Market Data

May 4, 2023

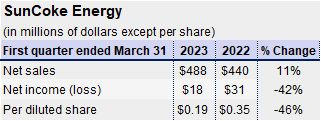

SunCoke Energy Q1 Earnings Slip 42%

Written by Becca Moczygemba

Metallurgical coke producer SunCoke Energy Q1 net earnings were hit by a “lower export coke contribution margin.”

Beyond the earnings results, SunCoke reported an extension of its coke agreement with Cleveland-Cliffs.

Beyond the earnings results, SunCoke reported an extension of its coke agreement with Cleveland-Cliffs.

“Last week we announced the extension of our Indiana Harbor coke agreement with Cleveland Cliffs through September 2035,” Katherine Gates, president of SunCoke Energy, said in a conference call with investors on Thursday.

“The key provisions of the extension are similar to the current contract,” she added.

Lisle, Ill.-based SunCoke Energy posted net income of $18 million in the first quarter, down 42% from $31 million a year earlier on net sales that rose 11% to $488 million.

The company’s coke performance was down 2.8% sequentially due to lower export coke sales contribution margin. The timing of non-contracted blast coke sales also had an impact on the results, the company said.

Though not as strong as the previous quarter’s performance, the Illinois-based coke producer’s logistics business made up for lower coke sales. Q1 logistics volumes for domestic coke came in at 994 kilotons, lower than the 1,023 kilotons produced in Q4 of last year, but higher than the 974 kilotons in Q1 of 2022.

On the earnings call it was also noted that SunCoke’s non-contracted blast coke sales are finalized through Q3 of this year, and all foundry coke sales are finalized for the year. Additionally, the foundry coke expansion project at its Jewell facility in Oakwood, Va., is progressing on time and on budget.

SunCoke operates metallurgical coke plants in Illinois, Indiana, Ohio, Virginia, and Brazil, producing approximately 6 million tons of coke each year.

By Becca Moczygemba, becca@steelmarketupdate.com