Market Segment

November 6, 2023

AISI: US Raw Steel Output Slips

Written by Becca Moczygemba

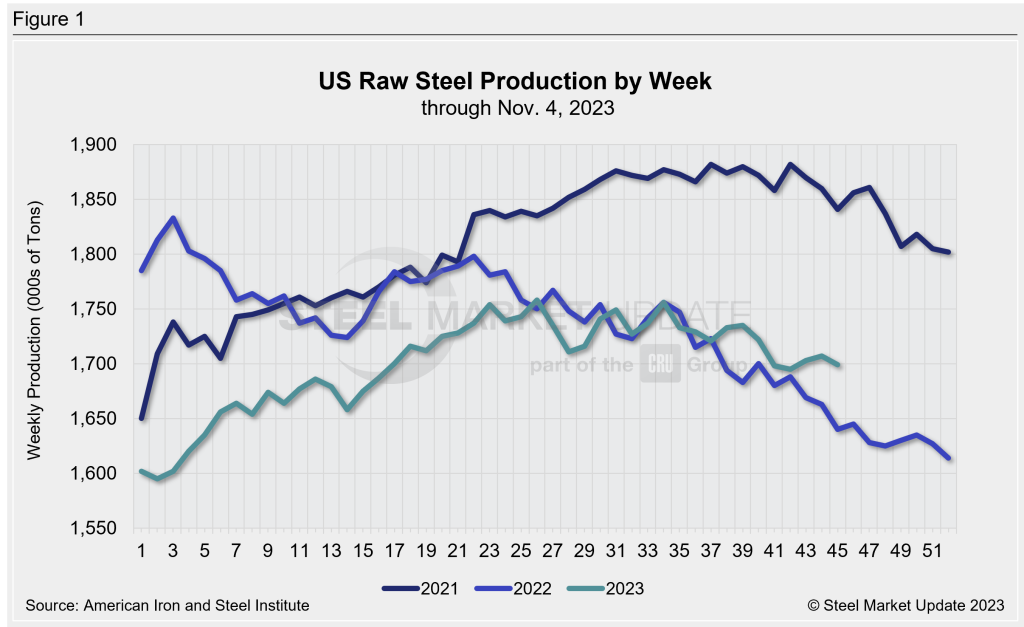

Raw steel production in the US was down for the week ended Nov. 4, according to data released by the American Iron and Steel Institute (AISI) on Monday, Nov. 6.

Domestic steel output receded to 1,699,000 tons, down 0.5% from 1,707,000 tons the previous week. There were increases in production the previous two weeks.

Year-over-year, production is up 6.6% from the 1,594,000 tons produced during the same week in 2022.

The mill capability utilization rate for the week was 73.9% compared to 74.3% the week before. During the same week one year ago, mill capability utilization was 71.5%.

Adjusted year-to-date production through Nov. 4 was 75,322,000 net tons at a capability utilization rate of 75.8%. Compared to the same time last year, that is down 0.7% from the 75,855,000 tons produced when the capability utilization rate was 78.1%.

The highest the capability utilization rate has been in 2023 was 78.1% during the last week of June.

Production by region is shown below with the week-over-week change shown in parentheses:

- Northeast – 132,000 (down 4,000 tons)

- Great Lakes – 555,000 (down 6,000 tons)

- Midwest – 179,000 (up 2,000 tons)

- South – 762,000 (down 4,000 tons)

- West –71,000 (up 4,000 tons)