Analysis

June 9, 2023

AHRI: Shipments Decline After Two Months of Increases

Written by Becca Moczygemba

US heating and cooling equipment shipments saw a drop in April from the previous month and year over year, according to the most recent data released from the Air Conditioning, Heating, and Refrigeration Institute (AHRI).

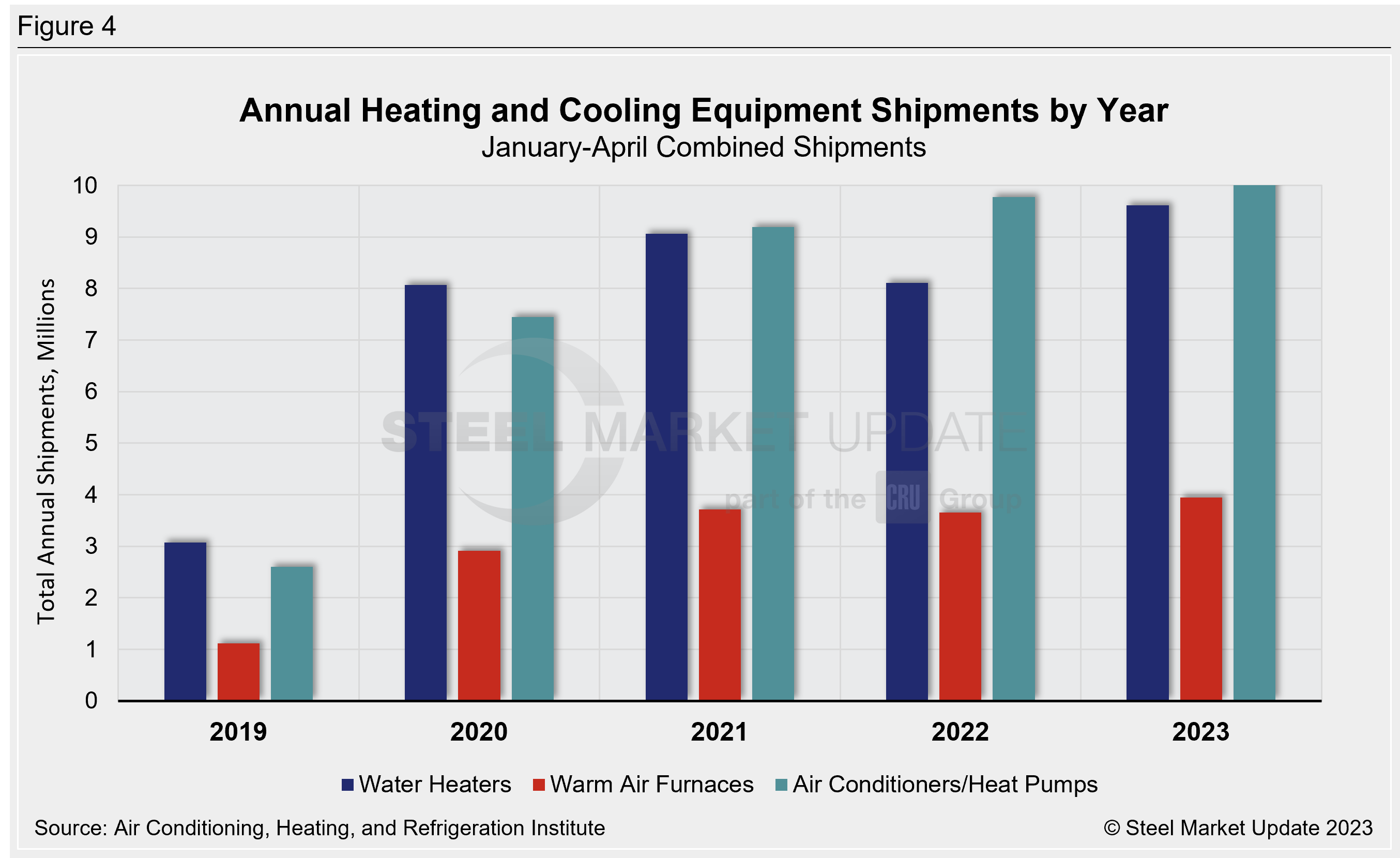

Total shipments in April were 1.74 million units, compared to 2.03 million units in March. Shipments were down 14% month over month (MoM), and down 16% year over year (YoY). This April drop follows two months of increases.

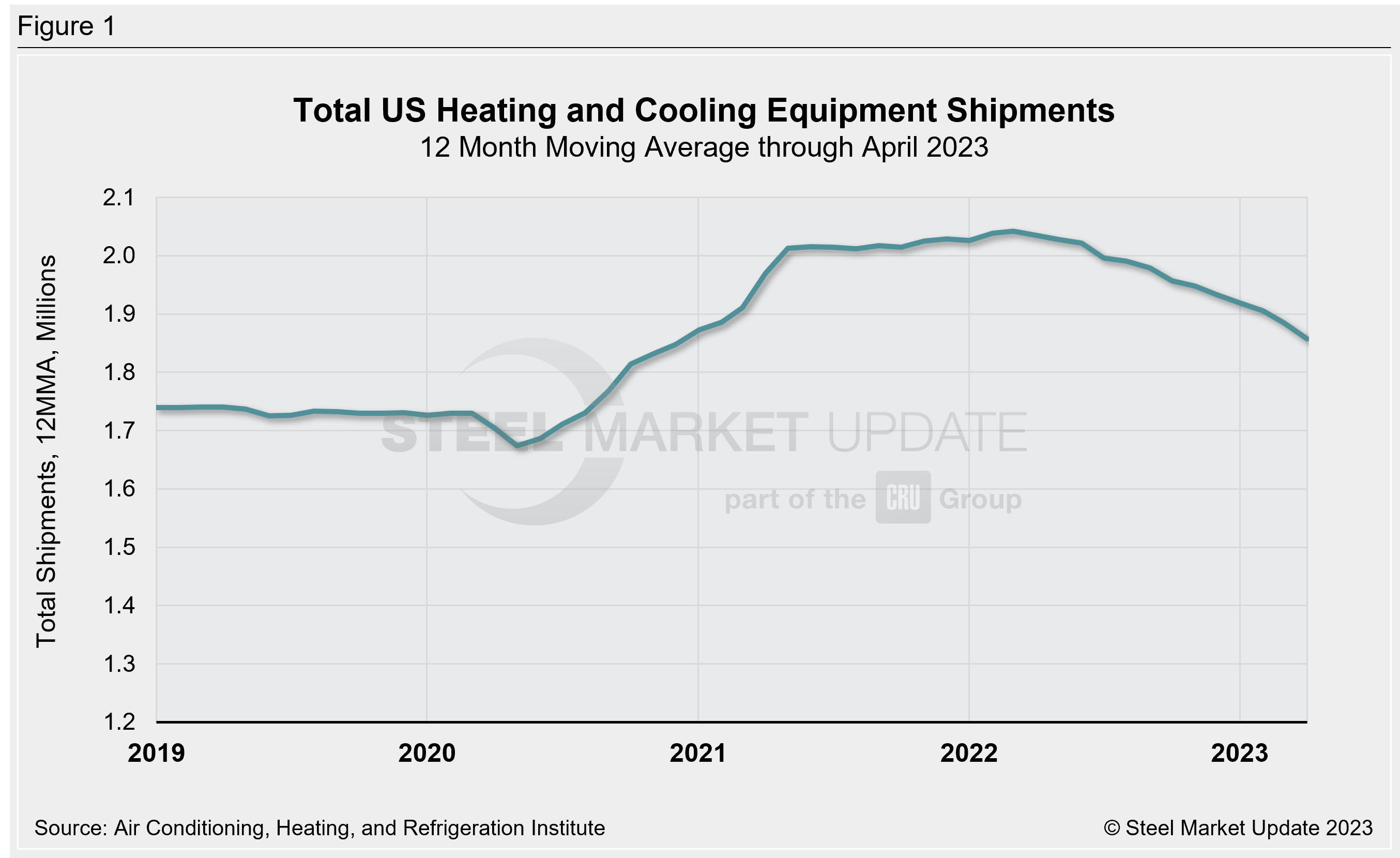

On a 12-month moving average (12MMA) basis, shipments were down to 1.86 million units per month compared to 2.03 million units in April 2022.

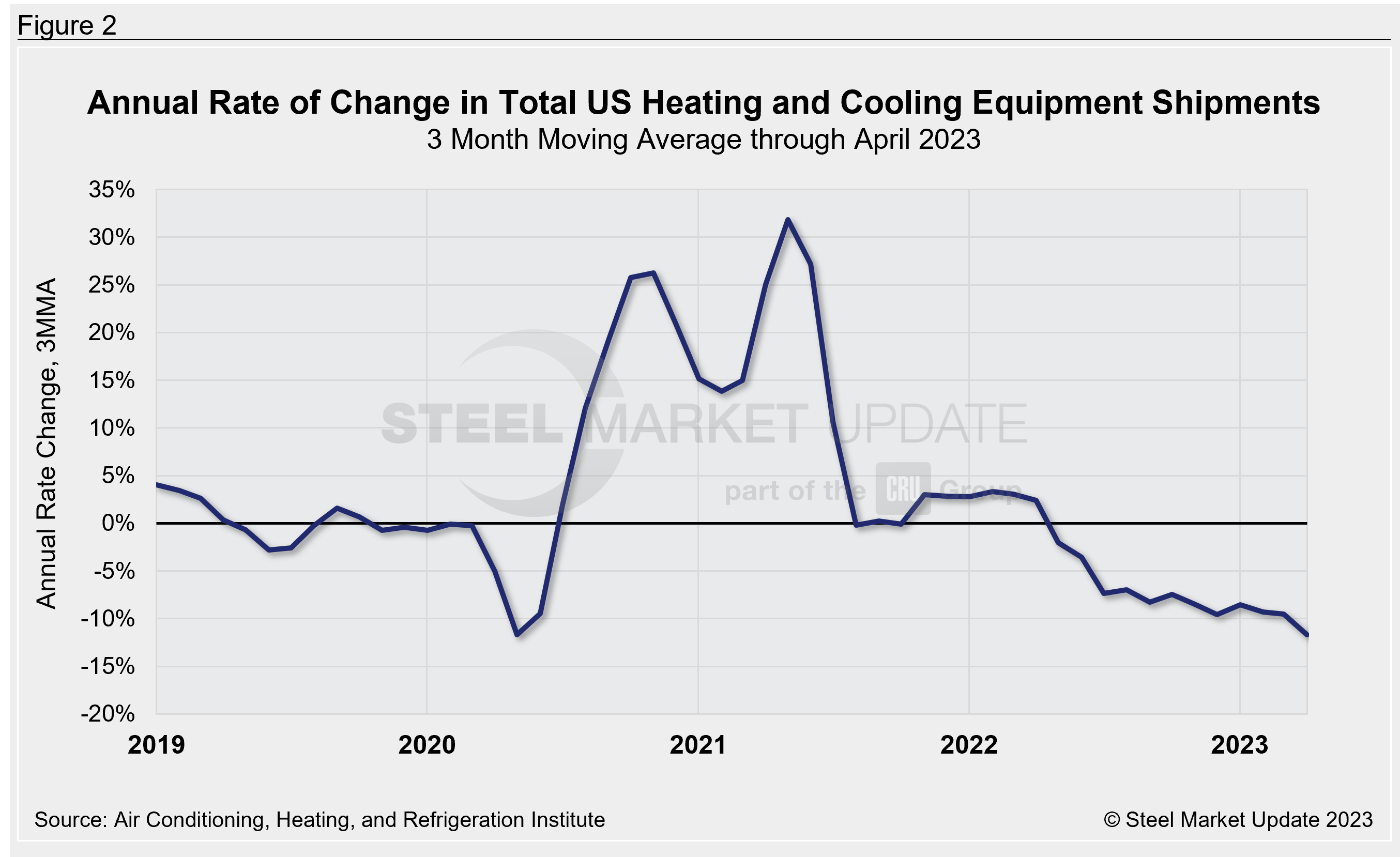

As shown in the chart below, total heating and cooling shipments on a three-month moving average (3MMA) basis through April were down 12% compared with the same period last year.

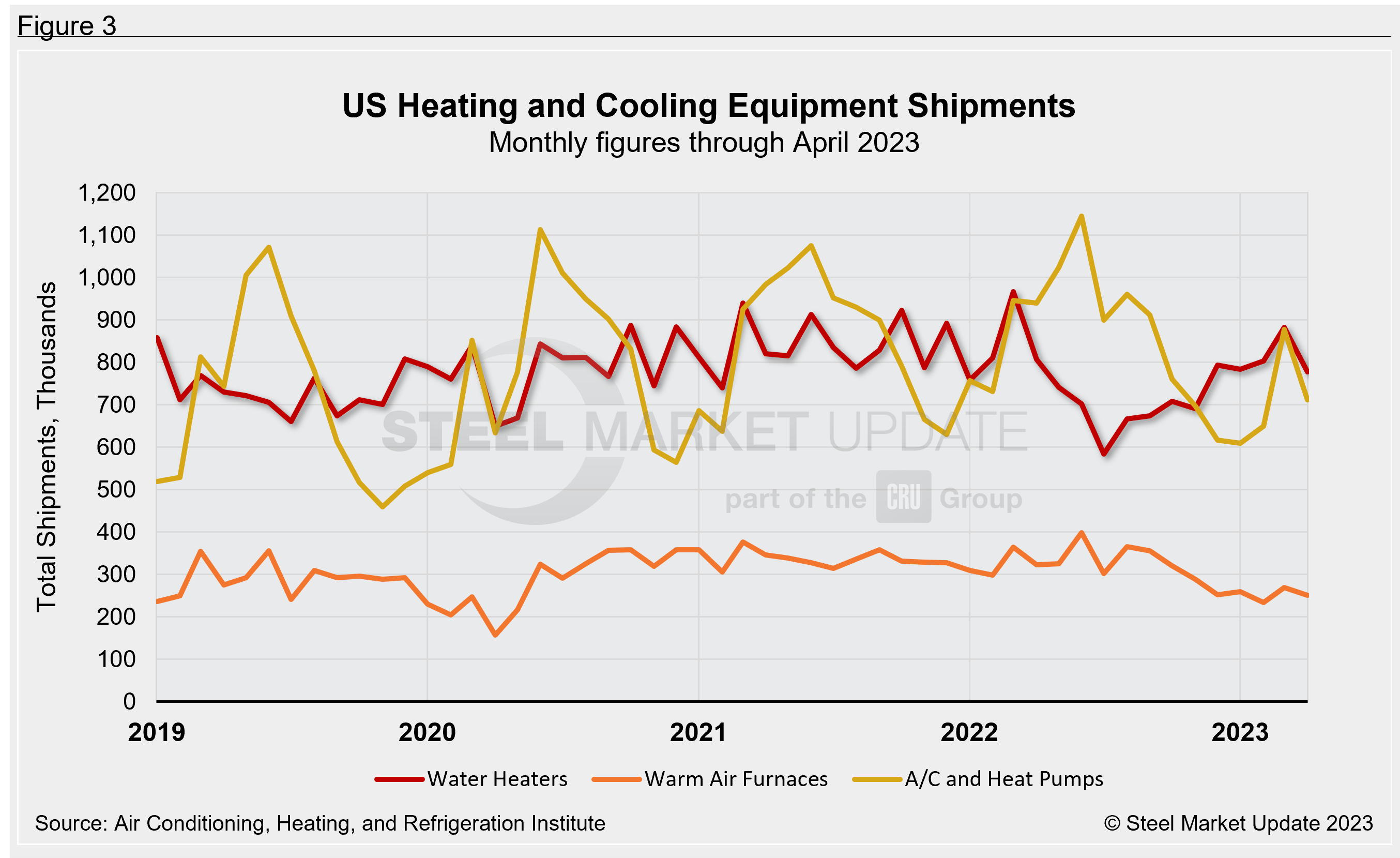

Residential and commercial storage water heater shipments decreased 4% YoY to a combined 778,156 units in April, but increased MoM from 882,119 units.

April shipments of warm air furnaces totaled 250,557 units, a decrease of 7% compared to March, but down 22% from a year earlier.

Central air conditioners and air-source heat pump shipments were down 19% MoM and dropped by 16% YoY. Units shipped in April totaled 712,049. When broken down by product, 418,975 air conditioners and 293,074 heat pumps were shipped, respectively.

The full press release from which this data comes from is available on the AHRI website.

An interactive history of heating and cooling equipment shipment data is available on our website. If you need assistance logging in to or navigating the website, please contact us at info@steelmarketupdate.com.

By Becca Moczygemba, becca@steelmarketupdate.com