Prices

April 5, 2023

Schnitzer's Q2 Earnings Slip, But Bullish on Q3

Despite reporting a steep drop in year-over-year (YoY) earnings in its fiscal second quarter, Schnitzer Steel Industries’ sequential results improved on higher sales volumes and average net selling prices for recycled metals.

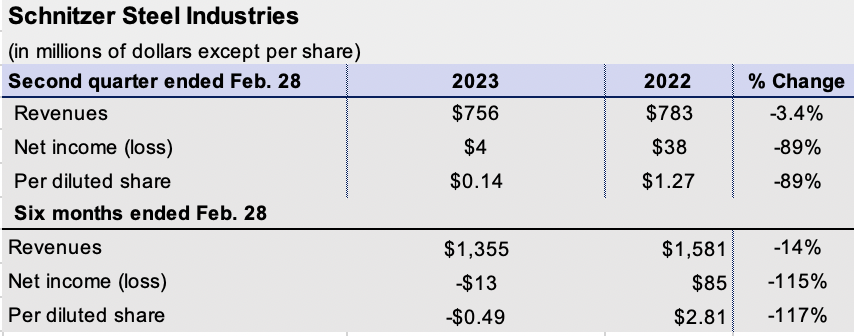

The Portland, Ore.-based scrap recycler and long steel producer posted net income of $4 million in its Q2 2023 ended Feb. 28, down 89% from $38 million a year earlier on revenues that slipped 3.4% to $756 million.

The Portland, Ore.-based scrap recycler and long steel producer posted net income of $4 million in its Q2 2023 ended Feb. 28, down 89% from $38 million a year earlier on revenues that slipped 3.4% to $756 million.

However, the company swung to a profit from its $18-million net loss in the previous quarter on revenues of $599 million.

“Our strong sequential performance improvement reflects strengthening demand and prices for recycled metals and the resolution of the operational disruptions we faced in the first quarter,” Tamara Lundgren, Schnitzer chairman and CEO, said in a statement.

“We achieved these results and generated strong operating cash flow despite tighter than expected supply flows,” she added.

Extended operational disruptions at its Everett, Mass., and Oakland, Calif., metals recycling facilities were resolved in mid-November.

Ferrous sales volumes stood at 1.263 million long tons in fiscal Q2, up 48% from Q1, and increasing 18% from a year earlier. Nonferrous sales volumes of 165 million pounds were up 1% sequentially and 12% YoY.

Average ferrous selling prices were up 8% quarter-over-quarter and down 18% YoY, while average nonferrous selling prices rose 10% sequentially but fell 10% YoY.

Regarding Schnitzer’s near-term forecast, Lundgren was bullish.

“Looking forward, we expect a further improvement in results in the third quarter driven by an expansion of metal margins as we realize the benefit of shipments contracted at higher prices and as supply flows improve seasonally,” she said.

She noted that Schnitzer continues to believe the structural demand for recycled metals remains positive.

Supporting this, Lundgren cited the “transition to low-carbon technologies, the increased focus on decarbonization, and the expected funding related to the Infrastructure Investment and Jobs Act and the Inflation Reduction Act, including Buy Clean provisions.”

By Ethan Bernard, ethan@steelmarketupdate.com