Analysis

March 22, 2023

Worthington 3Q'23 Earnings Fall on Lower Steel Prices

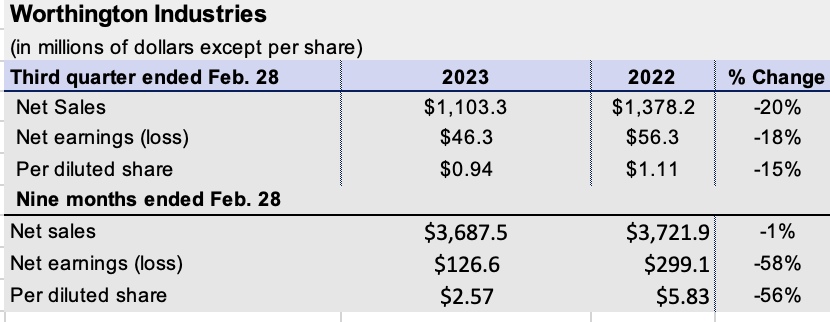

Worthington Industries reported lower net earnings in its fiscal 3Q ended Feb. 28 vs. the same period a year earlier on lower steel prices.

The Columbus, Ohio-based service center and processor posted 3Q 2023 net earnings of $46.3 million, down 18% from $56.3 million a year earlier on net sales that fell 20% to $1.1 billion.

The Columbus, Ohio-based service center and processor posted 3Q 2023 net earnings of $46.3 million, down 18% from $56.3 million a year earlier on net sales that fell 20% to $1.1 billion.

“Our teams delivered solid earnings with a nice improvement sequentially compared to our second quarter,” company president and CEO Andy Rose said in a statement.

“Steel Processing saw modest growth in automotive demand but continued to be negatively impacted by inventory-holding losses,” he added.

Worthington attributed the 20% drop in net sales primarily to lower average selling prices in the Steel Processing business “as steel prices declined significantly from the prior-year quarter.”

The company said the Steel Processing segment’s net sales totaled $757 million in 3Q, off 28% from the same quarter a year earlier.

The Building Products segment’s net sales totaled $151.9 million in 3Q, rising 14% year over year. Meanwhile, its Sustainable Energy Solutions unit’s net sales totaled $31.8 million, up 3% in the same comparison.

Looking forward, Rose said, “We have good momentum heading into our fourth quarter and are optimistic that underlying demand for our key end markets will remain healthy.”

“Higher interest rates are a potential headwind for commercial construction projects and auto financing,” Rose commented on the company’s earnings conference call on Thursday, March 23, noting, however, that “the $1.3 trillion of approved government investment spending from the Inflation Reduction Act, the CHIPS and Science Act, and the Infrastructure Investment and Jobs Act will certainly stimulate demand and likely benefit many of our businesses down the road.”

The North American industrial complex hasn’t been as impacted by higher interest rates as the tech or finance sectors have, but neither is it completely immune, Rose noted.

The company remained upbeat about its Worthington 2024 plan to split off its Steel Processing business into a distinct company by early 2024.

“We remain confident that our planned separation will create two, distinct market-leading companies that will generate long-term value for our shareholders,” Rose said.

The company announced senior leadership roles for the two new businesses, New Worthington and Worthington Steel, in early February.

By Ethan Bernard, ethan@steelmarketupdate.com