Market Data

May 11, 2023

Most Lead Times Down, Plate and CR Up Slightly

Written by Becca Moczygemba

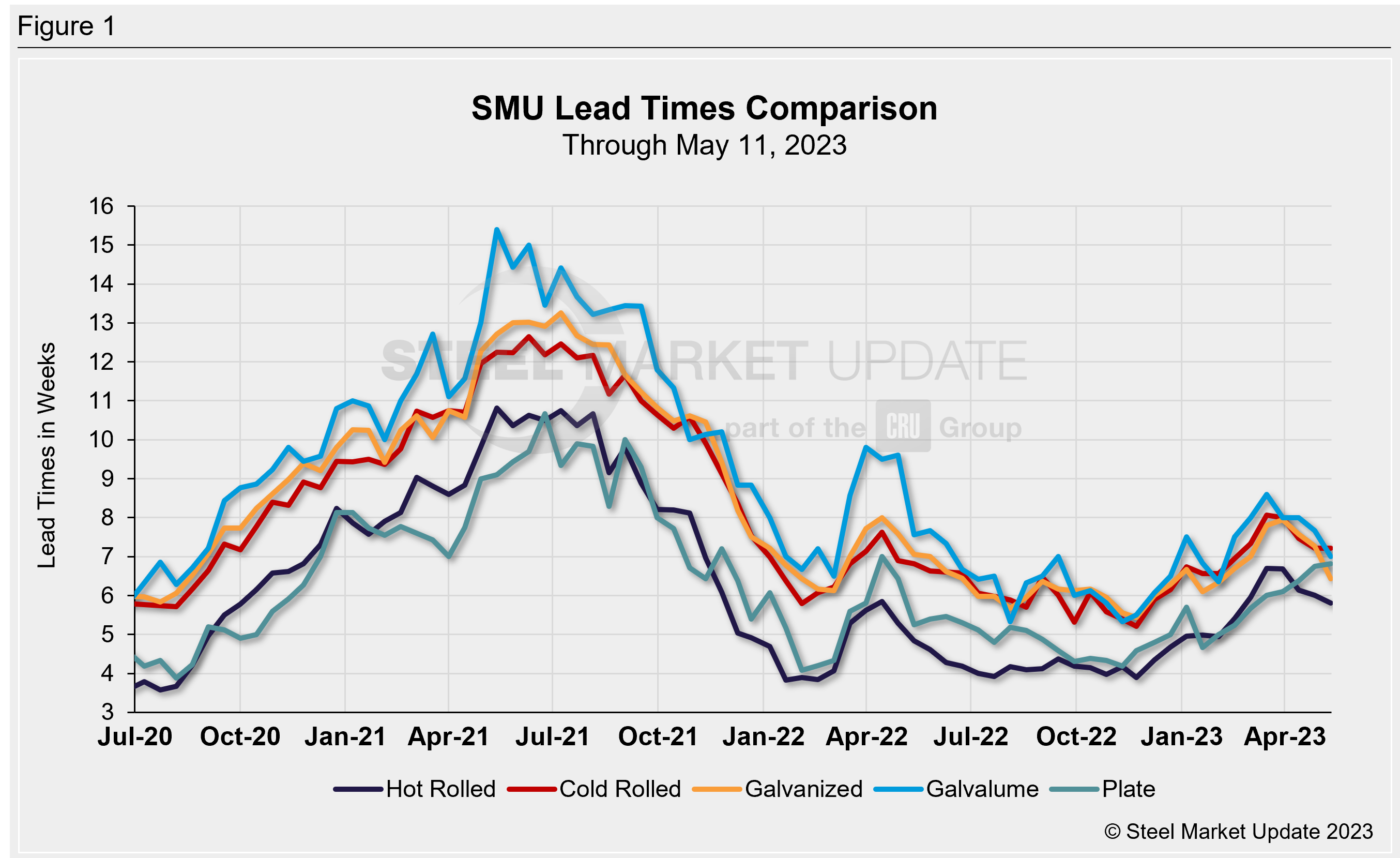

Steel mill lead times continue to decline for hot rolled, galvanized, and Galvalume products, while cold rolled and plate ticked up slightly, according to SMU’s latest steel market survey data.

Lead times took a downard turn in mid-April after climbing for nearly five months.

SMU’s hot-rolled lead time is 4 to 8 weeks with an average of 5.8 weeks. The average slipped from 6 weeks at the previous market check two weeks ago.

Cold-rolled lead times range from 5 to 10 weeks, with an average of 7.22 weeks, up from 7.21. Galvanized also currently ranges from 5 to 10 weeks, but with an average of 6.43 weeks. The galvanized average dropped 0.84 weeks from 7.27 weeks at the last check. Galvalume lead times are a bit tighter, ranging from 6 to 8 weeks, with an average lead time of 7 weeks.

Plate lead times are between 5 and 10 weeks, with an average of 6.82 weeks. The previous average was 6.75 weeks.

When asked about the future direction of lead times, about 48% of survey respondents reported they expect lead times to be flat into July. Only 4% percent think lead times will extend, and the other 48% think they will contract. Premium members can view a longer history of this data series and others in our market trends report.

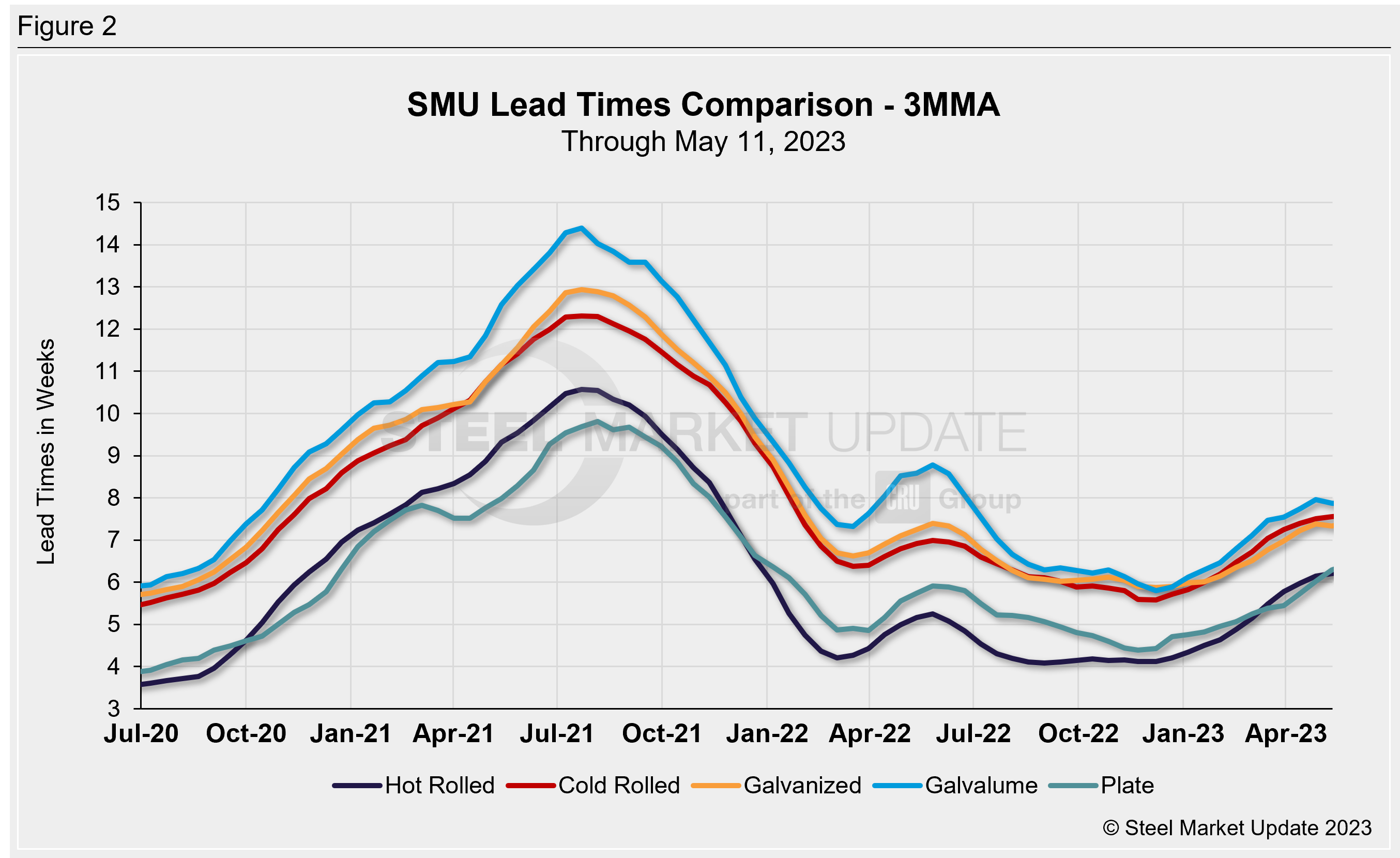

Looking at lead times on a three-month moving average (3MMA) basis can smooth out the variability of our twice monthly readings. As a 3MMA, lead times for all products are either flat or up modestly over the past month. The latest 3MMA lead time for hot rolled inched up 0.1 weeks to 6.2 weeks. Cold rolled remained flat at 7.5 weeks. Galvanized lead times dipped by 0.1 weeks to 7.3 weeks, while Galvalume lead times were down 0.1 weeks to 7.9 weeks. Plate lead times were up 0.3 weeks to 6.3 weeks.

Note: These lead times are based on the average from manufacturers and steel service centers who participated in this week’s SMU market trends analysis. SMU measures lead times as the time it takes from when an order is placed with the mill to when the order is processed and ready for shipping, not including delivery time to the buyer. Our lead times do not predict what any individual may get from any specific mill supplier. Look to your mill rep for actual lead times. To see an interactive history of our Steel Mill Lead Times data, visit our website here.

By Becca Moczygemba, becca@steelmarketupdate.com