Market Segment

April 24, 2023

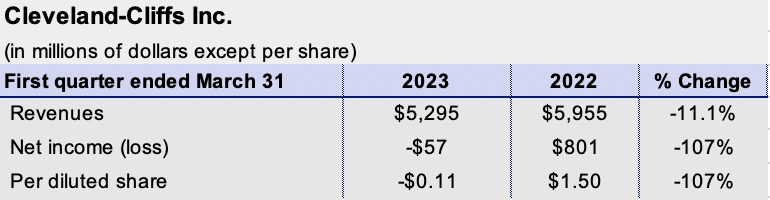

Cliffs Swings to $57M Loss in Q1

Cleveland-Cliffs swung to a loss in Q1 vs. a year earlier, but the loss narrowed from the previous quarter.

The Cleveland-based steelmaker posted a net loss of $57 million attributable to shareholders in the quarter ended March 31, compared with net income of $801 million in the year-earlier period on revenues that slid 11% to $5.3 billion.

The Cleveland-based steelmaker posted a net loss of $57 million attributable to shareholders in the quarter ended March 31, compared with net income of $801 million in the year-earlier period on revenues that slid 11% to $5.3 billion.

In Q4 2022 the company reported a net loss of $214 million on revenues of $5.04 billion.

Cliffs said it has lowered its full-year 2023 capital expenditures expectation to $675-725 million from $700-750 million previously.

The company reported steel shipments of 4.1 million net tons in Q1, up from 3.6 million net tons a year earlier.

“As we expect to continue to happen going forward, in Q1 we accomplished our goal of increasing steel shipments to above 4 million tons,” Cliffs’ chairman, president, and CEO Lourenco Goncalves said in a statement.

“Improved demand from our automotive clients has allowed us to be more selective when selling flat-rolled steel to the general marketplace, allowing us in Q1 to implement several price increases to non-contract clients,” he added.

The average net selling price per ton of steel products was $1,128 in Q1, down from $1,446 a year earlier, and off slightly from $1,156 in Q4 2022.

Looking forward, Goncalves expects that, throughout 2023, Cliffs should benefit from higher sales volumes to the automotive sector.

Also, he added, the company can capitalize on higher prices in yearly contract renegotiations with car manufacturers “that have Cleveland-Cliffs as their largest supplier of automotive steel.”

“With the final batch of yearly fixed-price contracts‑the ones dated April 1-successfully renewed, our outlook for a significant Ebidta expansion in Q2 remains intact,” Goncalves said.

By Ethan Bernard, ethan@steelmarketupdate.com