. This ranges from Chicago/Indiana and into the South, where things may even be slightly lower in some instances based on anecdotal data collection from clients.

December has quieted down, with 50% of the average settlement now known. But it is still of interest to us here, though much trade attention turns to January, which is pricing in some truly amazing spot price increases in the next five weeks, as the mills will be delighted to hear.

Markets shrugged off not insignificant outside market headwinds Friday to move higher for a third day on the back of that big index print we mentioned. The US Federal Reserve had hiked interest rates, and promised more.

In Singapore, iron ore dropped a hefty 3.9% Friday on news Chinese mills will consolidate purchases behind a new state conglomerate, European prices were down Friday, nonferrous prices like copper and aluminum have been slumping notably in recent days, etc.

Even so, January at $794/ton (Friday’s high) would mean spot prices are well above $800/ton in just five weeks’ time, and this is what makes futures markets interesting. That is, the market is convinced of something that has not materialized just yet, but very well MAY be materializing. Maybe.

Indeed, back to December, spot physical buyers seem to remain somewhat skeptical of spot buying even at $700, but the market is fully convinced we are well above $800/ton by the time January wraps in just five weeks.

The current December average is running at $642.5, and December futures were last trading $677/ton. In the event we printed up $30/ton this week to $697/ton, and then again another $30/ton increase to end the year, the December settlement average would be $677.50, so buyers at this level are betting for bigger gains in the coming weeks.

Will they get them? Hard to say, but it will take a lot of work from here as these are not minor moves.

When we last wrapped March futures on Dec. 9, they were trading at $770/ton, up $13/ton from the day prior. Friday they were trading at $805/ton, posting another $35/ton gain last week (4.5%) and up about $15/ton from just Wednesday when we saw these at $790/ton.

I have added December and January below for comparison. January has dropped about $15/ton since I started typing this Friday to last trade at $780/ton.

PS: The contango gets stronger through 2023 as well, so the story of any future overcapacity is being ignored by the forward market at this moment. All the market sees are sunny skies ahead for now.

Thanks for reading, steel wire aficionados!

Editor’s note: Spencer Johnson has been trading HRC futures for 14 years at StoneX (previously FCStone).

Spencer O. Johnson

LME/Ferrous Trading

StoneX Financial Inc.

O- 212-379-5492

Spencer.johnson@stonex.com