Government/Policy

March 23, 2023

HR Futures: Signs of Softness, Maybe

Written by Jack Marshall

I referred to the fast-paced mill price increase announcements for HR back on March 9. The HR spot index had just moved up over $100 per short ton (ST) from the prior week to set the monthly contract price at $1,017/ST.

HR spot indexes have continued to move higher albeit at a slower pace.

Hot Rolled

The latest CRU post indicates spot prices of $1,129/ST. This represents a $112/ST increase from two weeks ago but is still $71/ST shy of mill target prices of $1200/ST.

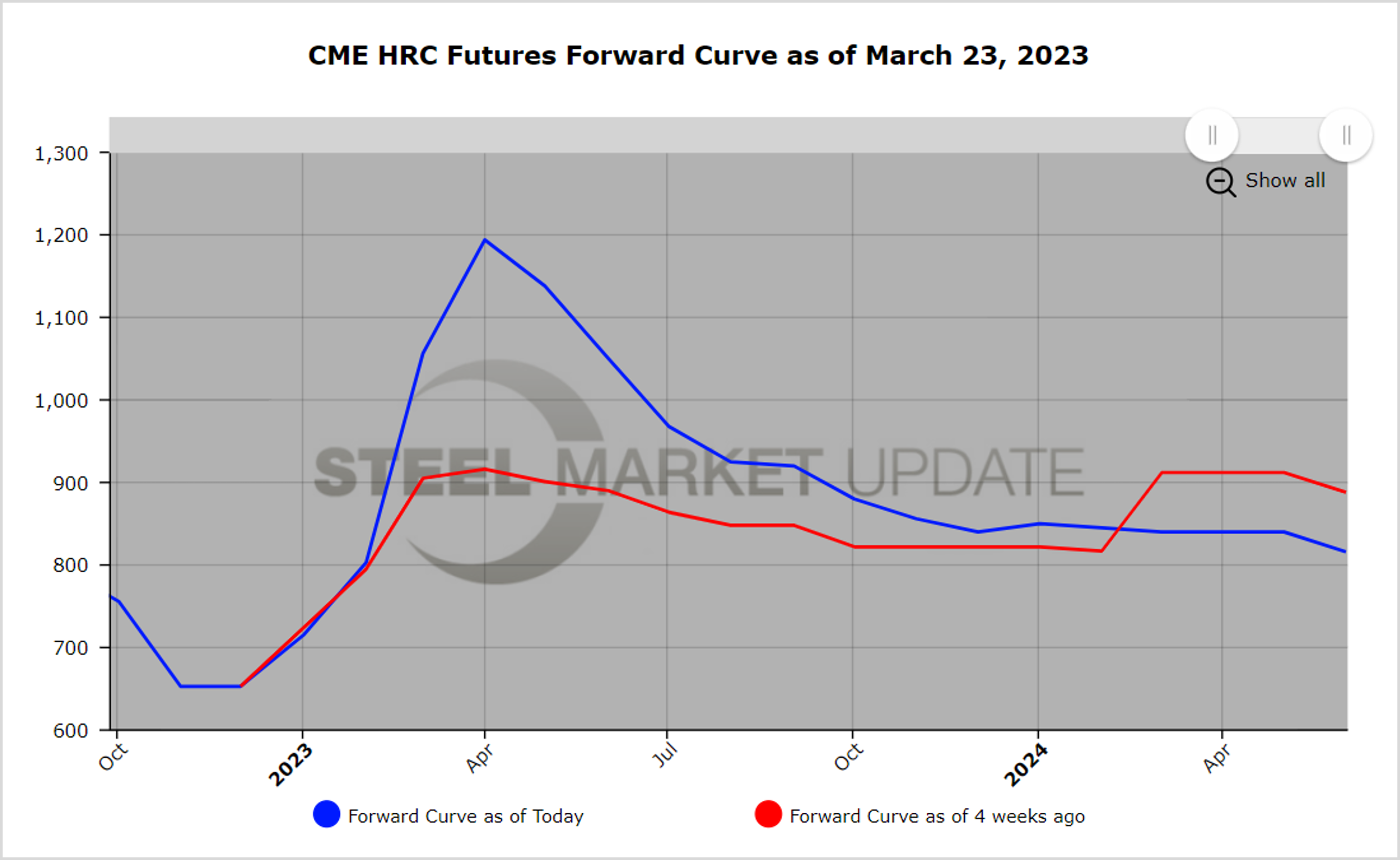

This week it appears that the market participant sentiment has shifted, and the exuberance reflected in higher HR prices further out the forward curve has turned less bullish. While open interest has seen a healthy increase this month, futures curve prices have retreated significantly.

Open interest just since March 9 has risen by 3,620 contracts, or 72,400 ST, helping the overall open interest top 30,000 ST for the first time this year. Despite the additional market participation, recent transactions reflect a lack of confidence that mills will get all the latest announced price increases for HR.

The latest HR settlements for quarterly averages also reflect this retracement in prices. Q2’23 HR settlement from March 9 as compared to March 23 ($1268/ST versus $1127/ST) reflects a price decline of $141/ST. Q3’23 HR settlement from March 9 as compared to March 23 ($1063/ST versus $938/ST) reflects a price decline of $125/ST.

The latest selling could be short lived should mills announce further price increases and on extended delivery schedules just as they are entering a period of maintenance outages.

Scrap

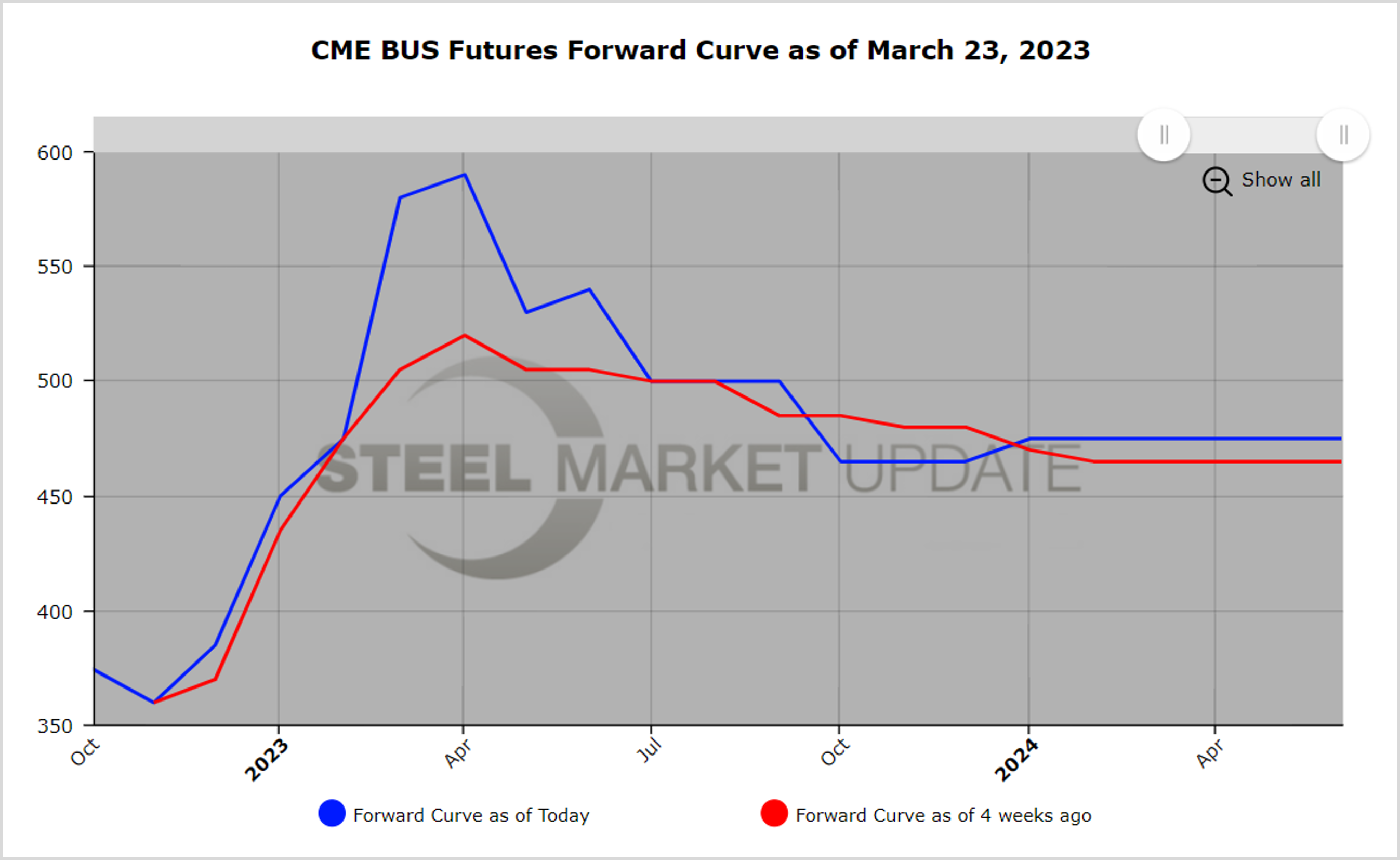

BUS futures activity has been relatively quiet since March 9. With the exception of a few days, BUS volumes have been light. Open interest remains flat. Softer prices for recent export scrap cargoes have eased pricing pressures.

Recent chatter has April BUS sideways to up slightly from March settlement: $556 per gross ton (GT). The BUS curve settlement prices have recently retraced on average about $70-80/GT. The latest trade in Q3’23 BUS was at $500/GT.

Editor’s note: Want to learn more about steel futures? Registration is open for SMU’s Introduction to Steel Hedging: Managing Price Risk Workshop. One will be held on April 26 in Chicago and another on June 20 in Pittsburgh. Learn more and register here.

{loadposition reserved_message}

By Jack Marshall of Crunch Risk LLC